ESG assurance focuses on verifying environmental, social, and governance data to enhance transparency and stakeholder trust, while non-financial assurance covers a broader range of non-financial information such as sustainability reports and corporate social responsibility disclosures. Both types of assurance help organizations demonstrate accountability beyond traditional financial metrics but differ in their scope and regulatory frameworks. Explore more about how ESG assurance impacts corporate reporting and risk management strategies.

Why it is important

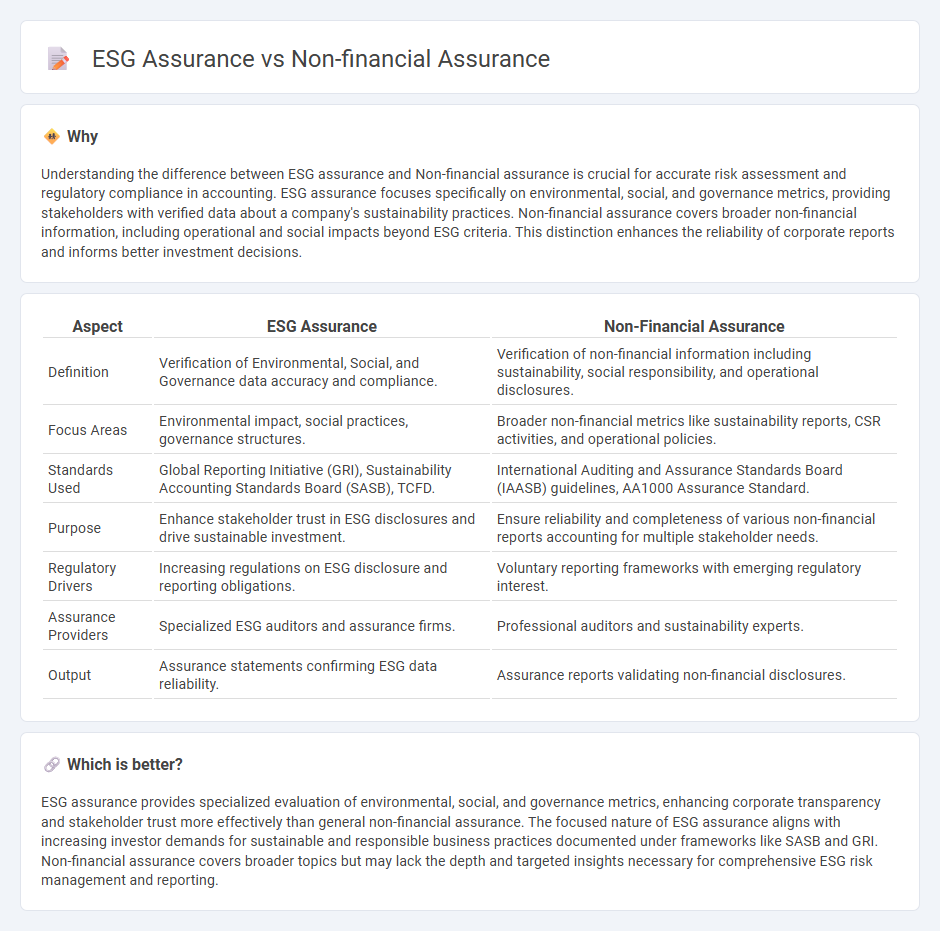

Understanding the difference between ESG assurance and Non-financial assurance is crucial for accurate risk assessment and regulatory compliance in accounting. ESG assurance focuses specifically on environmental, social, and governance metrics, providing stakeholders with verified data about a company's sustainability practices. Non-financial assurance covers broader non-financial information, including operational and social impacts beyond ESG criteria. This distinction enhances the reliability of corporate reports and informs better investment decisions.

Comparison Table

| Aspect | ESG Assurance | Non-Financial Assurance |

|---|---|---|

| Definition | Verification of Environmental, Social, and Governance data accuracy and compliance. | Verification of non-financial information including sustainability, social responsibility, and operational disclosures. |

| Focus Areas | Environmental impact, social practices, governance structures. | Broader non-financial metrics like sustainability reports, CSR activities, and operational policies. |

| Standards Used | Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), TCFD. | International Auditing and Assurance Standards Board (IAASB) guidelines, AA1000 Assurance Standard. |

| Purpose | Enhance stakeholder trust in ESG disclosures and drive sustainable investment. | Ensure reliability and completeness of various non-financial reports accounting for multiple stakeholder needs. |

| Regulatory Drivers | Increasing regulations on ESG disclosure and reporting obligations. | Voluntary reporting frameworks with emerging regulatory interest. |

| Assurance Providers | Specialized ESG auditors and assurance firms. | Professional auditors and sustainability experts. |

| Output | Assurance statements confirming ESG data reliability. | Assurance reports validating non-financial disclosures. |

Which is better?

ESG assurance provides specialized evaluation of environmental, social, and governance metrics, enhancing corporate transparency and stakeholder trust more effectively than general non-financial assurance. The focused nature of ESG assurance aligns with increasing investor demands for sustainable and responsible business practices documented under frameworks like SASB and GRI. Non-financial assurance covers broader topics but may lack the depth and targeted insights necessary for comprehensive ESG risk management and reporting.

Connection

ESG assurance and non-financial assurance both focus on verifying information beyond traditional financial metrics, emphasizing environmental, social, and governance factors to ensure transparency and reliability. They involve rigorous evaluation of corporate sustainability reports, ethical practices, and social responsibility disclosures to enhance stakeholder trust and compliance with regulatory standards. Integrating ESG assurance within non-financial assurance frameworks supports comprehensive risk management and promotes long-term value creation for investors and society.

Key Terms

Materiality

Non-financial assurance typically evaluates the accuracy and reliability of corporate sustainability data, while ESG assurance specifically targets the environmental, social, and governance factors that impact investor decisions and long-term value. Materiality in ESG assurance emphasizes identifying issues that materially affect financial performance and stakeholder interests, ensuring that reported information aligns with market expectations and regulatory requirements. Discover how focusing on materiality enhances the credibility and relevance of sustainability reporting by exploring best practices in ESG assurance.

Stakeholder engagement

Stakeholder engagement in non-financial assurance prioritizes verifying social responsibility practices, while ESG assurance incorporates environmental, social, and governance factors into a comprehensive evaluation framework. ESG assurance leverages data analytics to enhance transparency and accountability across multiple stakeholder groups, driving sustainable business strategies. Explore how integrating stakeholder engagement enhances assurance quality and stakeholder trust in sustainability performance.

Reporting standards

Non-financial assurance primarily verifies corporate social responsibility disclosures against frameworks such as the GRI Standards, while ESG assurance rigorously evaluates environmental, social, and governance performance according to specific standards like SASB and TCFD. The distinction lies in ESG assurance's deeper integration with financial materiality and risk management processes under evolving regulatory requirements such as the EU CSRD and SEC climate disclosure rules. Explore the latest reporting standards and assurance practices to understand their impact on corporate transparency and investor confidence.

Source and External Links

Aprio Non-Financial Assurance Services - Provides non-financial assurance services to help businesses enhance credibility and manage risks through reliable reporting.

A Buyer's Guide to Assurance on Non-Financial Information - Offers insights into assurance engagements for non-financial information, outlining key components such as subject matter and criteria.

EY Nonfinancial Reporting Advisory and Assurance - Helps clients communicate non-financial performance and provides assurance to enhance transparency and trust in sustainability reporting.

dowidth.com

dowidth.com