Digital ledger technology offers enhanced accuracy, real-time updates, and improved security through cryptographic methods compared to traditional paper-based ledgers prone to errors and physical damage. Blockchain and distributed ledger systems facilitate transparent and immutable record-keeping, transforming accounting processes across industries. Explore how integrating digital ledgers can optimize your accounting practices and ensure compliance.

Why it is important

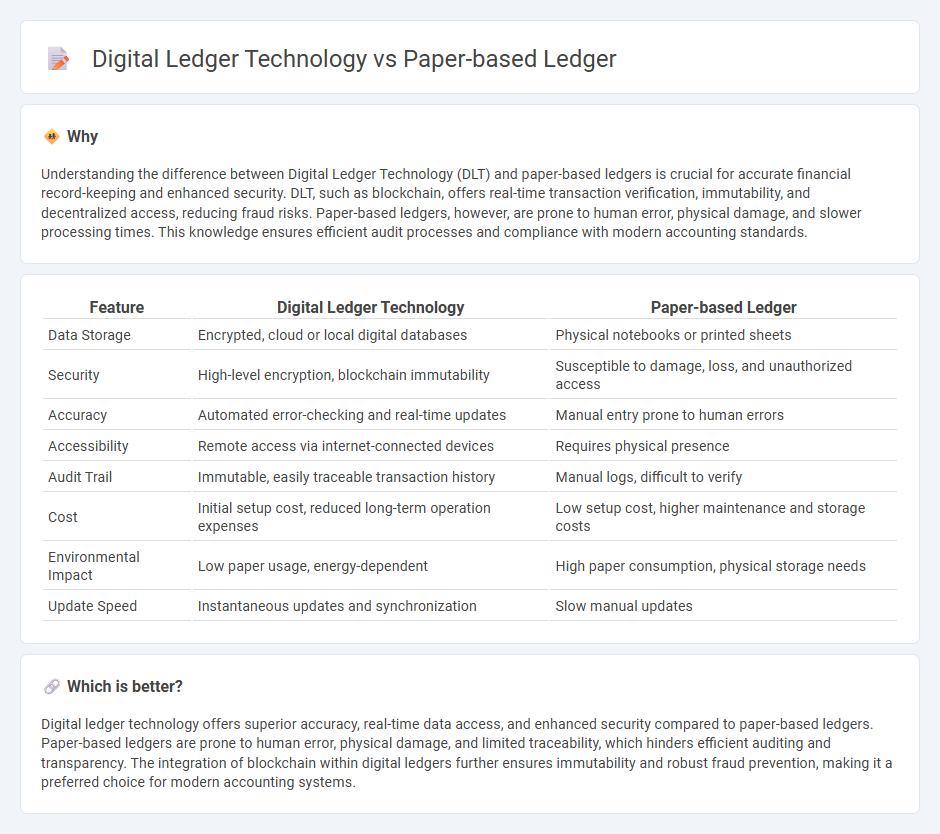

Understanding the difference between Digital Ledger Technology (DLT) and paper-based ledgers is crucial for accurate financial record-keeping and enhanced security. DLT, such as blockchain, offers real-time transaction verification, immutability, and decentralized access, reducing fraud risks. Paper-based ledgers, however, are prone to human error, physical damage, and slower processing times. This knowledge ensures efficient audit processes and compliance with modern accounting standards.

Comparison Table

| Feature | Digital Ledger Technology | Paper-based Ledger |

|---|---|---|

| Data Storage | Encrypted, cloud or local digital databases | Physical notebooks or printed sheets |

| Security | High-level encryption, blockchain immutability | Susceptible to damage, loss, and unauthorized access |

| Accuracy | Automated error-checking and real-time updates | Manual entry prone to human errors |

| Accessibility | Remote access via internet-connected devices | Requires physical presence |

| Audit Trail | Immutable, easily traceable transaction history | Manual logs, difficult to verify |

| Cost | Initial setup cost, reduced long-term operation expenses | Low setup cost, higher maintenance and storage costs |

| Environmental Impact | Low paper usage, energy-dependent | High paper consumption, physical storage needs |

| Update Speed | Instantaneous updates and synchronization | Slow manual updates |

Which is better?

Digital ledger technology offers superior accuracy, real-time data access, and enhanced security compared to paper-based ledgers. Paper-based ledgers are prone to human error, physical damage, and limited traceability, which hinders efficient auditing and transparency. The integration of blockchain within digital ledgers further ensures immutability and robust fraud prevention, making it a preferred choice for modern accounting systems.

Connection

Digital ledger technology (DLT) and paper-based ledger systems are connected through their core function of recording financial transactions and maintaining accounting records. While paper-based ledgers provide a traditional, physical method of documenting entries, DLT enhances accuracy, security, and transparency by utilizing decentralized databases and cryptographic validation. Businesses increasingly transition from manual paper ledgers to digital ledgers to improve auditability, reduce errors, and streamline financial reporting processes.

Key Terms

Record-keeping

Paper-based ledgers rely on physical documentation for record-keeping, which can be prone to errors, loss, and limited accessibility. Digital ledger technology, including blockchain systems, offers secure, immutable, and easily accessible records that enhance transparency and reduce fraud risks. Explore the advantages of digital ledgers over traditional methods to optimize your record-keeping processes.

Audit Trail

Paper-based ledgers provide a physical and chronological record of transactions, offering tangible audit trails but are prone to human error, tampering, and limited scalability. Digital ledger technology, like blockchain, ensures immutable, transparent, and time-stamped audit trails secured by cryptographic algorithms, enhancing accuracy and traceability in audits. Explore how integrating digital ledgers transforms audit practices for businesses and regulatory compliance.

Data Integrity

Paper-based ledgers provide tangible records but are prone to physical damage, loss, and manual errors, compromising data integrity. Digital ledger technology leverages cryptographic security, decentralization, and real-time validation to ensure higher accuracy, immutability, and traceability of data. Explore the evolving landscape of data integrity solutions to understand which ledger technology suits your needs best.

Source and External Links

Big E-Z Bookkeeping Paper Ledger System - A comprehensive paper-based system for tracking a year's worth of business income, expenses, bank reconciliation, and profits with customizable ledger sheets and optional payroll forms.

Digital vs. Paper: Which Bookkeeping Ledger Book is Right for You? - Offers an unbiased comparison of paper ledgers (tangible, tech-free, but time-consuming and prone to errors) versus digital alternatives for financial record-keeping.

Bulk Ledger Sheets & Paper - OnTimeSupplies.com - Supplies a wide variety of accounting ledger papers in different formats, sizes, and column counts for businesses, agencies, or personal use, suitable for manual bookkeeping or backup records.

dowidth.com

dowidth.com