Cryptocurrency taxation involves understanding complex regulatory frameworks that require accurate reporting of digital asset gains and losses. Cost basis methods, such as FIFO (First In, First Out), LIFO (Last In, First Out), and specific identification, play a crucial role in determining taxable events and capital gains. Explore how different cost basis techniques impact your cryptocurrency tax obligations and optimize compliance strategies.

Why it is important

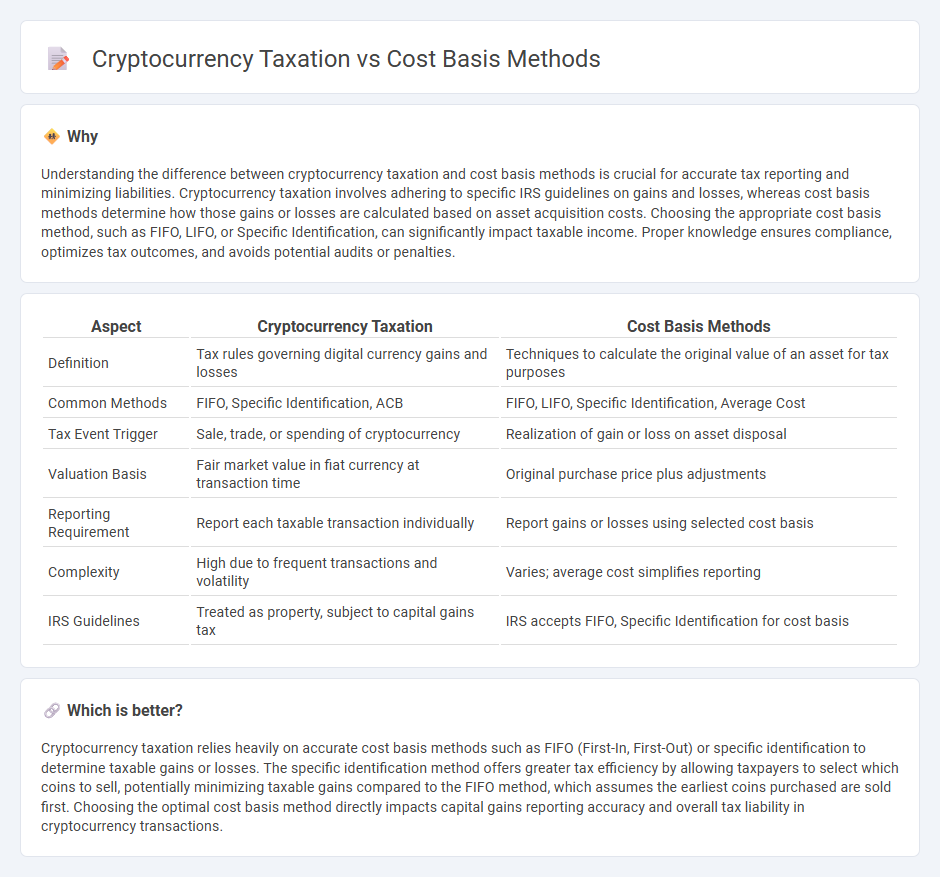

Understanding the difference between cryptocurrency taxation and cost basis methods is crucial for accurate tax reporting and minimizing liabilities. Cryptocurrency taxation involves adhering to specific IRS guidelines on gains and losses, whereas cost basis methods determine how those gains or losses are calculated based on asset acquisition costs. Choosing the appropriate cost basis method, such as FIFO, LIFO, or Specific Identification, can significantly impact taxable income. Proper knowledge ensures compliance, optimizes tax outcomes, and avoids potential audits or penalties.

Comparison Table

| Aspect | Cryptocurrency Taxation | Cost Basis Methods |

|---|---|---|

| Definition | Tax rules governing digital currency gains and losses | Techniques to calculate the original value of an asset for tax purposes |

| Common Methods | FIFO, Specific Identification, ACB | FIFO, LIFO, Specific Identification, Average Cost |

| Tax Event Trigger | Sale, trade, or spending of cryptocurrency | Realization of gain or loss on asset disposal |

| Valuation Basis | Fair market value in fiat currency at transaction time | Original purchase price plus adjustments |

| Reporting Requirement | Report each taxable transaction individually | Report gains or losses using selected cost basis |

| Complexity | High due to frequent transactions and volatility | Varies; average cost simplifies reporting |

| IRS Guidelines | Treated as property, subject to capital gains tax | IRS accepts FIFO, Specific Identification for cost basis |

Which is better?

Cryptocurrency taxation relies heavily on accurate cost basis methods such as FIFO (First-In, First-Out) or specific identification to determine taxable gains or losses. The specific identification method offers greater tax efficiency by allowing taxpayers to select which coins to sell, potentially minimizing taxable gains compared to the FIFO method, which assumes the earliest coins purchased are sold first. Choosing the optimal cost basis method directly impacts capital gains reporting accuracy and overall tax liability in cryptocurrency transactions.

Connection

Cryptocurrency taxation relies heavily on accurate cost basis methods to determine capital gains or losses when assets are sold or traded, impacting the taxable amount reported to tax authorities. Methods such as FIFO (First In, First Out), LIFO (Last In, First Out), and specific identification each produce different cost bases, influencing an investor's tax liability. Proper application of these cost basis methods ensures compliance with IRS regulations and optimizes tax reporting strategies in cryptocurrency transactions.

Key Terms

FIFO (First-In, First-Out)

FIFO (First-In, First-Out) is a common cost basis method used in cryptocurrency taxation, where the earliest acquired coins are considered sold first, impacting capital gains calculations. This method can result in higher or lower taxable gains depending on the market price fluctuations of the initial holdings compared to recent purchases. Explore how FIFO can optimize your crypto tax strategy and compliance by learning more about its implications and alternatives.

Specific Identification

Specific Identification allows cryptocurrency investors to selectively choose which coins they are selling, enabling precise calculation of cost basis for each transaction and potentially minimizing capital gains taxes. This method contrasts with FIFO (First-In, First-Out) and LIFO (Last-In, First-Out), which automatically assign cost basis based on coin acquisition order, often leading to higher tax liabilities. Learn more about how Specific Identification can optimize your cryptocurrency tax strategy.

Capital Gains

Cost basis methods such as FIFO (First In, First Out), LIFO (Last In, First Out), and Specific Identification play a crucial role in calculating capital gains for cryptocurrency transactions, directly influencing the taxable amount. Utilizing accurate cost basis tracking helps investors minimize tax liabilities by identifying the most beneficial gains or losses from crypto asset sales. Explore comprehensive strategies to optimize your cryptocurrency tax reporting and capitalize on potential savings.

Source and External Links

Save on Taxes: Know Your Cost Basis - Charles Schwab - Explains various cost basis methods including average, FIFO, LIFO, low cost, high cost, and tax lot optimizer for tax savings.

What is Cost Basis for Taxes? | Vanguard - Describes how cost basis is calculated, particularly focusing on the average cost method for mutual funds.

Fidelity.com Help - Cost Basis - Provides an overview of cost basis calculation and its impact on reporting capital gains and losses.

dowidth.com

dowidth.com