Digital asset valuation focuses on assessing the worth of cryptocurrencies, NFTs, and digital tokens using market trends and blockchain data, while inventory valuation estimates the cost of physical goods held for sale through methods like FIFO, LIFO, and weighted average. Both play crucial roles in accurate financial reporting and asset management for businesses engaged in digital and traditional commerce. Explore further to understand how each valuation method impacts accounting practices and financial decision-making.

Why it is important

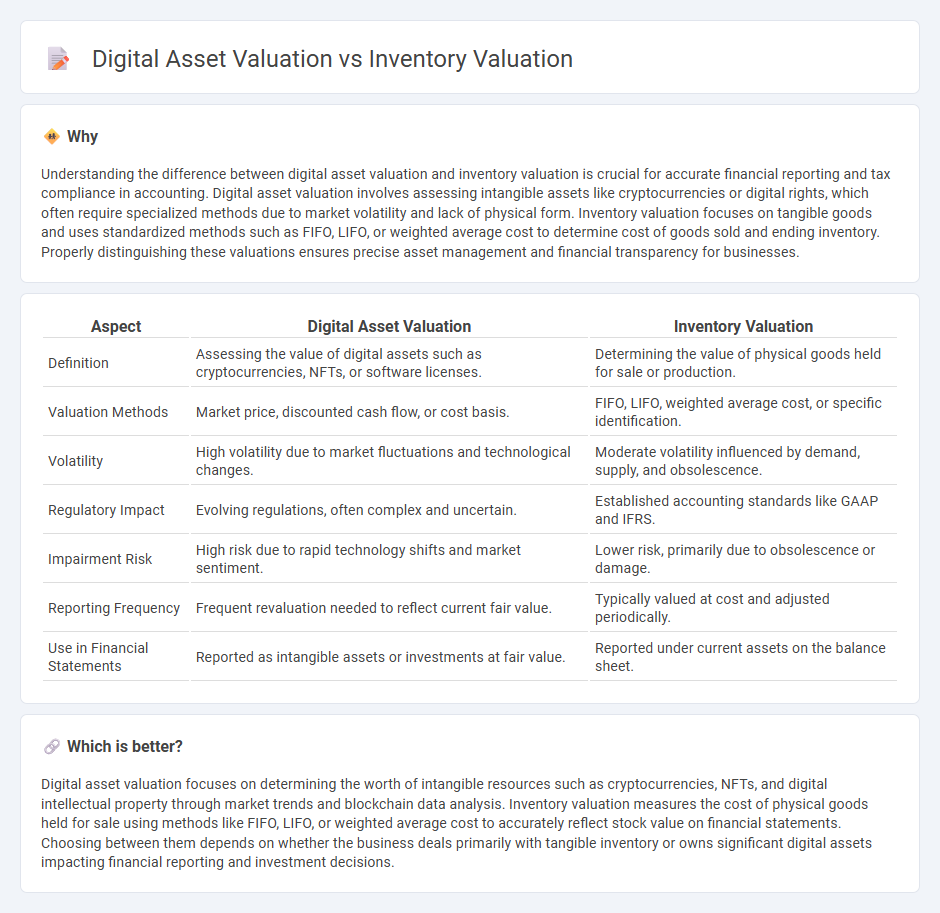

Understanding the difference between digital asset valuation and inventory valuation is crucial for accurate financial reporting and tax compliance in accounting. Digital asset valuation involves assessing intangible assets like cryptocurrencies or digital rights, which often require specialized methods due to market volatility and lack of physical form. Inventory valuation focuses on tangible goods and uses standardized methods such as FIFO, LIFO, or weighted average cost to determine cost of goods sold and ending inventory. Properly distinguishing these valuations ensures precise asset management and financial transparency for businesses.

Comparison Table

| Aspect | Digital Asset Valuation | Inventory Valuation |

|---|---|---|

| Definition | Assessing the value of digital assets such as cryptocurrencies, NFTs, or software licenses. | Determining the value of physical goods held for sale or production. |

| Valuation Methods | Market price, discounted cash flow, or cost basis. | FIFO, LIFO, weighted average cost, or specific identification. |

| Volatility | High volatility due to market fluctuations and technological changes. | Moderate volatility influenced by demand, supply, and obsolescence. |

| Regulatory Impact | Evolving regulations, often complex and uncertain. | Established accounting standards like GAAP and IFRS. |

| Impairment Risk | High risk due to rapid technology shifts and market sentiment. | Lower risk, primarily due to obsolescence or damage. |

| Reporting Frequency | Frequent revaluation needed to reflect current fair value. | Typically valued at cost and adjusted periodically. |

| Use in Financial Statements | Reported as intangible assets or investments at fair value. | Reported under current assets on the balance sheet. |

Which is better?

Digital asset valuation focuses on determining the worth of intangible resources such as cryptocurrencies, NFTs, and digital intellectual property through market trends and blockchain data analysis. Inventory valuation measures the cost of physical goods held for sale using methods like FIFO, LIFO, or weighted average cost to accurately reflect stock value on financial statements. Choosing between them depends on whether the business deals primarily with tangible inventory or owns significant digital assets impacting financial reporting and investment decisions.

Connection

Digital asset valuation and inventory valuation both rely on accurate assessment of asset worth to ensure precise financial reporting and compliance with accounting standards. Digital asset valuation involves determining the fair market value of intangible digital assets, such as cryptocurrencies or digital licenses, which impacts inventory valuation when these assets are held for sale or use. Proper integration of digital asset valuation into inventory accounting helps businesses maintain accurate balance sheets and optimize tax liabilities.

Key Terms

Inventory valuation:

Inventory valuation determines the monetary value of a company's inventory, crucial for accurate financial reporting and cost of goods sold calculation. Common methods include FIFO, LIFO, and weighted average, each affecting profit margins and tax liabilities differently. Explore detailed strategies and their impact on business finance to optimize inventory management and valuation accuracy.

Cost Flow Assumptions (FIFO, LIFO, Weighted Average)

Inventory valuation relies heavily on cost flow assumptions such as FIFO (First In, First Out), LIFO (Last In, First Out), and Weighted Average to accurately match costs with revenues and ensure precise financial reporting. Digital asset valuation, however, often struggles to apply these traditional methodologies due to the intangible nature and rapid appreciation or depreciation of digital assets like cryptocurrencies or NFTs. Explore how adapting cost flow assumptions can revolutionize the accuracy of digital asset valuations.

Net Realizable Value

Inventory valuation relies on Net Realizable Value (NRV) to reflect the estimated selling price minus costs of completion and sale, ensuring accurate asset reporting on balance sheets. Digital asset valuation often employs different approaches, such as market value or discounted cash flow, since NRV is less applicable due to digital assets' intangible nature and fluctuating market conditions. Explore further to understand how NRV impacts financial accuracy in diverse asset types.

Source and External Links

Inventory Valuation - Definition, Importance, How to - Inventory valuation refers to the accounting practice of determining the value of a business's inventory, generally using the lower of cost or market price for each item, which impacts financial reporting and inventory management.

Inventory valuation - AccountingTools - Inventory valuation is the cost of an entity's inventory at the end of a reporting period and affects cost of goods sold, profit, loan ratios, and income taxes, with costs including direct materials, labor, and overhead.

What Is Inventory Valuation? Definition, Importance and Methods - Inventory valuation is the cost of unsold inventory at a period end, crucial for profitability and taxes, with common valuation methods such as FIFO, LIFO, Weighted Average Cost, and Specific Identification.

dowidth.com

dowidth.com