Revenue recognition automation streamlines the accurate recording of income based on predefined criteria, ensuring compliance with accounting standards like ASC 606 or IFRS 15. Cash flow forecasting automation focuses on predicting future liquidity by analyzing outgoing and incoming cash, enhancing financial planning and risk management. Explore how these automation technologies revolutionize accounting processes for improved efficiency and decision-making.

Why it is important

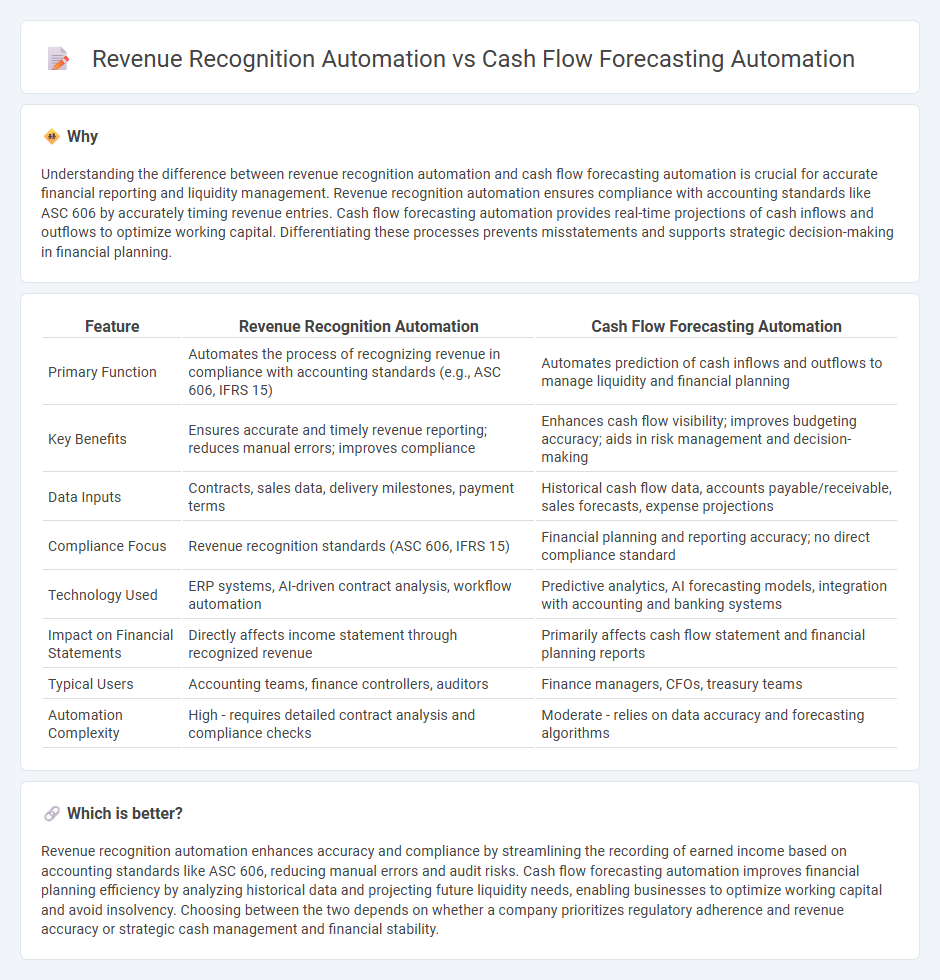

Understanding the difference between revenue recognition automation and cash flow forecasting automation is crucial for accurate financial reporting and liquidity management. Revenue recognition automation ensures compliance with accounting standards like ASC 606 by accurately timing revenue entries. Cash flow forecasting automation provides real-time projections of cash inflows and outflows to optimize working capital. Differentiating these processes prevents misstatements and supports strategic decision-making in financial planning.

Comparison Table

| Feature | Revenue Recognition Automation | Cash Flow Forecasting Automation |

|---|---|---|

| Primary Function | Automates the process of recognizing revenue in compliance with accounting standards (e.g., ASC 606, IFRS 15) | Automates prediction of cash inflows and outflows to manage liquidity and financial planning |

| Key Benefits | Ensures accurate and timely revenue reporting; reduces manual errors; improves compliance | Enhances cash flow visibility; improves budgeting accuracy; aids in risk management and decision-making |

| Data Inputs | Contracts, sales data, delivery milestones, payment terms | Historical cash flow data, accounts payable/receivable, sales forecasts, expense projections |

| Compliance Focus | Revenue recognition standards (ASC 606, IFRS 15) | Financial planning and reporting accuracy; no direct compliance standard |

| Technology Used | ERP systems, AI-driven contract analysis, workflow automation | Predictive analytics, AI forecasting models, integration with accounting and banking systems |

| Impact on Financial Statements | Directly affects income statement through recognized revenue | Primarily affects cash flow statement and financial planning reports |

| Typical Users | Accounting teams, finance controllers, auditors | Finance managers, CFOs, treasury teams |

| Automation Complexity | High - requires detailed contract analysis and compliance checks | Moderate - relies on data accuracy and forecasting algorithms |

Which is better?

Revenue recognition automation enhances accuracy and compliance by streamlining the recording of earned income based on accounting standards like ASC 606, reducing manual errors and audit risks. Cash flow forecasting automation improves financial planning efficiency by analyzing historical data and projecting future liquidity needs, enabling businesses to optimize working capital and avoid insolvency. Choosing between the two depends on whether a company prioritizes regulatory adherence and revenue accuracy or strategic cash management and financial stability.

Connection

Revenue recognition automation improves the accuracy and speed of recording sales, providing real-time financial data essential for precise cash flow forecasting automation. By integrating these systems, businesses gain enhanced visibility into future cash inflows, enabling more reliable and timely cash flow predictions. This connection streamlines financial planning, reduces manual errors, and supports strategic decision-making based on accurate revenue and cash flow insights.

Key Terms

**Cash Flow Forecasting Automation:**

Cash flow forecasting automation utilizes AI and machine learning to predict future cash inflows and outflows with high accuracy, enabling businesses to optimize liquidity management and avoid shortfalls. It integrates real-time data from bank accounts, invoices, and payment schedules, streamlining financial decision-making processes. Explore how adopting cash flow forecasting automation can transform your company's financial planning and stability.

Predictive Analytics

Cash flow forecasting automation leverages predictive analytics to anticipate future liquidity by analyzing historical cash inflows and outflows, enabling businesses to optimize financial planning and prevent cash shortages. Revenue recognition automation uses predictive analytics to accurately estimate earned revenue timings according to accounting standards, improving compliance and reducing financial closing delays. Explore detailed insights on how predictive analytics transforms these automation processes for enhanced financial accuracy and efficiency.

Liquidity Management

Cash flow forecasting automation enhances liquidity management by providing real-time visibility into inflows and outflows, enabling precise cash position predictions and timely decision-making. Revenue recognition automation ensures compliance and accuracy in reporting earnings, but it impacts liquidity indirectly through better alignment of revenue with cash collection schedules. Explore how integrating these automation tools can optimize your company's overall liquidity strategy and operational efficiency.

Source and External Links

Cash forecasting automation: Methods, benefits, best software - Automates data collection, integration, calculation, adjustments, scenario planning, and reporting to deliver efficient, accurate, and reliable cash flow forecasts tailored to organizational needs.

Automated Cash Flow Forecasting Software - HighRadius - Leverages AI and ML technologies to eliminate manual errors, provide real-time cash visibility, and enable proactive liquidity management by integrating with multiple financial data sources.

Nomentia Cash Flow Forecasting Software Powered by AI - Centralizes and automates cash flow forecasting across ERP systems and banks, offering AI-driven insights and rapid, customizable reporting for improved decision-making.

dowidth.com

dowidth.com