Continuous close streamlines accounting by updating financial records daily, enhancing accuracy and real-time insights compared to the traditional year-end close, which consolidates data only once annually. Continuous close reduces errors and accelerates reporting cycles, enabling businesses to make timely decisions based on current financial information. Explore more to understand how adopting continuous close can transform your accounting processes.

Why it is important

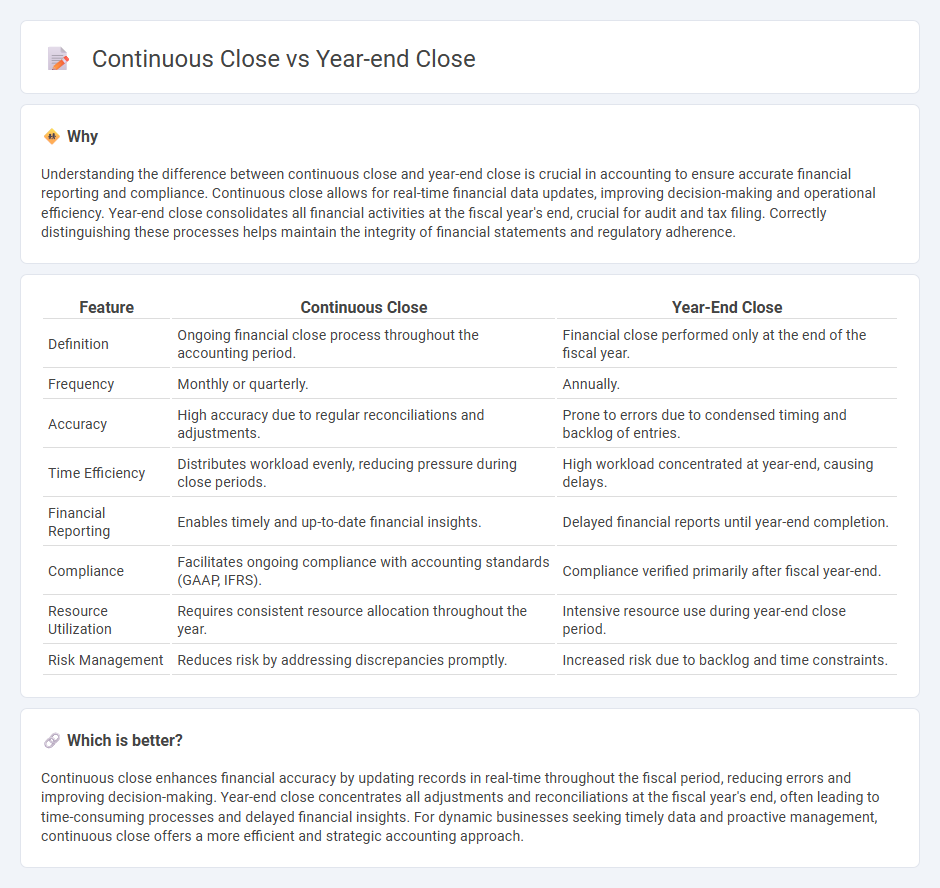

Understanding the difference between continuous close and year-end close is crucial in accounting to ensure accurate financial reporting and compliance. Continuous close allows for real-time financial data updates, improving decision-making and operational efficiency. Year-end close consolidates all financial activities at the fiscal year's end, crucial for audit and tax filing. Correctly distinguishing these processes helps maintain the integrity of financial statements and regulatory adherence.

Comparison Table

| Feature | Continuous Close | Year-End Close |

|---|---|---|

| Definition | Ongoing financial close process throughout the accounting period. | Financial close performed only at the end of the fiscal year. |

| Frequency | Monthly or quarterly. | Annually. |

| Accuracy | High accuracy due to regular reconciliations and adjustments. | Prone to errors due to condensed timing and backlog of entries. |

| Time Efficiency | Distributes workload evenly, reducing pressure during close periods. | High workload concentrated at year-end, causing delays. |

| Financial Reporting | Enables timely and up-to-date financial insights. | Delayed financial reports until year-end completion. |

| Compliance | Facilitates ongoing compliance with accounting standards (GAAP, IFRS). | Compliance verified primarily after fiscal year-end. |

| Resource Utilization | Requires consistent resource allocation throughout the year. | Intensive resource use during year-end close period. |

| Risk Management | Reduces risk by addressing discrepancies promptly. | Increased risk due to backlog and time constraints. |

Which is better?

Continuous close enhances financial accuracy by updating records in real-time throughout the fiscal period, reducing errors and improving decision-making. Year-end close concentrates all adjustments and reconciliations at the fiscal year's end, often leading to time-consuming processes and delayed financial insights. For dynamic businesses seeking timely data and proactive management, continuous close offers a more efficient and strategic accounting approach.

Connection

Continuous close integrates real-time financial data throughout the fiscal period, reducing errors and streamlining processes by maintaining up-to-date records. Year-end close consolidates all these accurate, verified transactions into final financial statements, ensuring compliance and completeness. This seamless connection minimizes audit risks and accelerates reporting timelines.

Key Terms

Cut-off Procedures

Year-end close involves finalizing all financial transactions up to a specific cut-off date, ensuring that revenues and expenses are accurately recorded within the fiscal year. Continuous close, on the other hand, performs cut-off procedures on an ongoing basis, enabling real-time financial data accuracy and reducing the risk of errors during period-end closing. Discover more insights on optimizing your accounting processes with advanced cut-off techniques.

Accruals and Deferrals

Year-end close consolidates all accruals and deferrals to finalize financial statements, ensuring compliance with accounting standards and accurate tax reporting. Continuous close spreads accruals and deferrals throughout the fiscal year, enhancing real-time financial visibility and improving decision-making efficiency. Explore how these approaches impact your accounting process and optimize financial accuracy.

Real-Time Reporting

Year-end close traditionally consolidates financial data at the fiscal period's end, while continuous close emphasizes ongoing real-time reporting through integrated systems. Real-time reporting enhances decision-making by providing immediate access to up-to-date financial metrics, facilitating timely adjustments and improved accuracy. Explore advanced real-time reporting techniques to optimize closing processes and financial transparency.

Source and External Links

Year-End Closing Process - Financials - The year-end closing process involves activities to comply with OMB requirements, including closing accounts with counterbalancing debits and credits over a one-year timeframe.

Year-End Accounting Checklist (2024) - This article provides a checklist for the year-end accounting close, involving reviewing and reconciling financial transactions to prepare for tax filings and budgeting.

Year End Close Process Explained (Step by Step) - This guide outlines an 11-step process for a successful year-end close, including reviewing and reconciling ledgers and preparing financial statements.

dowidth.com

dowidth.com