Continuous assurance provides real-time monitoring and verification of financial data through automated systems, enhancing accuracy and reducing the risk of errors. Reactive assurance occurs after an event, focusing on identifying and correcting discrepancies post-transaction, often through periodic audits. Explore the benefits and challenges of continuous and reactive assurance to optimize your accounting processes.

Why it is important

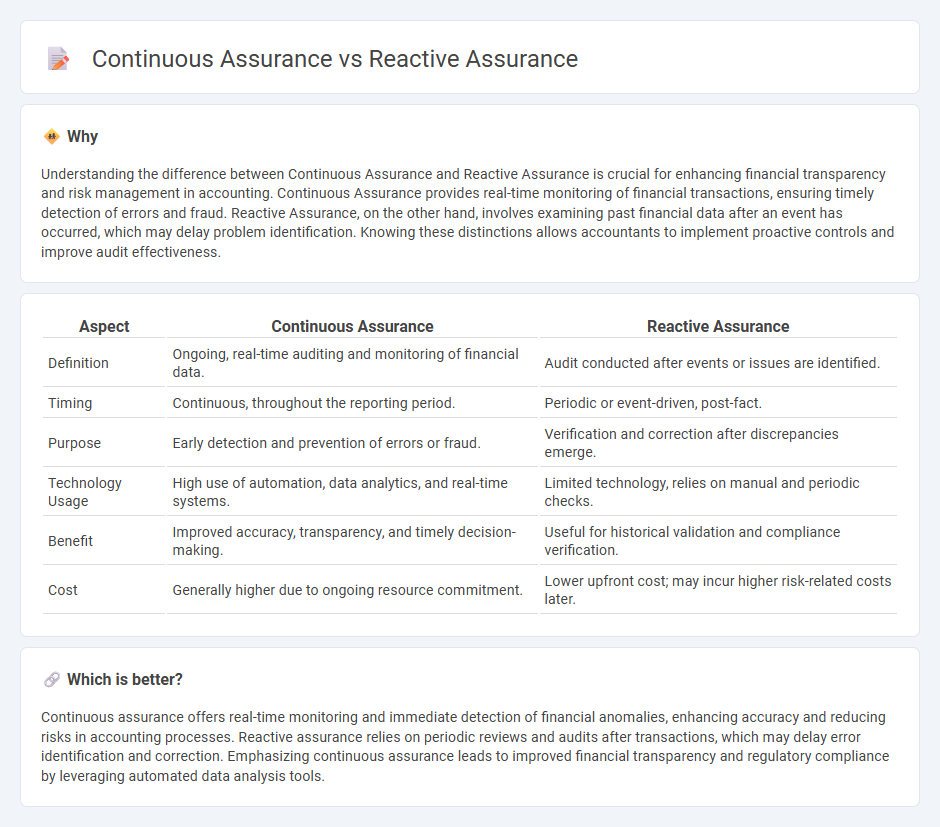

Understanding the difference between Continuous Assurance and Reactive Assurance is crucial for enhancing financial transparency and risk management in accounting. Continuous Assurance provides real-time monitoring of financial transactions, ensuring timely detection of errors and fraud. Reactive Assurance, on the other hand, involves examining past financial data after an event has occurred, which may delay problem identification. Knowing these distinctions allows accountants to implement proactive controls and improve audit effectiveness.

Comparison Table

| Aspect | Continuous Assurance | Reactive Assurance |

|---|---|---|

| Definition | Ongoing, real-time auditing and monitoring of financial data. | Audit conducted after events or issues are identified. |

| Timing | Continuous, throughout the reporting period. | Periodic or event-driven, post-fact. |

| Purpose | Early detection and prevention of errors or fraud. | Verification and correction after discrepancies emerge. |

| Technology Usage | High use of automation, data analytics, and real-time systems. | Limited technology, relies on manual and periodic checks. |

| Benefit | Improved accuracy, transparency, and timely decision-making. | Useful for historical validation and compliance verification. |

| Cost | Generally higher due to ongoing resource commitment. | Lower upfront cost; may incur higher risk-related costs later. |

Which is better?

Continuous assurance offers real-time monitoring and immediate detection of financial anomalies, enhancing accuracy and reducing risks in accounting processes. Reactive assurance relies on periodic reviews and audits after transactions, which may delay error identification and correction. Emphasizing continuous assurance leads to improved financial transparency and regulatory compliance by leveraging automated data analysis tools.

Connection

Continuous assurance and reactive assurance are connected through their complementary roles in enhancing financial reporting accuracy and internal controls. Continuous assurance involves real-time monitoring and automated data analysis to identify discrepancies as they occur, while reactive assurance focuses on investigating and addressing issues after they have been detected. Together, these approaches ensure a comprehensive risk management framework by combining proactive oversight with timely corrective actions.

Key Terms

Audit frequency

Reactive assurance involves audit activities conducted after an event or transaction has occurred, often triggered by identified risks or anomalies, resulting in less frequent, periodic audits. Continuous assurance employs real-time or near-real-time monitoring techniques, utilizing automated tools and data analytics to provide ongoing audit coverage and immediate detection of issues. Explore the benefits and implementation strategies of both audit approaches to enhance organizational risk management.

Real-time monitoring

Reactive assurance addresses issues after they occur by analyzing historical data and performing retrospective audits, which can delay problem resolution and reduce operational efficiency. Continuous assurance leverages real-time monitoring and automated controls to provide ongoing validation of processes, enabling immediate detection and response to anomalies or compliance breaches. Discover how integrating continuous assurance transforms risk management and enhances decision-making in dynamic business environments.

Risk response

Reactive assurance addresses risks after they have materialized by investigating incidents and implementing corrective actions to mitigate future occurrences. Continuous assurance proactively monitors risk indicators in real-time, allowing organizations to detect and respond to potential threats promptly, thereby reducing the likelihood of adverse impacts. Explore in-depth insights on how integrating these assurance approaches enhances risk management effectiveness.

Source and External Links

Difference Between Reactive, Proactive and Predictive Risk Management in Aviation SMS - Reactive assurance involves responding to safety events or incidents after they occur, often used in new safety programs lacking historical data for proactive measures.

Reactive Compliance Criteria - Reactive assurance applies criteria for evaluating and verifying compliance after activities have taken place, commonly used in certification standards for traders.

From a Reactive to a Proactive Model, Service Assurance is Transforming - Traditionally, reactive assurance in service contexts means waiting for problems to arise before addressing them, often resulting in slower incident resolution and less efficient service.

dowidth.com

dowidth.com