Dynamic discounting offers businesses the opportunity to optimize cash flow by providing early payment discounts based on real-time invoice processing, contrasting with traditional payment terms that specify fixed deadlines for settling invoices. Unlike static payment schedules, dynamic discounting incentivizes faster payments through variable discounts, enhancing supplier relationships and improving working capital management. Explore more about how dynamic discounting can transform your accounting processes and financial strategies.

Why it is important

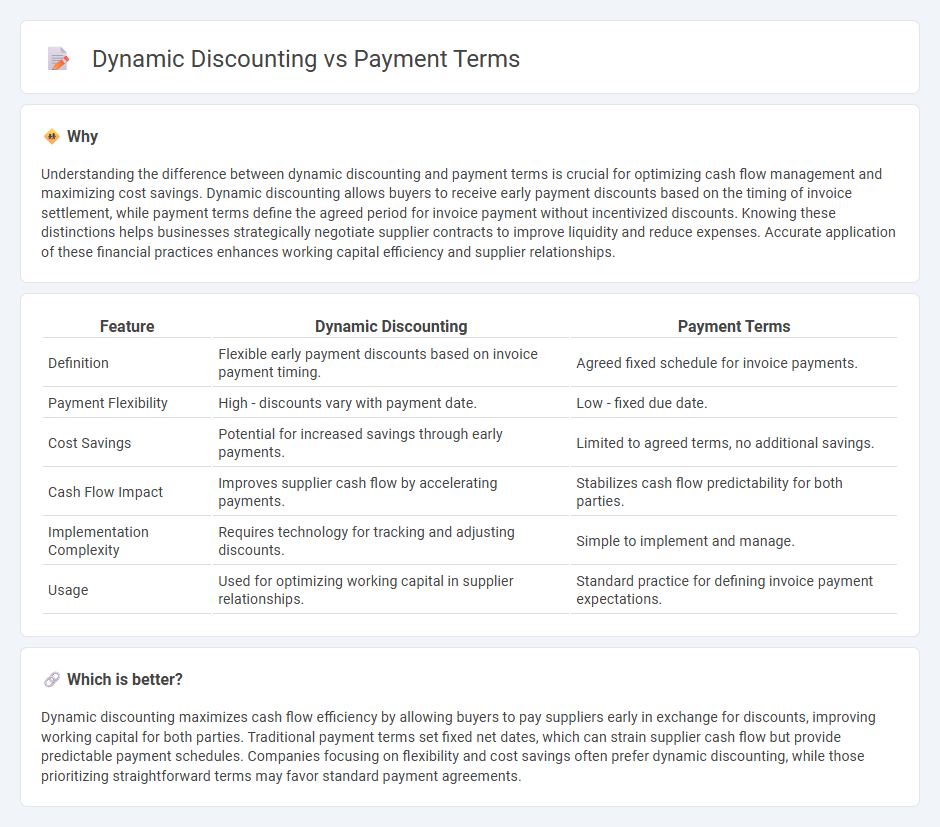

Understanding the difference between dynamic discounting and payment terms is crucial for optimizing cash flow management and maximizing cost savings. Dynamic discounting allows buyers to receive early payment discounts based on the timing of invoice settlement, while payment terms define the agreed period for invoice payment without incentivized discounts. Knowing these distinctions helps businesses strategically negotiate supplier contracts to improve liquidity and reduce expenses. Accurate application of these financial practices enhances working capital efficiency and supplier relationships.

Comparison Table

| Feature | Dynamic Discounting | Payment Terms |

|---|---|---|

| Definition | Flexible early payment discounts based on invoice payment timing. | Agreed fixed schedule for invoice payments. |

| Payment Flexibility | High - discounts vary with payment date. | Low - fixed due date. |

| Cost Savings | Potential for increased savings through early payments. | Limited to agreed terms, no additional savings. |

| Cash Flow Impact | Improves supplier cash flow by accelerating payments. | Stabilizes cash flow predictability for both parties. |

| Implementation Complexity | Requires technology for tracking and adjusting discounts. | Simple to implement and manage. |

| Usage | Used for optimizing working capital in supplier relationships. | Standard practice for defining invoice payment expectations. |

Which is better?

Dynamic discounting maximizes cash flow efficiency by allowing buyers to pay suppliers early in exchange for discounts, improving working capital for both parties. Traditional payment terms set fixed net dates, which can strain supplier cash flow but provide predictable payment schedules. Companies focusing on flexibility and cost savings often prefer dynamic discounting, while those prioritizing straightforward terms may favor standard payment agreements.

Connection

Dynamic discounting leverages flexible payment terms to optimize cash flow by allowing buyers to pay invoices earlier in exchange for discounts, benefiting both buyers and suppliers. This strategy improves working capital management by aligning payment timing with available liquidity and enhancing supplier relationships through timely payments. Integrating dynamic discounting within payment terms fosters financial efficiency and reduces costs across the supply chain.

Key Terms

Net Payment Terms

Net Payment Terms specify the fixed period within which a buyer must pay the supplier, typically ranging from 30 to 90 days, ensuring clear cash flow expectations. Dynamic Discounting allows buyers to pay invoices early in exchange for a variable discount rate based on the timing of payment, optimizing working capital for both parties. Explore how integrating Net Payment Terms with dynamic discounting strategies can enhance financial efficiency and supplier relationships.

Early Payment Discount

Early Payment Discount incentivizes buyers to settle invoices before the due date by offering a percentage reduction on the payment amount, enhancing supplier cash flow and strengthening buyer-supplier relationships. Payment terms typically define fixed deadlines for payments without flexibility, whereas dynamic discounting allows adaptable discounts based on earlier payment dates, optimizing working capital efficiency. Explore how integrating Early Payment Discounts with dynamic discounting can maximize financial benefits and operational agility.

Dynamic Discounting Platform

Dynamic discounting platforms optimize payment terms by enabling buyers to pay suppliers earlier in exchange for discounts, improving cash flow for both parties. These platforms use real-time data and automation to facilitate flexible payment schedules, reducing costs and enhancing supplier relationships. Discover how integrating a dynamic discounting platform can transform your accounts payable strategy for greater financial efficiency.

Source and External Links

What Are Payment Terms? Definition and Types - Payment terms outline the conditions for payment, including billing methods, payment due dates, accepted payment forms, and any discounts or late fees.

What are Payment Terms? - Payment terms specify when and how payments are made, including conditions for credit, interest, installments, discounts, and late fees.

What are Payment Terms? Examples and Meanings - Payment terms detail the amount owed, payment methods, and due dates, with examples such as cash in advance, net 30, or payment terms with discounts.

dowidth.com

dowidth.com