Dynamic discounting offers businesses flexible early payment options to suppliers in exchange for discounts, enhancing cash flow management and reducing procurement costs. Trade credit allows companies to purchase goods or services on account, deferring payment to improve short-term liquidity and working capital. Explore the key differences and benefits of dynamic discounting versus trade credit to optimize your financial strategies.

Why it is important

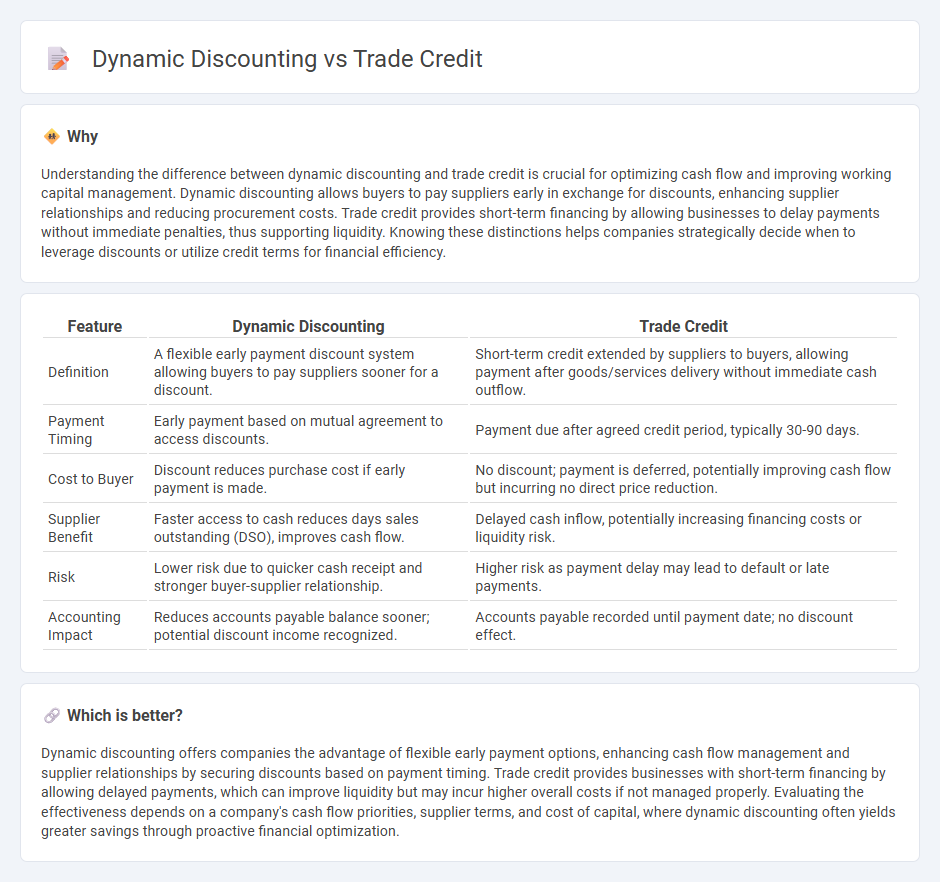

Understanding the difference between dynamic discounting and trade credit is crucial for optimizing cash flow and improving working capital management. Dynamic discounting allows buyers to pay suppliers early in exchange for discounts, enhancing supplier relationships and reducing procurement costs. Trade credit provides short-term financing by allowing businesses to delay payments without immediate penalties, thus supporting liquidity. Knowing these distinctions helps companies strategically decide when to leverage discounts or utilize credit terms for financial efficiency.

Comparison Table

| Feature | Dynamic Discounting | Trade Credit |

|---|---|---|

| Definition | A flexible early payment discount system allowing buyers to pay suppliers sooner for a discount. | Short-term credit extended by suppliers to buyers, allowing payment after goods/services delivery without immediate cash outflow. |

| Payment Timing | Early payment based on mutual agreement to access discounts. | Payment due after agreed credit period, typically 30-90 days. |

| Cost to Buyer | Discount reduces purchase cost if early payment is made. | No discount; payment is deferred, potentially improving cash flow but incurring no direct price reduction. |

| Supplier Benefit | Faster access to cash reduces days sales outstanding (DSO), improves cash flow. | Delayed cash inflow, potentially increasing financing costs or liquidity risk. |

| Risk | Lower risk due to quicker cash receipt and stronger buyer-supplier relationship. | Higher risk as payment delay may lead to default or late payments. |

| Accounting Impact | Reduces accounts payable balance sooner; potential discount income recognized. | Accounts payable recorded until payment date; no discount effect. |

Which is better?

Dynamic discounting offers companies the advantage of flexible early payment options, enhancing cash flow management and supplier relationships by securing discounts based on payment timing. Trade credit provides businesses with short-term financing by allowing delayed payments, which can improve liquidity but may incur higher overall costs if not managed properly. Evaluating the effectiveness depends on a company's cash flow priorities, supplier terms, and cost of capital, where dynamic discounting often yields greater savings through proactive financial optimization.

Connection

Dynamic discounting and trade credit are connected through their roles in managing working capital and improving cash flow between buyers and suppliers. Dynamic discounting allows buyers to take advantage of early payment discounts by paying invoices before the due date, effectively transforming trade credit terms into a flexible cash management tool. This practice optimizes financial relationships by balancing payment timing and cash availability, enhancing overall supply chain finance efficiency.

Key Terms

Accounts Payable

Trade credit allows buyers to purchase goods and delay payment, enhancing short-term cash flow management for Accounts Payable teams by extending payment terms without immediate financial outlay. Dynamic discounting offers early payment discounts through flexible, technology-driven solutions, enabling companies to optimize working capital by reducing costs and strengthening supplier relationships. Explore how these strategies can transform your Accounts Payable processes for improved financial efficiency.

Payment Terms

Trade credit offers businesses deferred payment terms, allowing buyers to pay suppliers after delivery, typically within 30 to 90 days, enhancing short-term liquidity without immediate cash outflow. Dynamic discounting provides flexible payment terms by enabling early payments in exchange for variable discounts, optimizing working capital based on real-time cash availability. Explore how adjusting payment terms through these strategies can improve your cash flow management and supplier relationships.

Cash Flow Management

Trade credit allows businesses to defer payments to suppliers, enhancing short-term cash flow by postponing outflows without incurring interest. Dynamic discounting offers early payment options in exchange for discounts, optimizing working capital and reducing procurement costs through flexible terms tailored to cash flow availability. Explore how integrating trade credit and dynamic discounting strategies can significantly improve your cash flow management efficiency.

Source and External Links

Trade Credit: What It Is, Advantages and Disadvantages - NerdWallet - Trade credit is a short-term financing arrangement where a customer purchases goods or services from a supplier and pays later, often with terms like discounts for early payment and penalties for late payment.

What is Trade Credit? - Corporate Finance Institute - Trade credit is a "buy now, pay later" agreement between businesses allowing deferred payment, typically ranging from 7 to 120 days, often including early payment discounts, and recorded as accounts receivable or payable on financial statements.

What is Trade Credit? - What Does It Mean for Buyers & Sellers? - Trade credit benefits buyers by improving cash flow and offering free financing and benefits sellers by attracting customers and increasing revenue, but risks include payment delays and credit issues for both parties.

dowidth.com

dowidth.com