Outsourced bookkeeping services provide expert financial record-keeping with personalized oversight, ensuring accuracy and compliance tailored to your business needs. Automated expense management leverages software to streamline invoice processing and spending tracking, enhancing efficiency and reducing human error. Discover how choosing the right solution can optimize your accounting operations and financial control.

Why it is important

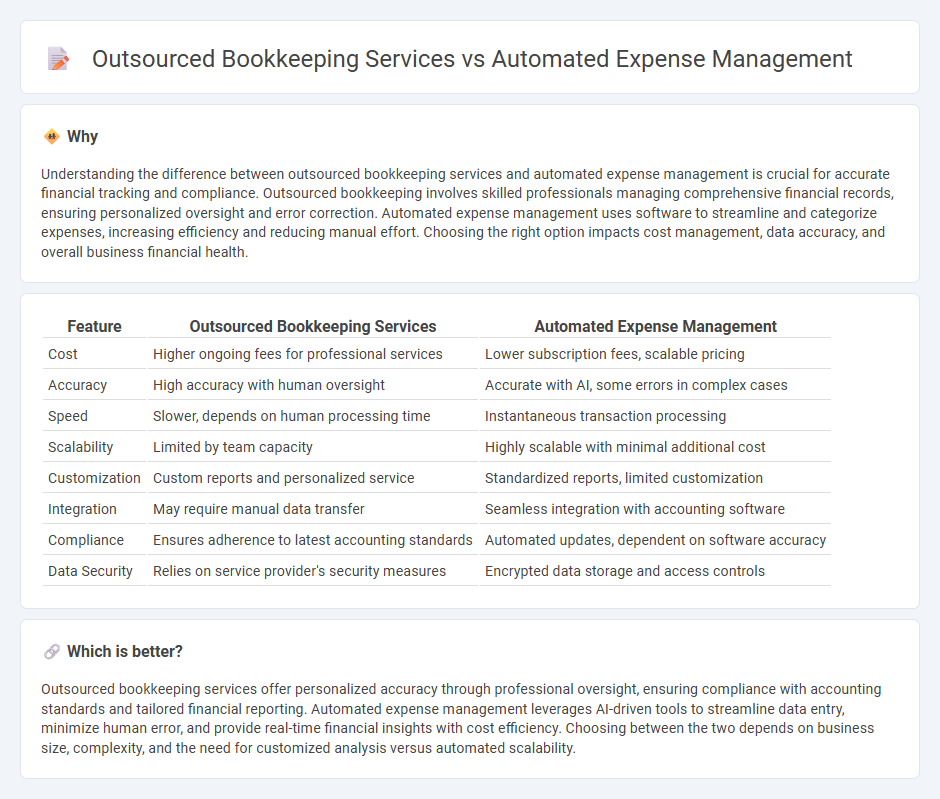

Understanding the difference between outsourced bookkeeping services and automated expense management is crucial for accurate financial tracking and compliance. Outsourced bookkeeping involves skilled professionals managing comprehensive financial records, ensuring personalized oversight and error correction. Automated expense management uses software to streamline and categorize expenses, increasing efficiency and reducing manual effort. Choosing the right option impacts cost management, data accuracy, and overall business financial health.

Comparison Table

| Feature | Outsourced Bookkeeping Services | Automated Expense Management |

|---|---|---|

| Cost | Higher ongoing fees for professional services | Lower subscription fees, scalable pricing |

| Accuracy | High accuracy with human oversight | Accurate with AI, some errors in complex cases |

| Speed | Slower, depends on human processing time | Instantaneous transaction processing |

| Scalability | Limited by team capacity | Highly scalable with minimal additional cost |

| Customization | Custom reports and personalized service | Standardized reports, limited customization |

| Integration | May require manual data transfer | Seamless integration with accounting software |

| Compliance | Ensures adherence to latest accounting standards | Automated updates, dependent on software accuracy |

| Data Security | Relies on service provider's security measures | Encrypted data storage and access controls |

Which is better?

Outsourced bookkeeping services offer personalized accuracy through professional oversight, ensuring compliance with accounting standards and tailored financial reporting. Automated expense management leverages AI-driven tools to streamline data entry, minimize human error, and provide real-time financial insights with cost efficiency. Choosing between the two depends on business size, complexity, and the need for customized analysis versus automated scalability.

Connection

Outsourced bookkeeping services integrate automated expense management tools to streamline financial data entry and reduce human errors. Automated systems categorize expenses in real-time, enabling outsourced bookkeepers to maintain accurate, up-to-date financial records efficiently. This synergy improves cost control and enhances reporting accuracy for businesses relying on external accounting support.

Key Terms

**Automated Expense Management:**

Automated expense management streamlines financial workflows by leveraging AI-powered tools to capture, categorize, and reconcile expenses in real time, reducing manual errors and accelerating reporting accuracy. This technology integrates seamlessly with accounting software like QuickBooks and Xero, enhancing visibility and control over corporate spending across multiple departments. Explore how automated expense management can transform your financial operations and boost efficiency.

Real-time Tracking

Automated expense management systems provide real-time tracking of expenses by instantly capturing and categorizing transactions through integrated software and mobile apps. Outsourced bookkeeping services rely on periodic updates and manual data entry, which can delay the availability of up-to-date financial information. Discover how real-time tracking can enhance your financial accuracy and decision-making by exploring automated solutions further.

Receipt Scanning

Automated expense management leverages AI-powered receipt scanning to instantly capture and categorize expenses, reducing manual entry errors and speeding up processing times. Outsourced bookkeeping services often rely on human review for receipt scanning, which can increase accuracy but may slow down expense reconciliation. Explore how AI-driven receipt scanning transforms financial workflows and enhances business efficiency.

Source and External Links

How to Automate Expense Reporting in 5 Steps - Automated expense reporting uses software to capture, categorize, route, and reconcile employee expenses with minimal manual input, featuring automation of credit card integration, mobile receipt capture, custom approval workflows, policy enforcement, and AI-based OCR capabilities.

The Essential Guide to Expense Management Automation - Expense management automation streamlines tracking, approval, and reimbursement by using AI to optimize workflows, auto-generate receipts, enforce policies, and enable natural-language search to reduce errors and speed up expense processing.

Expense management software - Automated expense management software facilitates tracking expenses, ensures compliance through policy enforcement, speeds approvals with mobile-friendly access, offers secure digital document storage, and integrates with ERP systems to provide real-time spend visibility and reduce manual workload.

dowidth.com

dowidth.com