Supply chain finance accounting focuses on managing payments, receivables, and cash flow between suppliers and buyers to optimize working capital and reduce financing costs. Intercompany accounting involves recording and reconciling transactions between different entities within the same corporate group to ensure accuracy and compliance in consolidated financial statements. Explore the key differences and best practices in supply chain finance accounting versus intercompany accounting to enhance your financial management strategies.

Why it is important

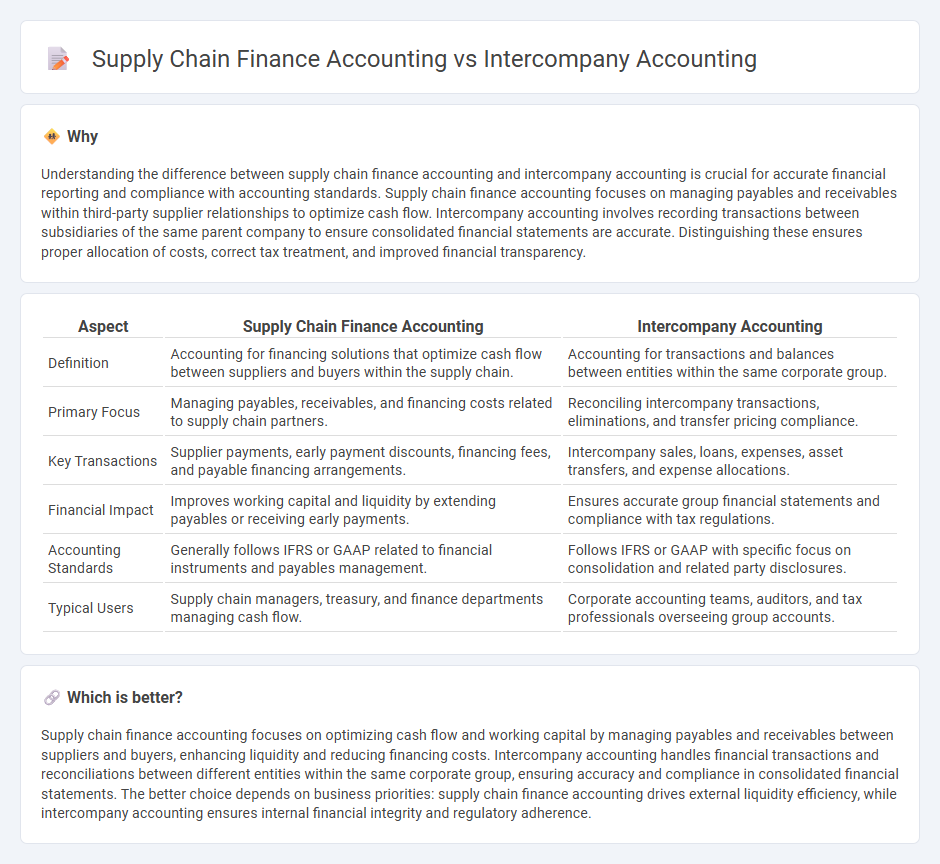

Understanding the difference between supply chain finance accounting and intercompany accounting is crucial for accurate financial reporting and compliance with accounting standards. Supply chain finance accounting focuses on managing payables and receivables within third-party supplier relationships to optimize cash flow. Intercompany accounting involves recording transactions between subsidiaries of the same parent company to ensure consolidated financial statements are accurate. Distinguishing these ensures proper allocation of costs, correct tax treatment, and improved financial transparency.

Comparison Table

| Aspect | Supply Chain Finance Accounting | Intercompany Accounting |

|---|---|---|

| Definition | Accounting for financing solutions that optimize cash flow between suppliers and buyers within the supply chain. | Accounting for transactions and balances between entities within the same corporate group. |

| Primary Focus | Managing payables, receivables, and financing costs related to supply chain partners. | Reconciling intercompany transactions, eliminations, and transfer pricing compliance. |

| Key Transactions | Supplier payments, early payment discounts, financing fees, and payable financing arrangements. | Intercompany sales, loans, expenses, asset transfers, and expense allocations. |

| Financial Impact | Improves working capital and liquidity by extending payables or receiving early payments. | Ensures accurate group financial statements and compliance with tax regulations. |

| Accounting Standards | Generally follows IFRS or GAAP related to financial instruments and payables management. | Follows IFRS or GAAP with specific focus on consolidation and related party disclosures. |

| Typical Users | Supply chain managers, treasury, and finance departments managing cash flow. | Corporate accounting teams, auditors, and tax professionals overseeing group accounts. |

Which is better?

Supply chain finance accounting focuses on optimizing cash flow and working capital by managing payables and receivables between suppliers and buyers, enhancing liquidity and reducing financing costs. Intercompany accounting handles financial transactions and reconciliations between different entities within the same corporate group, ensuring accuracy and compliance in consolidated financial statements. The better choice depends on business priorities: supply chain finance accounting drives external liquidity efficiency, while intercompany accounting ensures internal financial integrity and regulatory adherence.

Connection

Supply chain finance accounting and intercompany accounting are connected through the need to accurately record and reconcile transactions between affiliated entities in a supply chain network. Supply chain finance accounting tracks payments and financing activities among suppliers, buyers, and financial institutions, while intercompany accounting ensures that internal transactions between related companies are correctly accounted for and eliminated in consolidated financial statements. Effective integration of both accounting functions enhances transparency, reduces risks of double counting, and improves cash flow management across the corporate group.

Key Terms

**Intercompany accounting:**

Intercompany accounting manages financial transactions between affiliated business units, ensuring accurate consolidation and compliance with regulatory standards such as IFRS and GAAP. It focuses on intercompany reconciliations, transfer pricing, and elimination of intercompany profits to maintain transparent financial reporting across the corporate group. Explore in-depth strategies and best practices to optimize intercompany accounting processes and improve financial integrity.

Elimination entries

Intercompany accounting focuses on eliminating transactions between subsidiaries to prevent double counting in consolidated financial statements, ensuring accurate reporting of revenues, expenses, and balances. Supply chain finance accounting, however, involves managing payables and receivables within the supply chain, with elimination entries primarily addressing financing arrangements and related party transactions to reflect true cash flow and risk exposure. Explore detailed methodologies and examples to understand the distinct elimination processes in both accounting practices.

Transfer pricing

Intercompany accounting strictly manages financial transactions between subsidiaries to ensure compliance with transfer pricing regulations, minimizing tax risks and avoiding double taxation. Supply chain finance accounting integrates transfer pricing principles to optimize working capital and liquidity by aligning payment terms and financing costs across the supply chain. Explore comprehensive strategies to effectively balance transfer pricing and cash flow management in global operations.

Source and External Links

What is Intercompany Accounting? | F&A Glossary - BlackLine - Intercompany accounting records financial transactions between different entities under the same parent company, ensuring accurate financial statements by not recognizing profit or loss from these internal transactions as they occur within related entities.

What is Intercompany Accounting: Challenges & Best Practices - It involves managing receivables and payables between related entities within a corporate group, reconciling intercompany balances, and eliminating these transactions during consolidation to prevent double-counting of revenue and expenses.

What Is Intercompany Accounting? Best Practices and Management - Intercompany accounting eliminates the financial effects of transactions between subsidiaries or parent and subsidiary to produce consolidated financial statements reflecting only third-party activity, with best practices including governance, automation, and reconciliation steps to improve accuracy.

dowidth.com

dowidth.com