Digital asset taxation involves the valuation and reporting of cryptocurrencies and blockchain-based assets, governed by evolving IRS guidelines emphasizing transparency and compliance. Mineral rights taxation pertains to the assessment and levy on the ownership or extraction of natural resources, often involving complex state-specific regulations and royalty income tracking. Explore more to understand the nuanced accounting treatments and tax implications unique to each asset class.

Why it is important

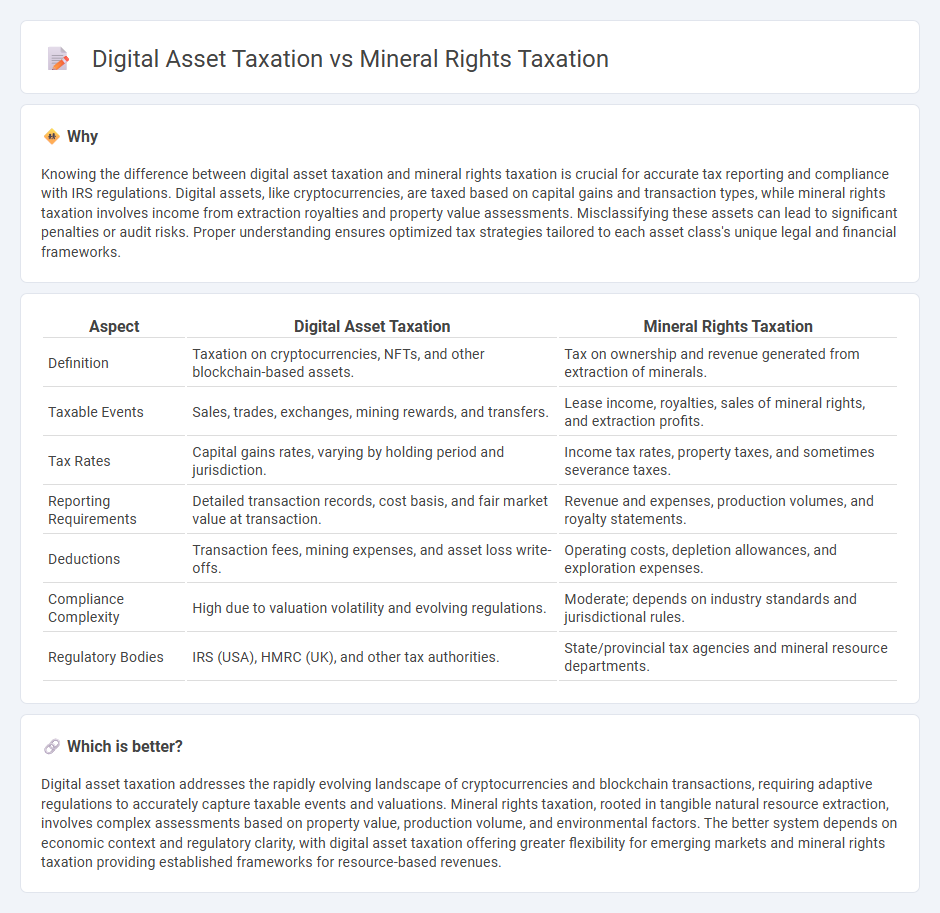

Knowing the difference between digital asset taxation and mineral rights taxation is crucial for accurate tax reporting and compliance with IRS regulations. Digital assets, like cryptocurrencies, are taxed based on capital gains and transaction types, while mineral rights taxation involves income from extraction royalties and property value assessments. Misclassifying these assets can lead to significant penalties or audit risks. Proper understanding ensures optimized tax strategies tailored to each asset class's unique legal and financial frameworks.

Comparison Table

| Aspect | Digital Asset Taxation | Mineral Rights Taxation |

|---|---|---|

| Definition | Taxation on cryptocurrencies, NFTs, and other blockchain-based assets. | Tax on ownership and revenue generated from extraction of minerals. |

| Taxable Events | Sales, trades, exchanges, mining rewards, and transfers. | Lease income, royalties, sales of mineral rights, and extraction profits. |

| Tax Rates | Capital gains rates, varying by holding period and jurisdiction. | Income tax rates, property taxes, and sometimes severance taxes. |

| Reporting Requirements | Detailed transaction records, cost basis, and fair market value at transaction. | Revenue and expenses, production volumes, and royalty statements. |

| Deductions | Transaction fees, mining expenses, and asset loss write-offs. | Operating costs, depletion allowances, and exploration expenses. |

| Compliance Complexity | High due to valuation volatility and evolving regulations. | Moderate; depends on industry standards and jurisdictional rules. |

| Regulatory Bodies | IRS (USA), HMRC (UK), and other tax authorities. | State/provincial tax agencies and mineral resource departments. |

Which is better?

Digital asset taxation addresses the rapidly evolving landscape of cryptocurrencies and blockchain transactions, requiring adaptive regulations to accurately capture taxable events and valuations. Mineral rights taxation, rooted in tangible natural resource extraction, involves complex assessments based on property value, production volume, and environmental factors. The better system depends on economic context and regulatory clarity, with digital asset taxation offering greater flexibility for emerging markets and mineral rights taxation providing established frameworks for resource-based revenues.

Connection

Digital asset taxation and mineral rights taxation intersect through the shared complexity of valuing non-traditional and fluctuating assets for accounting purposes. Both require specialized knowledge to accurately assess income, capital gains, and depreciation due to market volatility and regulatory nuances. Understanding these connections enhances compliance strategies and informed financial reporting within the field of accounting.

Key Terms

Depletion Allowance

Mineral rights taxation allows owners to claim a depletion allowance, reducing taxable income based on the exhaustion of natural resources, a tax benefit not applicable to digital assets like cryptocurrencies. Digital asset taxation primarily involves capital gains or losses without specific allowances similar to depletion rules found in mineral rights. Explore the nuances of depletion allowances and their impact on tax strategy to better understand how these tax treatments differ.

Capital Gains

Capital gains taxation on mineral rights involves complex valuation based on extraction activities and fluctuating commodity prices, often influenced by federal and state regulations. Digital asset capitalization gains are calculated from the difference between purchase and sale prices, subject to IRS guidelines on cryptocurrency and NFT transactions. Explore detailed tax implications and reporting requirements to optimize your capital gains strategy.

Fair Market Value

Mineral rights taxation often relies on Fair Market Value (FMV) determined by appraisal of physical resources and lease income potential, whereas digital asset taxation uses FMV based on real-time market prices and trading volumes. The key distinction lies in valuation frequency and volatility, with digital assets requiring more dynamic and frequent FMV assessments due to their fluctuating market nature. Explore further to understand how FMV principles adapt across these diverse asset classes.

Source and External Links

Navigating The Tax Implications When Selling Mineral Rights - Mineral rights sales are generally taxed as capital gains, with long-term holdings (over one year) qualifying for reduced capital gains tax rates of 0%, 15%, or 20%, while short-term sales are taxed as ordinary income.

How Mineral Rights are Taxed - Texas Royalty Brokers - Selling mineral rights usually triggers capital gains tax at rates of 15% to 20%, which can be more tax-efficient than paying ordinary income tax rates on royalty payments collected over many years.

Mineral Rights and Oil Royalties Taxes - How to Report on Tax Return - Royalty income from mineral rights is taxable as ordinary income federally and at the state level, while additional taxes such as county-level ad valorem taxes and state severance taxes may also apply depending on mineral production activity.

dowidth.com

dowidth.com