Single entry bookkeeping records financial transactions in a simple ledger, focusing primarily on income and expenses with minimal detail. Triple entry bookkeeping enhances transparency by integrating blockchain technology, providing an immutable record that links the sender, receiver, and transaction, thus reducing errors and fraud. Explore the advantages of triple entry bookkeeping to understand its impact on accuracy and trust in financial management.

Why it is important

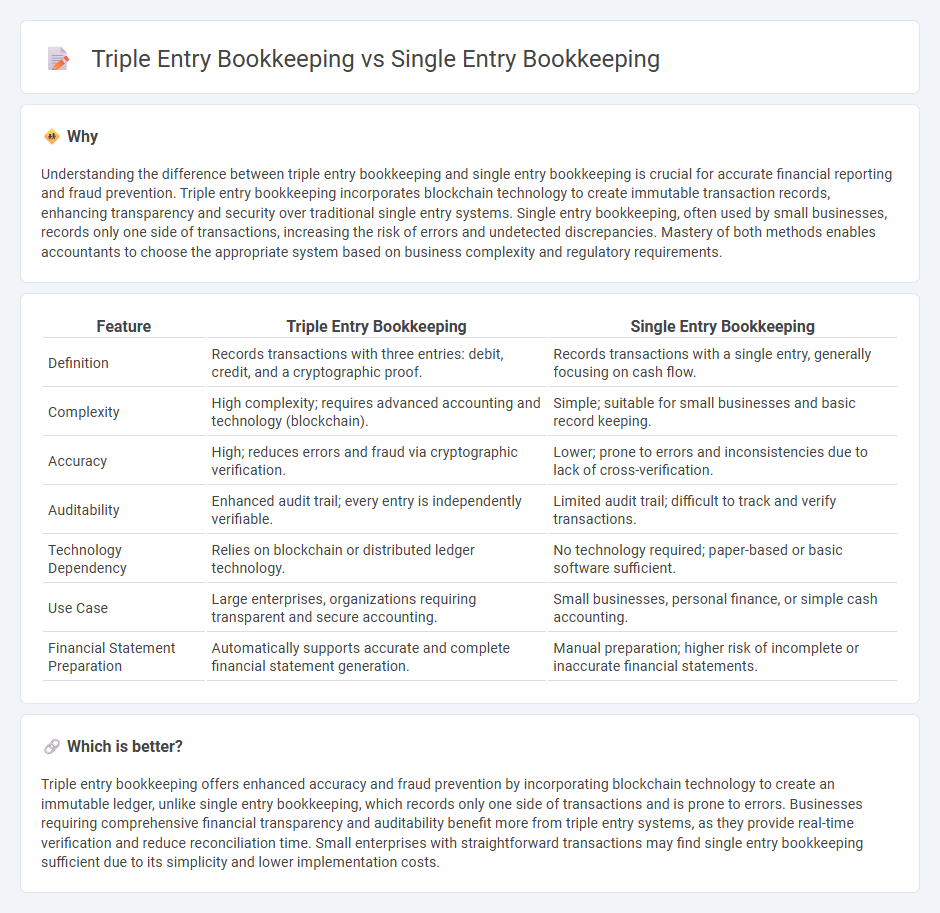

Understanding the difference between triple entry bookkeeping and single entry bookkeeping is crucial for accurate financial reporting and fraud prevention. Triple entry bookkeeping incorporates blockchain technology to create immutable transaction records, enhancing transparency and security over traditional single entry systems. Single entry bookkeeping, often used by small businesses, records only one side of transactions, increasing the risk of errors and undetected discrepancies. Mastery of both methods enables accountants to choose the appropriate system based on business complexity and regulatory requirements.

Comparison Table

| Feature | Triple Entry Bookkeeping | Single Entry Bookkeeping |

|---|---|---|

| Definition | Records transactions with three entries: debit, credit, and a cryptographic proof. | Records transactions with a single entry, generally focusing on cash flow. |

| Complexity | High complexity; requires advanced accounting and technology (blockchain). | Simple; suitable for small businesses and basic record keeping. |

| Accuracy | High; reduces errors and fraud via cryptographic verification. | Lower; prone to errors and inconsistencies due to lack of cross-verification. |

| Auditability | Enhanced audit trail; every entry is independently verifiable. | Limited audit trail; difficult to track and verify transactions. |

| Technology Dependency | Relies on blockchain or distributed ledger technology. | No technology required; paper-based or basic software sufficient. |

| Use Case | Large enterprises, organizations requiring transparent and secure accounting. | Small businesses, personal finance, or simple cash accounting. |

| Financial Statement Preparation | Automatically supports accurate and complete financial statement generation. | Manual preparation; higher risk of incomplete or inaccurate financial statements. |

Which is better?

Triple entry bookkeeping offers enhanced accuracy and fraud prevention by incorporating blockchain technology to create an immutable ledger, unlike single entry bookkeeping, which records only one side of transactions and is prone to errors. Businesses requiring comprehensive financial transparency and auditability benefit more from triple entry systems, as they provide real-time verification and reduce reconciliation time. Small enterprises with straightforward transactions may find single entry bookkeeping sufficient due to its simplicity and lower implementation costs.

Connection

Triple entry bookkeeping builds on single entry bookkeeping by adding a cryptographic verification layer to each transaction, enhancing accuracy and transparency. While single entry bookkeeping records transactions in a single ledger, triple entry bookkeeping records them in two ledgers plus a third cryptographically secured ledger entry. This connection allows businesses to improve auditability and reduce fraud risks through synchronized and verifiable transaction records.

Key Terms

**Single Entry Bookkeeping:**

Single entry bookkeeping records financial transactions using a single ledger, primarily focusing on cash receipts and payments without tracking assets or liabilities in detail. This method simplifies accounting for small businesses with straightforward financial activities but lacks the accuracy and fraud prevention features of double or triple entry systems. Explore deeper insights into single entry bookkeeping to understand its suitable applications and limitations fully.

Cash Book

Single entry bookkeeping records individual transactions primarily in the cash book, capturing only cash inflows and outflows for straightforward financial tracking. Triple entry bookkeeping enhances accuracy by integrating a third component--a cryptographic receipt or verification--alongside debit and credit entries within the cash book, improving transparency and fraud prevention. Explore the detailed mechanisms and benefits of each system to optimize your business accounting accuracy and security.

Receipts and Payments

Single entry bookkeeping records only receipts and payments, providing a simple cash-based tracking system ideal for small businesses or personal finances. Triple entry bookkeeping enhances this by incorporating a third ledger, typically a blockchain-based system, that records and verifies transactions, ensuring higher transparency and fraud prevention. Explore how triple entry bookkeeping transforms accuracy and trust in financial records.

Source and External Links

What is Single-Entry Bookkeeping? Explained with Examples - Single-entry bookkeeping records each financial transaction in a single entry and involves recording every income and expense transaction in a cash book or ledger with a running balance but does not provide the dual record system of double-entry bookkeeping.

Single Entry Bookkeeping: Everything You Need to Know - This system captures one line per transaction recording date, description, income or expense, and running bank balance, making it simpler and useful for small businesses to track cash flow efficiently.

A Complete Guide to Single-Entry Bookkeeping (With Example) - Single-entry bookkeeping involves maintaining records in a cashbook or journal where each transaction affects the cash balance by adding income or subtracting expenses to keep an ongoing total, resembling a checking account register.

dowidth.com

dowidth.com