Taxonomy alignment ensures consistent categorization of financial data, enhancing accuracy in accounting systems. Segment reporting breaks down financial information by business units, providing detailed insights into performance and risks across departments. Explore how these practices improve financial transparency and decision-making accuracy.

Why it is important

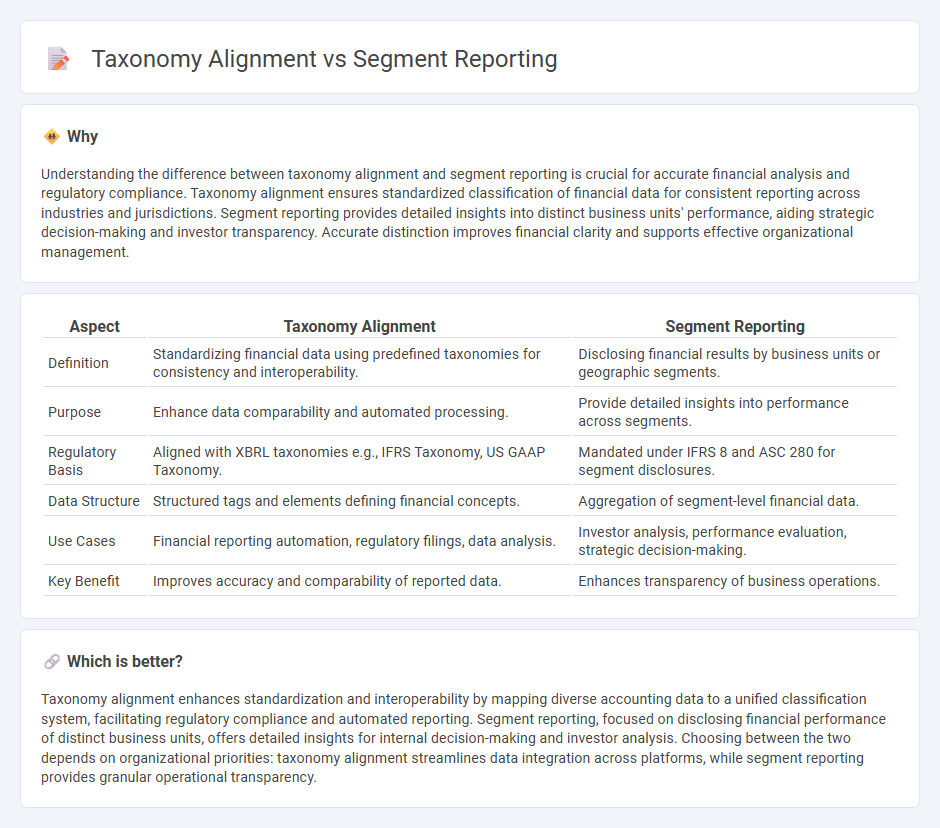

Understanding the difference between taxonomy alignment and segment reporting is crucial for accurate financial analysis and regulatory compliance. Taxonomy alignment ensures standardized classification of financial data for consistent reporting across industries and jurisdictions. Segment reporting provides detailed insights into distinct business units' performance, aiding strategic decision-making and investor transparency. Accurate distinction improves financial clarity and supports effective organizational management.

Comparison Table

| Aspect | Taxonomy Alignment | Segment Reporting |

|---|---|---|

| Definition | Standardizing financial data using predefined taxonomies for consistency and interoperability. | Disclosing financial results by business units or geographic segments. |

| Purpose | Enhance data comparability and automated processing. | Provide detailed insights into performance across segments. |

| Regulatory Basis | Aligned with XBRL taxonomies e.g., IFRS Taxonomy, US GAAP Taxonomy. | Mandated under IFRS 8 and ASC 280 for segment disclosures. |

| Data Structure | Structured tags and elements defining financial concepts. | Aggregation of segment-level financial data. |

| Use Cases | Financial reporting automation, regulatory filings, data analysis. | Investor analysis, performance evaluation, strategic decision-making. |

| Key Benefit | Improves accuracy and comparability of reported data. | Enhances transparency of business operations. |

Which is better?

Taxonomy alignment enhances standardization and interoperability by mapping diverse accounting data to a unified classification system, facilitating regulatory compliance and automated reporting. Segment reporting, focused on disclosing financial performance of distinct business units, offers detailed insights for internal decision-making and investor analysis. Choosing between the two depends on organizational priorities: taxonomy alignment streamlines data integration across platforms, while segment reporting provides granular operational transparency.

Connection

Taxonomy alignment in accounting ensures the standardized classification of financial data, which enhances the accuracy and consistency of segment reporting by enabling uniform identification of reporting segments across organizations. Segment reporting relies on taxonomy alignment to present detailed financial performance and risks of individual business units, facilitating regulatory compliance such as IFRS 8 requirements. Effective taxonomy alignment supports clearer disclosures and comparability in financial statements, improving stakeholder analysis of company segments.

Key Terms

Segment Disclosure

Segment reporting provides detailed financial information by business unit or geographic area, enhancing transparency for stakeholders. Taxonomy alignment ensures that segment disclosures comply with standardized digital reporting frameworks, such as the IFRS taxonomy, facilitating data comparability and regulatory compliance. Explore how integrating taxonomy alignment strengthens segment disclosure accuracy and consistency.

Financial Reporting Standards (e.g., IFRS 8)

Segment reporting, as mandated by IFRS 8, requires entities to disclose financial information about operating segments to enhance transparency and decision-making for investors. Taxonomy alignment involves structuring financial data according to specific definitions and relationships within reporting standards to support consistent digital reporting and automate data exchange. Explore the nuances of segment reporting and taxonomy alignment to improve compliance and financial data quality.

XBRL Tagging

Segment reporting in XBRL tagging involves categorizing financial data according to business units, geographies, or products to provide detailed insights for stakeholders. Taxonomy alignment ensures that tags adhere to regulatory standards, enabling consistent data interpretation and interoperability across reporting platforms. Explore the nuances of XBRL tagging to enhance transparency and compliance in financial disclosures.

Source and External Links

What is Segment Reporting? - Vintti - Segment reporting involves breaking down a company's financial performance by business units, product lines, or geographies into operating segments, which are then evaluated for materiality to decide their disclosure for clearer performance insights of diversified companies.

A Roadmap to Segment Reporting | Deloitte US - Segment reporting provides transparency into a public entity's different business activities and economic environments to help financial statement users better understand performance and prospects, guided by ASC 280 and enhanced by recent FASB updates.

Handbook: Segment reporting - KPMG International - This handbook explains segment reporting requirements including the latest FASB amendments (ASU 2023-07) that expand segment disclosure obligations, such as reporting significant segment expenses, and addresses related SEC filing guidance for US and non-US companies.

dowidth.com

dowidth.com