Carbon accounting focuses on quantifying greenhouse gas emissions to support environmental sustainability and regulatory compliance. Integrated reporting combines financial, environmental, social, and governance data to provide a comprehensive view of organizational performance and long-term value creation. Explore how these approaches transform accounting practices and drive corporate responsibility.

Why it is important

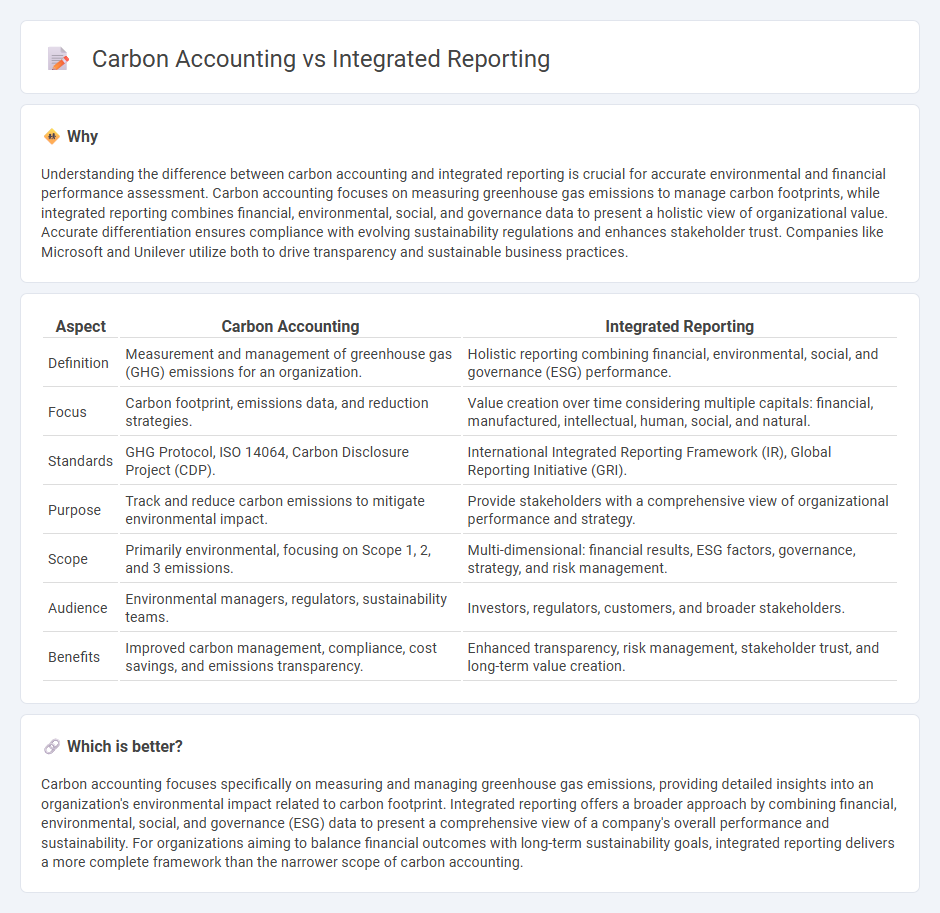

Understanding the difference between carbon accounting and integrated reporting is crucial for accurate environmental and financial performance assessment. Carbon accounting focuses on measuring greenhouse gas emissions to manage carbon footprints, while integrated reporting combines financial, environmental, social, and governance data to present a holistic view of organizational value. Accurate differentiation ensures compliance with evolving sustainability regulations and enhances stakeholder trust. Companies like Microsoft and Unilever utilize both to drive transparency and sustainable business practices.

Comparison Table

| Aspect | Carbon Accounting | Integrated Reporting |

|---|---|---|

| Definition | Measurement and management of greenhouse gas (GHG) emissions for an organization. | Holistic reporting combining financial, environmental, social, and governance (ESG) performance. |

| Focus | Carbon footprint, emissions data, and reduction strategies. | Value creation over time considering multiple capitals: financial, manufactured, intellectual, human, social, and natural. |

| Standards | GHG Protocol, ISO 14064, Carbon Disclosure Project (CDP). | International Integrated Reporting Framework (IR), Global Reporting Initiative (GRI). |

| Purpose | Track and reduce carbon emissions to mitigate environmental impact. | Provide stakeholders with a comprehensive view of organizational performance and strategy. |

| Scope | Primarily environmental, focusing on Scope 1, 2, and 3 emissions. | Multi-dimensional: financial results, ESG factors, governance, strategy, and risk management. |

| Audience | Environmental managers, regulators, sustainability teams. | Investors, regulators, customers, and broader stakeholders. |

| Benefits | Improved carbon management, compliance, cost savings, and emissions transparency. | Enhanced transparency, risk management, stakeholder trust, and long-term value creation. |

Which is better?

Carbon accounting focuses specifically on measuring and managing greenhouse gas emissions, providing detailed insights into an organization's environmental impact related to carbon footprint. Integrated reporting offers a broader approach by combining financial, environmental, social, and governance (ESG) data to present a comprehensive view of a company's overall performance and sustainability. For organizations aiming to balance financial outcomes with long-term sustainability goals, integrated reporting delivers a more complete framework than the narrower scope of carbon accounting.

Connection

Carbon accounting quantifies greenhouse gas emissions, providing critical data for companies to measure their environmental impact. Integrated reporting combines financial, environmental, social, and governance information, incorporating carbon accounting metrics to present a holistic view of corporate performance. This connection enhances transparency and supports sustainable decision-making by aligning environmental data with financial outcomes.

Key Terms

**Integrated Reporting:**

Integrated Reporting (IR) combines financial, environmental, social, and governance (ESG) data into a unified report, offering stakeholders a holistic view of a company's value creation over time. Unlike carbon accounting, which specifically measures greenhouse gas emissions, IR provides a broader context of sustainability, strategy, and performance, aligning with frameworks like the International Integrated Reporting Council (IIRC) standards. Explore how Integrated Reporting drives transparency and strategic decision-making across industries.

Value Creation

Integrated reporting emphasizes value creation by combining financial, environmental, social, and governance data into a holistic narrative that illustrates how an organization generates sustainable value over time. Carbon accounting specifically focuses on quantifying and managing greenhouse gas emissions to reduce environmental impact and comply with regulatory requirements. Explore how integrating these approaches drives both transparency and long-term strategic growth.

Capitals (financial, manufactured, intellectual, etc.)

Integrated reporting provides a holistic view by incorporating multiple capitals--financial, manufactured, intellectual, human, social, and natural--into a unified corporate report, emphasizing how these capitals create value over time. Carbon accounting specifically targets the natural capital dimension by measuring and managing greenhouse gas emissions to assess environmental impact and compliance. Explore further to understand how combining these approaches enhances sustainable business strategy and stakeholder communication.

Source and External Links

Integrated Reporting - Wikipedia - Integrated reporting is a process that results in communication about how an organization's strategy, governance, performance, and prospects lead to the creation of value.

What is Integrated Reporting? - ESG - Integrated reporting provides a complete view of a company's financial and non-financial factors, emphasizing how environmental, social, and governance issues impact long-term performance.

Integrated Reporting Explained - YouTube - This video explains integrated reporting as a process founded on integrated thinking, resulting in a periodic report about value creation over time.

dowidth.com

dowidth.com