Supply chain finance optimizes cash flow by allowing buyers to extend payment terms while suppliers receive early payment through third-party financing. Accounts receivable financing enables businesses to improve liquidity by selling outstanding invoices to a lender at a discount. Discover more about how these financing options can enhance your company's financial strategy.

Why it is important

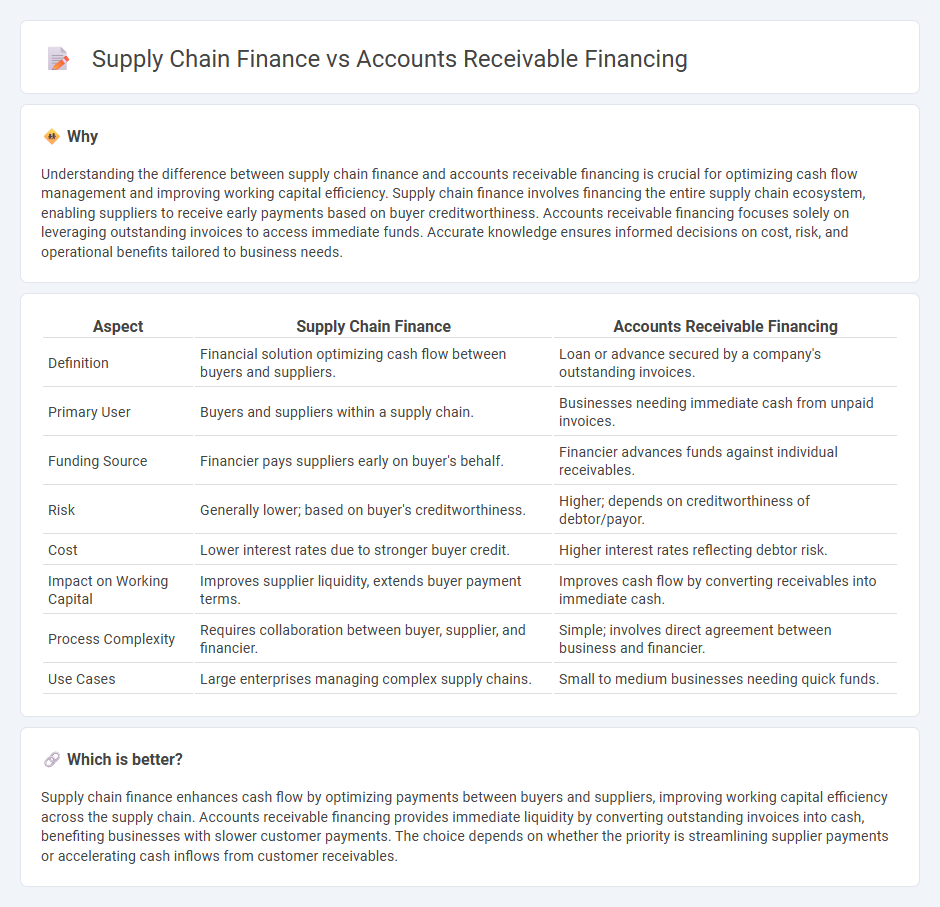

Understanding the difference between supply chain finance and accounts receivable financing is crucial for optimizing cash flow management and improving working capital efficiency. Supply chain finance involves financing the entire supply chain ecosystem, enabling suppliers to receive early payments based on buyer creditworthiness. Accounts receivable financing focuses solely on leveraging outstanding invoices to access immediate funds. Accurate knowledge ensures informed decisions on cost, risk, and operational benefits tailored to business needs.

Comparison Table

| Aspect | Supply Chain Finance | Accounts Receivable Financing |

|---|---|---|

| Definition | Financial solution optimizing cash flow between buyers and suppliers. | Loan or advance secured by a company's outstanding invoices. |

| Primary User | Buyers and suppliers within a supply chain. | Businesses needing immediate cash from unpaid invoices. |

| Funding Source | Financier pays suppliers early on buyer's behalf. | Financier advances funds against individual receivables. |

| Risk | Generally lower; based on buyer's creditworthiness. | Higher; depends on creditworthiness of debtor/payor. |

| Cost | Lower interest rates due to stronger buyer credit. | Higher interest rates reflecting debtor risk. |

| Impact on Working Capital | Improves supplier liquidity, extends buyer payment terms. | Improves cash flow by converting receivables into immediate cash. |

| Process Complexity | Requires collaboration between buyer, supplier, and financier. | Simple; involves direct agreement between business and financier. |

| Use Cases | Large enterprises managing complex supply chains. | Small to medium businesses needing quick funds. |

Which is better?

Supply chain finance enhances cash flow by optimizing payments between buyers and suppliers, improving working capital efficiency across the supply chain. Accounts receivable financing provides immediate liquidity by converting outstanding invoices into cash, benefiting businesses with slower customer payments. The choice depends on whether the priority is streamlining supplier payments or accelerating cash inflows from customer receivables.

Connection

Supply chain finance and accounts receivable financing are interconnected through their emphasis on optimizing cash flow and working capital management for businesses. Supply chain finance enables suppliers to receive early payments on outstanding invoices, while accounts receivable financing allows companies to leverage their receivables as collateral for immediate funds. Both financial solutions enhance liquidity, reduce payment delays, and strengthen supplier-buyer relationships within the accounting framework.

Key Terms

Factoring

Factoring is a common form of accounts receivable financing where businesses sell their invoices to a third party, known as a factor, to improve cash flow by receiving immediate funds. Supply chain finance typically involves collaborative financing solutions that optimize working capital across the supply chain, using the buyer's creditworthiness to offer better financing terms to suppliers. Explore more about how factoring compares to other supply chain finance options to enhance liquidity management.

Reverse factoring

Reverse factoring, a subset of supply chain finance, improves working capital by enabling suppliers to receive early payment on invoices approved by the buyer, reducing days sales outstanding. Accounts receivable financing involves businesses borrowing funds against outstanding invoices without buyer approval, often at higher costs and credit risks. Explore the benefits and mechanisms of reverse factoring to optimize cash flow and strengthen supplier relationships.

Working capital

Accounts receivable financing accelerates cash flow by converting outstanding invoices into immediate funds, enhancing working capital efficiency. Supply chain finance optimizes working capital across the supply chain by providing suppliers early payment options through buyer-approved financing solutions. Explore how these financing strategies can streamline cash flow and improve liquidity for your business operations.

Source and External Links

The Ins and Outs of Accounts Receivable Financing - This article explains the mechanics of accounts receivable financing, including how companies use outstanding invoices to secure working capital or loans.

What is Accounts Receivable Financing? - This page describes the three primary types of receivables finance: asset-based lending, traditional factoring, and selective receivables finance.

What is Accounts Receivable Financing? - This resource outlines the pros and cons of accounts receivable financing, including immediate cash flow and potential costs.

dowidth.com

dowidth.com