Environmental, Social, and Governance (ESG) integration in accounting emphasizes sustainable business practices by embedding non-financial factors into financial analysis and reporting, enhancing transparency and stakeholder trust. Risk management in accounting focuses on identifying, assessing, and mitigating financial and operational risks to protect company assets and ensure regulatory compliance. Explore how aligning ESG criteria with risk management strategies can drive long-term value and resilience.

Why it is important

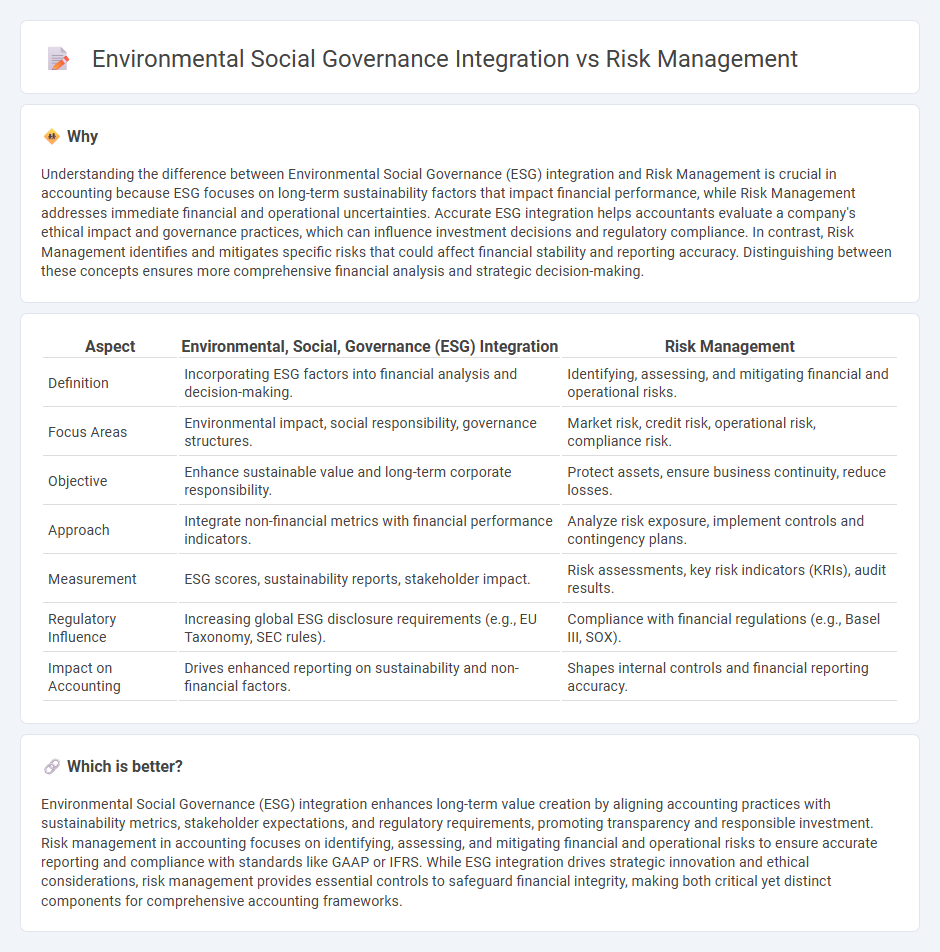

Understanding the difference between Environmental Social Governance (ESG) integration and Risk Management is crucial in accounting because ESG focuses on long-term sustainability factors that impact financial performance, while Risk Management addresses immediate financial and operational uncertainties. Accurate ESG integration helps accountants evaluate a company's ethical impact and governance practices, which can influence investment decisions and regulatory compliance. In contrast, Risk Management identifies and mitigates specific risks that could affect financial stability and reporting accuracy. Distinguishing between these concepts ensures more comprehensive financial analysis and strategic decision-making.

Comparison Table

| Aspect | Environmental, Social, Governance (ESG) Integration | Risk Management |

|---|---|---|

| Definition | Incorporating ESG factors into financial analysis and decision-making. | Identifying, assessing, and mitigating financial and operational risks. |

| Focus Areas | Environmental impact, social responsibility, governance structures. | Market risk, credit risk, operational risk, compliance risk. |

| Objective | Enhance sustainable value and long-term corporate responsibility. | Protect assets, ensure business continuity, reduce losses. |

| Approach | Integrate non-financial metrics with financial performance indicators. | Analyze risk exposure, implement controls and contingency plans. |

| Measurement | ESG scores, sustainability reports, stakeholder impact. | Risk assessments, key risk indicators (KRIs), audit results. |

| Regulatory Influence | Increasing global ESG disclosure requirements (e.g., EU Taxonomy, SEC rules). | Compliance with financial regulations (e.g., Basel III, SOX). |

| Impact on Accounting | Drives enhanced reporting on sustainability and non-financial factors. | Shapes internal controls and financial reporting accuracy. |

Which is better?

Environmental Social Governance (ESG) integration enhances long-term value creation by aligning accounting practices with sustainability metrics, stakeholder expectations, and regulatory requirements, promoting transparency and responsible investment. Risk management in accounting focuses on identifying, assessing, and mitigating financial and operational risks to ensure accurate reporting and compliance with standards like GAAP or IFRS. While ESG integration drives strategic innovation and ethical considerations, risk management provides essential controls to safeguard financial integrity, making both critical yet distinct components for comprehensive accounting frameworks.

Connection

Environmental, Social, and Governance (ESG) integration in accounting enhances risk management by identifying potential financial risks related to sustainability practices and regulatory compliance. Incorporating ESG factors enables firms to anticipate environmental liabilities, social controversies, and governance failures that could impact long-term profitability. This proactive approach improves decision-making and ensures more accurate financial reporting and risk mitigation strategies.

Key Terms

Risk Assessment

Risk assessment in risk management evaluates potential threats and vulnerabilities that could impact organizational objectives, emphasizing identification, analysis, and mitigation strategies. Environmental, Social, and Governance (ESG) integration broadens risk assessment by incorporating sustainability factors such as climate change risks, social responsibility, and corporate governance practices into decision-making processes. Explore how harmonizing risk management and ESG risk assessments enhances resilience and long-term value creation.

Materiality

Risk management and Environmental Social Governance (ESG) integration converge significantly through the lens of materiality, emphasizing the prioritization of issues that can impact both financial and non-financial performance. Effective materiality assessment identifies critical ESG factors that influence enterprise risk profiles and long-term value creation, enabling organizations to align strategic decisions with stakeholder interests and regulatory requirements. Explore how mastering materiality in risk and ESG frameworks drives sustainable growth and more resilient business models.

ESG Reporting

Risk management in ESG reporting involves identifying and mitigating environmental, social, and governance risks to ensure sustainable business practices and compliance with regulatory standards. ESG integration embeds these factors into corporate strategy and decision-making, enhancing transparency and accountability in sustainability performance. Explore how combining risk management with ESG integration strengthens reporting accuracy and stakeholder trust.

Source and External Links

Five Steps of the Risk Management Process 2025 - 360Factors - The risk management process consists of five essential steps: identifying the risk, analyzing the risk, evaluating or ranking the risk, treating the risk, and monitoring and reviewing the risk.

What is risk management? - Thomson Reuters Legal Solutions - Risk management involves identifying, assessing, and controlling potential risks or uncertainties that could negatively affect an organization's operations, often using tools like risk assessment matrices to visualize and prioritize risks.

What is Risk Management? Importance, Benefits and Guide - Risk management is about identifying, assessing, and controlling threats to an organization's capital, operations, and financial performance, aiming to make smart decisions on which risks are worth taking rather than eliminating risk entirely.

dowidth.com

dowidth.com