Smart contracts automate accounting processes by securely recording transactions on blockchain ledgers, reducing errors and increasing efficiency compared to manual ledger entries. Manual ledger accounting relies on human input, which can lead to discrepancies and slower reconciliation times. Explore the benefits and challenges of integrating smart contracts into traditional accounting systems to optimize financial management.

Why it is important

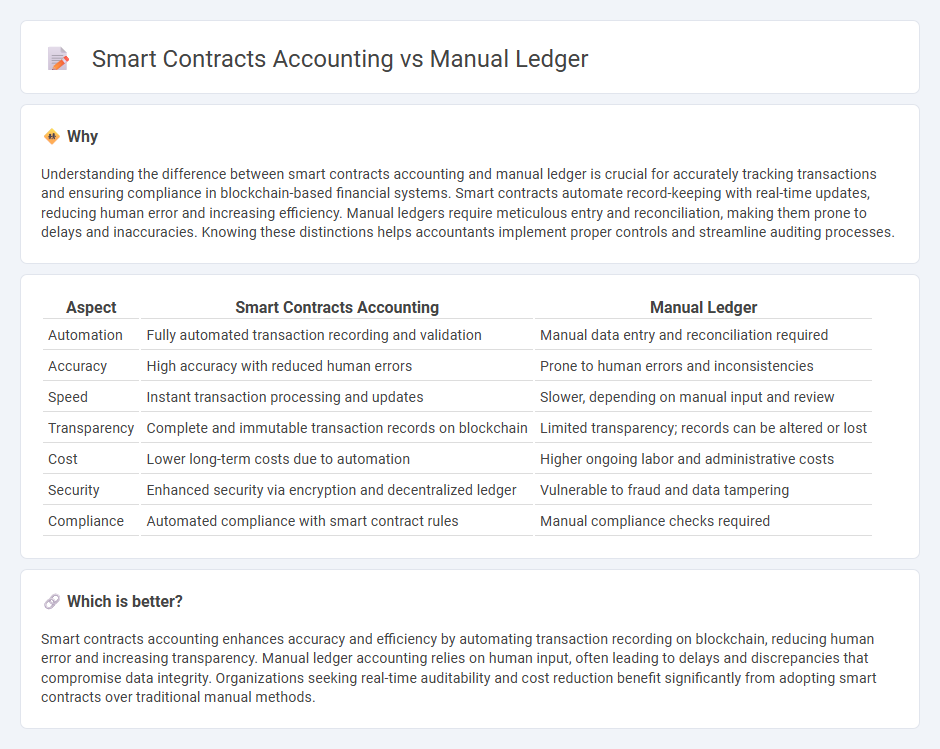

Understanding the difference between smart contracts accounting and manual ledger is crucial for accurately tracking transactions and ensuring compliance in blockchain-based financial systems. Smart contracts automate record-keeping with real-time updates, reducing human error and increasing efficiency. Manual ledgers require meticulous entry and reconciliation, making them prone to delays and inaccuracies. Knowing these distinctions helps accountants implement proper controls and streamline auditing processes.

Comparison Table

| Aspect | Smart Contracts Accounting | Manual Ledger |

|---|---|---|

| Automation | Fully automated transaction recording and validation | Manual data entry and reconciliation required |

| Accuracy | High accuracy with reduced human errors | Prone to human errors and inconsistencies |

| Speed | Instant transaction processing and updates | Slower, depending on manual input and review |

| Transparency | Complete and immutable transaction records on blockchain | Limited transparency; records can be altered or lost |

| Cost | Lower long-term costs due to automation | Higher ongoing labor and administrative costs |

| Security | Enhanced security via encryption and decentralized ledger | Vulnerable to fraud and data tampering |

| Compliance | Automated compliance with smart contract rules | Manual compliance checks required |

Which is better?

Smart contracts accounting enhances accuracy and efficiency by automating transaction recording on blockchain, reducing human error and increasing transparency. Manual ledger accounting relies on human input, often leading to delays and discrepancies that compromise data integrity. Organizations seeking real-time auditability and cost reduction benefit significantly from adopting smart contracts over traditional manual methods.

Connection

Smart contracts accounting automates transaction verification and recording on blockchain, ensuring accuracy and transparency in financial data. Manual ledger accounting complements this by providing a traditional, human-verified record for audits and compliance purposes. Integrating both systems enhances financial integrity, reduces errors, and streamlines reconciliation processes in accounting workflows.

Key Terms

Double-entry bookkeeping

Manual ledger accounting relies on traditional double-entry bookkeeping where every financial transaction is recorded in debits and credits to maintain the accounting equation. Smart contracts automate double-entry bookkeeping by executing programmable transactions on blockchain, ensuring real-time, immutable, and transparent financial records without manual reconciliation. Explore how integrating smart contracts can revolutionize accuracy and efficiency in your accounting processes.

Automation

Manual ledger accounting requires extensive human input for data entry and reconciliation, increasing the risk of errors and delays. Smart contracts automate financial transactions and enforce predetermined rules on blockchain platforms, ensuring real-time accuracy and reducing the need for manual oversight. Explore how automation in smart contracts can transform traditional accounting processes and enhance operational efficiency.

Immutable records

Manual ledger accounting relies on physical or digital books maintained by individuals, which are prone to errors, tampering, and loss, making the records less immutable. Smart contracts accounting uses blockchain technology to create automated, self-executing contracts with records that are cryptographically secured and immutable, ensuring transparency and trust. Discover how the shift to smart contracts can revolutionize record-keeping in your accounting processes.

Source and External Links

manual accounting system | Wex - Law.Cornell.Edu - A manual ledger is part of a manual accounting system where financial transactions are recorded by hand in physical books or pads, typically featuring multiple columns for date, account type, debit or credit amounts, and observations, often used by small businesses to reduce costs and manage low transaction volumes.

How to Create a Manual General Ledger with Excel? - A manual ledger can be created using Excel by setting up columns such as date, description, debit, and credit to record each financial transaction clearly, allowing regular updates to maintain an accurate financial overview of a business.

Ledger in accounting: Process, example & free template - A ledger is a bookkeeping record that categorizes and stores all financial transactions, with manual ledgers often serving as essential tools for compiling financial statements by showing opening balances, debits, credits, and ending balances for each account.

dowidth.com

dowidth.com