Cryptocurrency auditing focuses on verifying digital asset transactions and ensuring blockchain compliance with security protocols, while government auditing primarily reviews financial statements and regulatory adherence within public sector organizations. Both types of auditing require specialized knowledge of relevant frameworks, but cryptocurrency auditing demands expertise in cryptographic technologies and decentralized ledger systems. Explore the distinctions further to understand how innovative digital audits transform traditional government oversight.

Why it is important

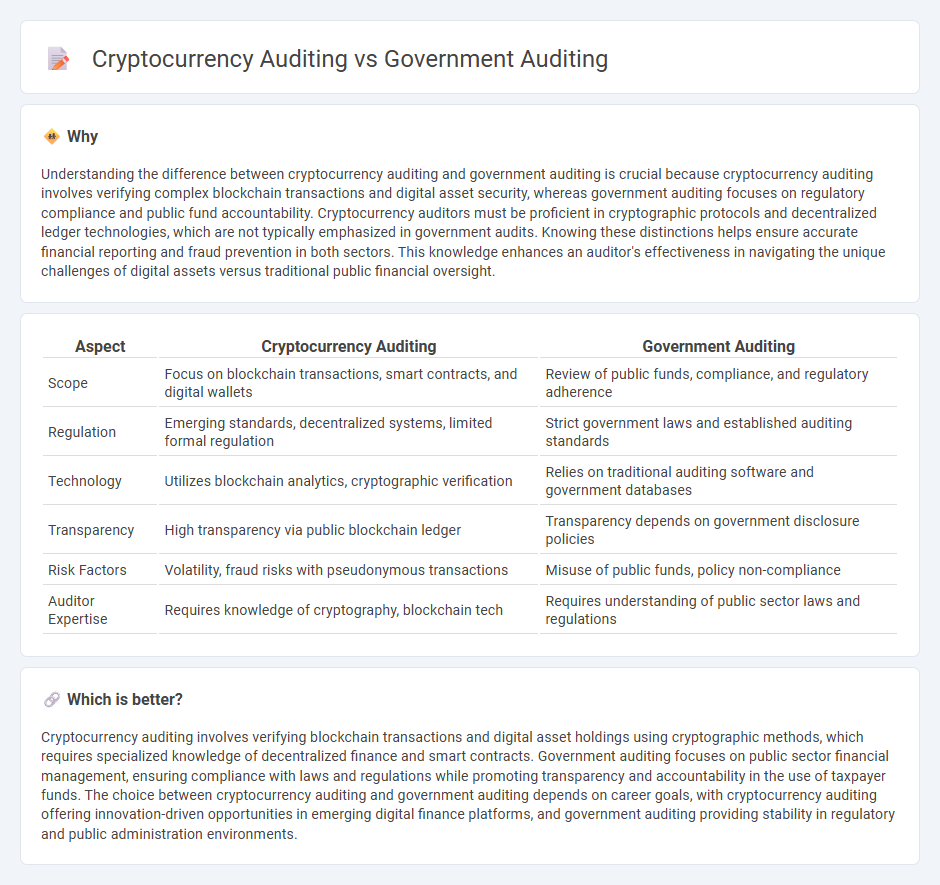

Understanding the difference between cryptocurrency auditing and government auditing is crucial because cryptocurrency auditing involves verifying complex blockchain transactions and digital asset security, whereas government auditing focuses on regulatory compliance and public fund accountability. Cryptocurrency auditors must be proficient in cryptographic protocols and decentralized ledger technologies, which are not typically emphasized in government audits. Knowing these distinctions helps ensure accurate financial reporting and fraud prevention in both sectors. This knowledge enhances an auditor's effectiveness in navigating the unique challenges of digital assets versus traditional public financial oversight.

Comparison Table

| Aspect | Cryptocurrency Auditing | Government Auditing |

|---|---|---|

| Scope | Focus on blockchain transactions, smart contracts, and digital wallets | Review of public funds, compliance, and regulatory adherence |

| Regulation | Emerging standards, decentralized systems, limited formal regulation | Strict government laws and established auditing standards |

| Technology | Utilizes blockchain analytics, cryptographic verification | Relies on traditional auditing software and government databases |

| Transparency | High transparency via public blockchain ledger | Transparency depends on government disclosure policies |

| Risk Factors | Volatility, fraud risks with pseudonymous transactions | Misuse of public funds, policy non-compliance |

| Auditor Expertise | Requires knowledge of cryptography, blockchain tech | Requires understanding of public sector laws and regulations |

Which is better?

Cryptocurrency auditing involves verifying blockchain transactions and digital asset holdings using cryptographic methods, which requires specialized knowledge of decentralized finance and smart contracts. Government auditing focuses on public sector financial management, ensuring compliance with laws and regulations while promoting transparency and accountability in the use of taxpayer funds. The choice between cryptocurrency auditing and government auditing depends on career goals, with cryptocurrency auditing offering innovation-driven opportunities in emerging digital finance platforms, and government auditing providing stability in regulatory and public administration environments.

Connection

Cryptocurrency auditing assesses the accuracy and compliance of digital asset transactions, ensuring transparency within blockchain systems. Government auditing utilizes these principles to regulate and oversee cryptocurrency activities, enhancing financial accountability and preventing fraud. Both fields rely on advanced verification techniques and regulatory frameworks to maintain trust in financial reporting.

Key Terms

**Government Auditing:**

Government auditing involves examining public sector financial records and operations to ensure compliance with laws, regulations, and efficient use of taxpayer funds. It emphasizes accountability, transparency, and prevention of fraud within government agencies and programs. Discover more about how government auditing safeguards public resources and promotes fiscal responsibility.

Compliance

Government auditing emphasizes strict adherence to regulatory frameworks, ensuring public funds are used appropriately and that agencies comply with laws and policies. Cryptocurrency auditing focuses on verifying blockchain transactions, smart contract integrity, and compliance with emerging digital asset regulations to prevent fraud and maintain transparency. Explore the key compliance differences between these auditing practices to understand their unique challenges and standards.

Internal Controls

Government auditing emphasizes evaluating internal controls to ensure compliance with laws, regulations, and accurate financial reporting within public sector entities. Cryptocurrency auditing focuses on assessing the security and reliability of decentralized ledgers, smart contracts, and digital asset management systems to prevent fraud and operational risks. Explore how advancements in auditing technologies are transforming internal control assessments in both fields.

Source and External Links

Best Practices for State and Local Government Auditors - AICPA - State and local government auditors are critical to ensuring transparency, efficiency, effectiveness, and accountability in government by performing financial audits, attestation engagements, performance audits, special reports, and investigative reports in accordance with statutory authority and public requests.

The Importance of Government Audit: Ensuring Accountability - Government audits uphold accountability and transparency in the public sector by independently examining financial records, operations, and compliance, helping to identify wasteful spending, detect fraud, and build public trust.

Government Accounting and Auditing - The CPA Journal - Government auditing in the U.S. follows standards set in the GAO's Yellow Book (GAGAS), which apply to entities receiving federal funds, with the "single audit" requirement triggered when federal assistance exceeds a set threshold in a reporting year.

dowidth.com

dowidth.com