Tax technology solutions enhance accuracy and efficiency in tax calculations by leveraging automation, AI, and real-time data integration. Compliance management platforms streamline regulatory adherence through centralized monitoring, risk assessment, and audit trail capabilities. Explore the benefits and differences between these platforms to optimize your accounting processes.

Why it is important

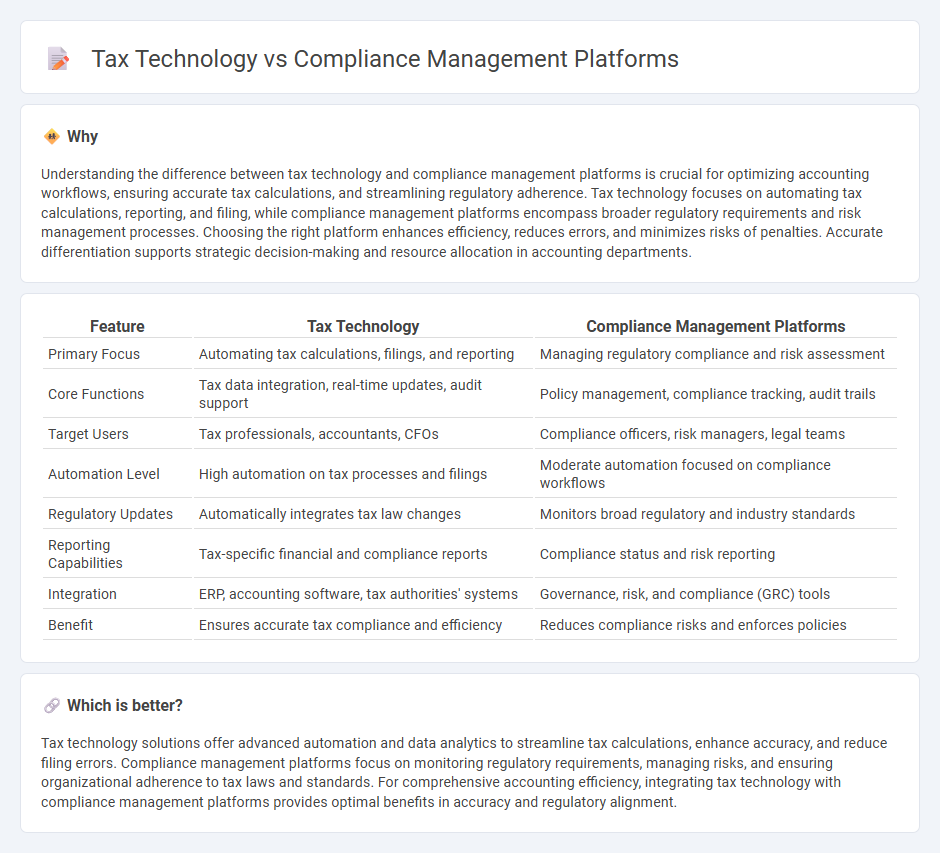

Understanding the difference between tax technology and compliance management platforms is crucial for optimizing accounting workflows, ensuring accurate tax calculations, and streamlining regulatory adherence. Tax technology focuses on automating tax calculations, reporting, and filing, while compliance management platforms encompass broader regulatory requirements and risk management processes. Choosing the right platform enhances efficiency, reduces errors, and minimizes risks of penalties. Accurate differentiation supports strategic decision-making and resource allocation in accounting departments.

Comparison Table

| Feature | Tax Technology | Compliance Management Platforms |

|---|---|---|

| Primary Focus | Automating tax calculations, filings, and reporting | Managing regulatory compliance and risk assessment |

| Core Functions | Tax data integration, real-time updates, audit support | Policy management, compliance tracking, audit trails |

| Target Users | Tax professionals, accountants, CFOs | Compliance officers, risk managers, legal teams |

| Automation Level | High automation on tax processes and filings | Moderate automation focused on compliance workflows |

| Regulatory Updates | Automatically integrates tax law changes | Monitors broad regulatory and industry standards |

| Reporting Capabilities | Tax-specific financial and compliance reports | Compliance status and risk reporting |

| Integration | ERP, accounting software, tax authorities' systems | Governance, risk, and compliance (GRC) tools |

| Benefit | Ensures accurate tax compliance and efficiency | Reduces compliance risks and enforces policies |

Which is better?

Tax technology solutions offer advanced automation and data analytics to streamline tax calculations, enhance accuracy, and reduce filing errors. Compliance management platforms focus on monitoring regulatory requirements, managing risks, and ensuring organizational adherence to tax laws and standards. For comprehensive accounting efficiency, integrating tax technology with compliance management platforms provides optimal benefits in accuracy and regulatory alignment.

Connection

Tax technology integrates advanced software solutions to automate tax calculations, reporting, and filing processes, enhancing accuracy and efficiency in compliance management platforms. These platforms centralize regulatory requirements, streamlining risk assessment and ensuring adherence to evolving tax laws through real-time data analysis. By combining tax technology with compliance management, organizations achieve seamless regulatory compliance while minimizing errors and reducing operational costs.

Key Terms

Regulatory Reporting

Compliance management platforms streamline regulatory reporting by automating data collection, monitoring deadlines, and ensuring adherence to evolving legal requirements, which reduces the risk of non-compliance penalties. Tax technology leverages specialized tools like tax engines and analytics to accurately calculate liabilities, generate reports, and integrate seamlessly with financial systems for comprehensive tax reporting. Explore how integrating compliance management and tax technology can enhance accuracy and efficiency in regulatory reporting processes.

Tax Automation

Compliance management platforms streamline regulatory adherence across multiple domains, integrating tax rules but often lacking specialized automation for complex tax processes. Tax technology, particularly tax automation tools, focuses on optimizing tax calculations, reporting, and filing through AI-driven workflows and real-time data analysis, significantly reducing errors and manual effort. Explore how advanced tax automation elevates accuracy and efficiency in your organization's tax management by learning more about leading solutions.

Audit Trail

Compliance management platforms provide a comprehensive audit trail by automating documentation processes, ensuring real-time tracking of regulatory adherence and changes across multiple departments. Tax technology focuses on specialized audit trail features that capture detailed transaction histories and tax-related calculations for precise reporting and dispute resolution. Discover how integrating both solutions can enhance audit transparency and regulatory confidence in your organization.

Source and External Links

Top 13 Compliance Automation Tools in 2025 - Secureframe is a prominent compliance management platform that automates compliance across multiple regulatory frameworks like SOC 2, ISO 27001, PCI DSS, CCPA, GDPR, and HIPAA, offering seamless integration with technology stacks, continuous monitoring, and audit readiness features.

Compliance Management Software - MetricStream provides a cloud-based compliance management solution that maps regulations to internal policies and business units, uses AI to manage regulatory changes effectively, and offers powerful control assessment and reporting capabilities to strengthen enterprise-wide compliance programs.

9 Best Compliance Management Software Tools of 2025 - Cflow is a cloud-based compliance management tool focused on workflow automation, task tracking, and reporting, while HIPAA One specializes in helping healthcare organizations comply with HIPAA regulations through risk assessments, data mapping, and training modules.

dowidth.com

dowidth.com