Forensic analysis in accounting focuses on detecting and investigating financial fraud, often involving detailed examination of transactions to uncover irregularities. Internal controls evaluation assesses the effectiveness of policies and procedures designed to prevent errors and fraud, ensuring accuracy and compliance within financial operations. Discover more about how these critical accounting functions protect organizational integrity and financial health.

Why it is important

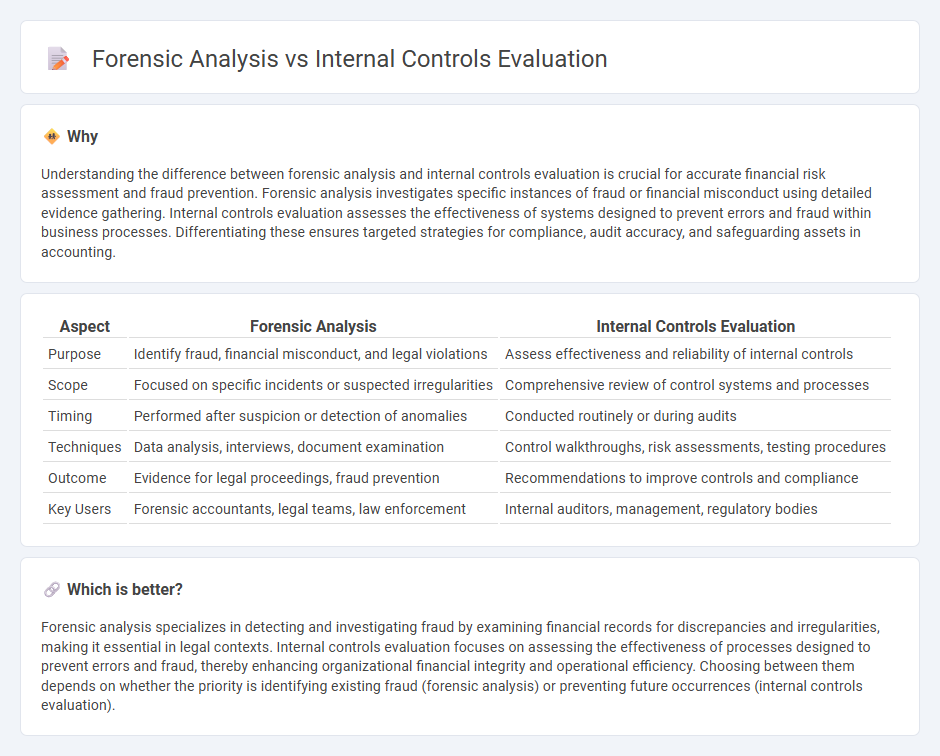

Understanding the difference between forensic analysis and internal controls evaluation is crucial for accurate financial risk assessment and fraud prevention. Forensic analysis investigates specific instances of fraud or financial misconduct using detailed evidence gathering. Internal controls evaluation assesses the effectiveness of systems designed to prevent errors and fraud within business processes. Differentiating these ensures targeted strategies for compliance, audit accuracy, and safeguarding assets in accounting.

Comparison Table

| Aspect | Forensic Analysis | Internal Controls Evaluation |

|---|---|---|

| Purpose | Identify fraud, financial misconduct, and legal violations | Assess effectiveness and reliability of internal controls |

| Scope | Focused on specific incidents or suspected irregularities | Comprehensive review of control systems and processes |

| Timing | Performed after suspicion or detection of anomalies | Conducted routinely or during audits |

| Techniques | Data analysis, interviews, document examination | Control walkthroughs, risk assessments, testing procedures |

| Outcome | Evidence for legal proceedings, fraud prevention | Recommendations to improve controls and compliance |

| Key Users | Forensic accountants, legal teams, law enforcement | Internal auditors, management, regulatory bodies |

Which is better?

Forensic analysis specializes in detecting and investigating fraud by examining financial records for discrepancies and irregularities, making it essential in legal contexts. Internal controls evaluation focuses on assessing the effectiveness of processes designed to prevent errors and fraud, thereby enhancing organizational financial integrity and operational efficiency. Choosing between them depends on whether the priority is identifying existing fraud (forensic analysis) or preventing future occurrences (internal controls evaluation).

Connection

Forensic analysis and internal controls evaluation are interconnected through their shared goal of detecting and preventing financial fraud. Forensic analysis investigates discrepancies and fraudulent activities by scrutinizing financial records, while internal controls evaluation assesses the effectiveness of policies and procedures designed to mitigate risks. Strengthening internal controls reduces vulnerabilities, making forensic investigations more focused and efficient in identifying irregularities.

Key Terms

**Internal Controls Evaluation:**

Internal controls evaluation systematically assesses organizational processes to ensure accuracy, compliance, and risk mitigation in financial reporting and operations. It identifies weaknesses in control mechanisms that could lead to fraud, error, or inefficiency, enhancing overall corporate governance. Explore more about how internal controls evaluation strengthens your business integrity and operational resilience.

Segregation of Duties

Segregation of Duties (SoD) is a critical internal control designed to reduce the risk of errors and fraud by dividing responsibilities among different employees, ensuring no single individual has control over all aspects of a financial transaction. Internal controls evaluation assesses SoD effectiveness through regular audits, process reviews, and risk assessments to identify weaknesses and enhance operational integrity. Explore how detailed forensic analysis can uncover hidden SoD violations and fraudulent activities beyond standard internal controls evaluation.

Risk Assessment

Internal controls evaluation primarily focuses on assessing the effectiveness of risk management processes and identifying vulnerabilities within an organization's operational framework. Forensic analysis targets the detection and investigation of fraud by thoroughly examining transactional data and identifying anomalies linked to risk exposure. Explore detailed methodologies to enhance your organization's risk assessment strategies.

Source and External Links

Internal Controls Evaluation - Diligent - This webpage provides a 6-step process for evaluating internal controls, emphasizing culture, risk assessment, and reporting.

Assessing the System of Internal Control - KPMG - This document offers key questions for assessing internal controls, focusing on risk management and organizational culture.

Internal Controls and Self-Assessment - Govops - This guide discusses self-assessment techniques for internal controls, including routine checks and formal audits.

dowidth.com

dowidth.com