Fractional CFOs provide part-time financial leadership, offering strategic planning and financial management tailored to businesses needing expert guidance without full-time commitment. Consulting CFOs focus on specific projects or challenges, delivering targeted advice and solutions to optimize financial performance. Discover how choosing between a fractional CFO and a consulting CFO can impact your company's growth and financial health.

Why it is important

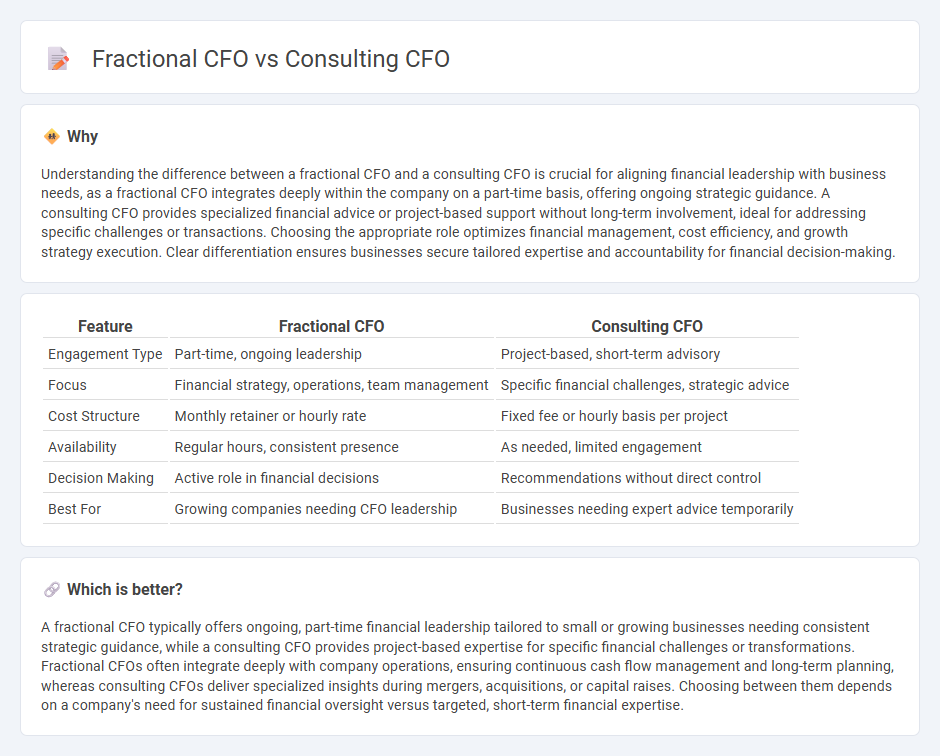

Understanding the difference between a fractional CFO and a consulting CFO is crucial for aligning financial leadership with business needs, as a fractional CFO integrates deeply within the company on a part-time basis, offering ongoing strategic guidance. A consulting CFO provides specialized financial advice or project-based support without long-term involvement, ideal for addressing specific challenges or transactions. Choosing the appropriate role optimizes financial management, cost efficiency, and growth strategy execution. Clear differentiation ensures businesses secure tailored expertise and accountability for financial decision-making.

Comparison Table

| Feature | Fractional CFO | Consulting CFO |

|---|---|---|

| Engagement Type | Part-time, ongoing leadership | Project-based, short-term advisory |

| Focus | Financial strategy, operations, team management | Specific financial challenges, strategic advice |

| Cost Structure | Monthly retainer or hourly rate | Fixed fee or hourly basis per project |

| Availability | Regular hours, consistent presence | As needed, limited engagement |

| Decision Making | Active role in financial decisions | Recommendations without direct control |

| Best For | Growing companies needing CFO leadership | Businesses needing expert advice temporarily |

Which is better?

A fractional CFO typically offers ongoing, part-time financial leadership tailored to small or growing businesses needing consistent strategic guidance, while a consulting CFO provides project-based expertise for specific financial challenges or transformations. Fractional CFOs often integrate deeply with company operations, ensuring continuous cash flow management and long-term planning, whereas consulting CFOs deliver specialized insights during mergers, acquisitions, or capital raises. Choosing between them depends on a company's need for sustained financial oversight versus targeted, short-term financial expertise.

Connection

Fractional CFOs and consulting CFOs both provide expert financial leadership on a flexible basis, supporting businesses with strategic planning, cash flow management, and risk analysis. They optimize financial operations by offering tailored advice and insights without the commitment of a full-time executive, aligning financial goals with long-term business growth. Their roles enhance decision-making processes, improve profitability, and ensure regulatory compliance across diverse industries.

Key Terms

Strategic Decision-Making

A consulting CFO primarily offers expert guidance on financial strategies, budgeting, and forecasting, providing businesses with critical insights for informed decision-making. In contrast, a fractional CFO actively integrates into the leadership team, driving strategic initiatives and operational execution on a part-time basis. Explore the differences and benefits of consulting versus fractional CFO roles to enhance your company's financial strategy.

Financial Reporting

Consulting CFOs provide specialized financial reporting services on a project basis, often addressing specific reporting challenges or audit preparations. Fractional CFOs integrate regularly within a company's leadership, offering continuous oversight of financial reporting, compliance, and strategic insights aligned with long-term business goals. Explore detailed distinctions to determine which CFO approach best supports your financial reporting needs.

Resource Allocation

Consulting CFOs typically provide strategic financial advice on a project basis, helping businesses optimize short-term resource allocation without long-term commitments. Fractional CFOs offer ongoing part-time executive leadership, integrating deeply into company operations to continuously manage and allocate resources efficiently. Discover how each role can uniquely align with your business goals and financial strategy.

Source and External Links

CFO Consulting Services - Offers expert CFO consulting services to optimize financial strategies and enhance growth for businesses through advanced financial planning and transaction management.

What is a Consulting CFO? Does My Business Need One? - Helps businesses determine if they need a consulting CFO for financial leadership, budgeting, data analysis, and strategic financial planning.

How to Begin CFO Consulting - Provides a step-by-step guide for professionals looking to start a career in CFO consulting, including understanding the role and responsibilities of a CFO consultant.

dowidth.com

dowidth.com