Carbon footprint accounting quantifies greenhouse gas emissions to assess environmental impact, focusing specifically on carbon output across organizational activities. Integrated reporting combines financial, environmental, social, and governance metrics into a unified framework, promoting transparency and sustainability in corporate performance. Explore how these approaches complement each other to enhance holistic business accountability.

Why it is important

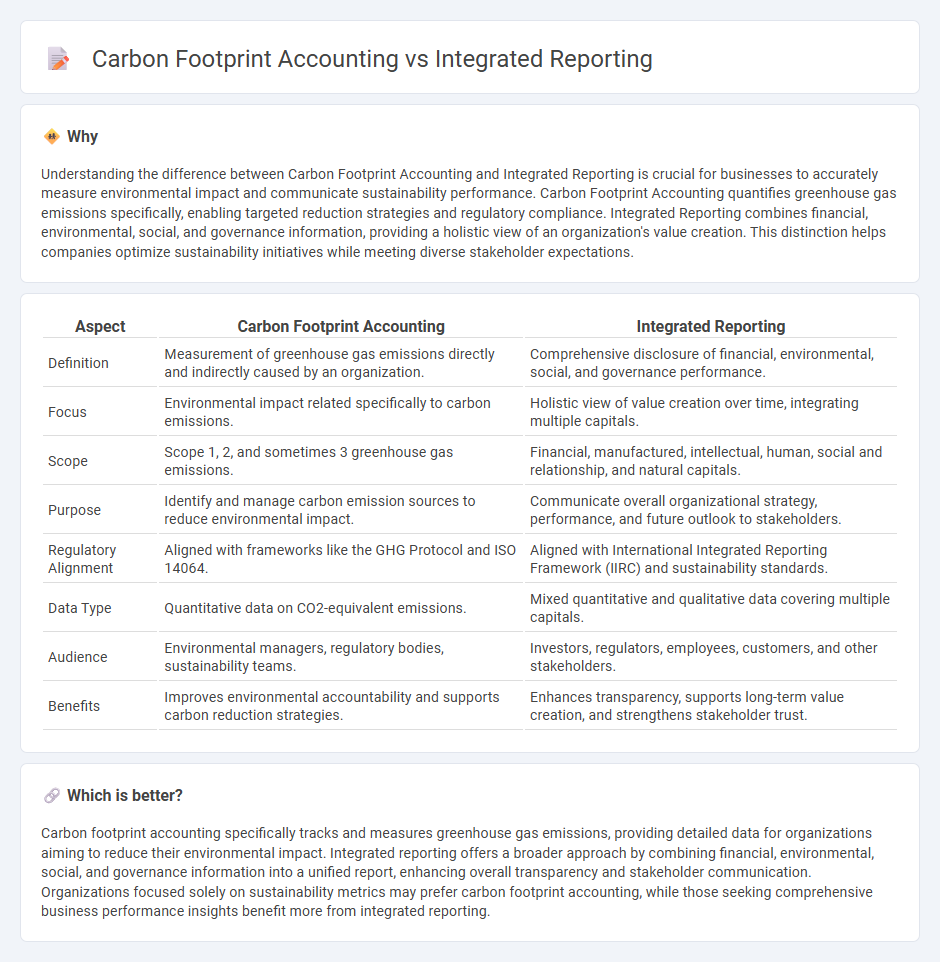

Understanding the difference between Carbon Footprint Accounting and Integrated Reporting is crucial for businesses to accurately measure environmental impact and communicate sustainability performance. Carbon Footprint Accounting quantifies greenhouse gas emissions specifically, enabling targeted reduction strategies and regulatory compliance. Integrated Reporting combines financial, environmental, social, and governance information, providing a holistic view of an organization's value creation. This distinction helps companies optimize sustainability initiatives while meeting diverse stakeholder expectations.

Comparison Table

| Aspect | Carbon Footprint Accounting | Integrated Reporting |

|---|---|---|

| Definition | Measurement of greenhouse gas emissions directly and indirectly caused by an organization. | Comprehensive disclosure of financial, environmental, social, and governance performance. |

| Focus | Environmental impact related specifically to carbon emissions. | Holistic view of value creation over time, integrating multiple capitals. |

| Scope | Scope 1, 2, and sometimes 3 greenhouse gas emissions. | Financial, manufactured, intellectual, human, social and relationship, and natural capitals. |

| Purpose | Identify and manage carbon emission sources to reduce environmental impact. | Communicate overall organizational strategy, performance, and future outlook to stakeholders. |

| Regulatory Alignment | Aligned with frameworks like the GHG Protocol and ISO 14064. | Aligned with International Integrated Reporting Framework (IIRC) and sustainability standards. |

| Data Type | Quantitative data on CO2-equivalent emissions. | Mixed quantitative and qualitative data covering multiple capitals. |

| Audience | Environmental managers, regulatory bodies, sustainability teams. | Investors, regulators, employees, customers, and other stakeholders. |

| Benefits | Improves environmental accountability and supports carbon reduction strategies. | Enhances transparency, supports long-term value creation, and strengthens stakeholder trust. |

Which is better?

Carbon footprint accounting specifically tracks and measures greenhouse gas emissions, providing detailed data for organizations aiming to reduce their environmental impact. Integrated reporting offers a broader approach by combining financial, environmental, social, and governance information into a unified report, enhancing overall transparency and stakeholder communication. Organizations focused solely on sustainability metrics may prefer carbon footprint accounting, while those seeking comprehensive business performance insights benefit more from integrated reporting.

Connection

Carbon footprint accounting quantifies greenhouse gas emissions associated with business activities, providing critical environmental data that Integrated Reporting incorporates alongside financial metrics to present a comprehensive view of organizational performance. Integrated Reporting frameworks utilize carbon footprint data to inform stakeholders about sustainability risks and opportunities influencing long-term value creation. This connection enhances transparent decision-making by aligning ecological impact assessment with economic reporting standards.

Key Terms

Value Creation

Integrated reporting offers a holistic view of value creation by combining financial, environmental, social, and governance data to provide stakeholders with a comprehensive understanding of a company's long-term sustainability and performance. Carbon footprint accounting specifically measures and reports greenhouse gas emissions, helping organizations identify reduction opportunities and manage climate-related risks within their value chains. Explore more about how these approaches complement each other to drive strategic value and sustainable growth.

Sustainability Metrics

Integrated reporting combines financial and sustainability metrics to provide a holistic view of organizational performance, emphasizing environmental, social, and governance (ESG) factors alongside traditional financial data. Carbon footprint accounting specifically measures greenhouse gas emissions associated with an organization's activities, offering detailed insights into environmental impact for targeted reduction strategies. Explore how these frameworks complement each other to enhance corporate sustainability effectiveness.

Greenhouse Gas (GHG) Emissions

Integrated reporting offers a comprehensive framework combining financial, environmental, and social data to highlight a company's overall impact, while carbon footprint accounting specifically quantifies Greenhouse Gas (GHG) emissions to measure environmental impact. Carbon footprint accounting provides detailed metrics on Scope 1, 2, and 3 emissions essential for targeted GHG reduction strategies, whereas integrated reporting places GHG emissions within broader sustainability and governance contexts. Explore more to understand how each approach drives corporate sustainability and regulatory compliance objectives.

Source and External Links

Integrated reporting - Wikipedia - Integrated reporting (IR) is a concise communication about how an organization's strategy, governance, performance, and prospects lead to value creation over time by integrating financial and other relevant information for better decision making and accountability, mainly targeting investors.

What is Integrated Reporting? - ESG - Integrated reporting presents a holistic view of a company's financial and non-financial factors, emphasizing how ESG issues and various capitals contribute to sustainable long-term value creation for stakeholders.

INTERNATIONAL <IR> FRAMEWORK - Integrated Reporting - The

dowidth.com

dowidth.com