Forensic analysis in accounting involves examining financial records to detect fraud, errors, and irregularities, ensuring legal compliance and aiding legal proceedings. Budgetary control focuses on planning and monitoring financial resources to manage costs and improve organizational efficiency. Explore how these distinct accounting practices protect and optimize business finances.

Why it is important

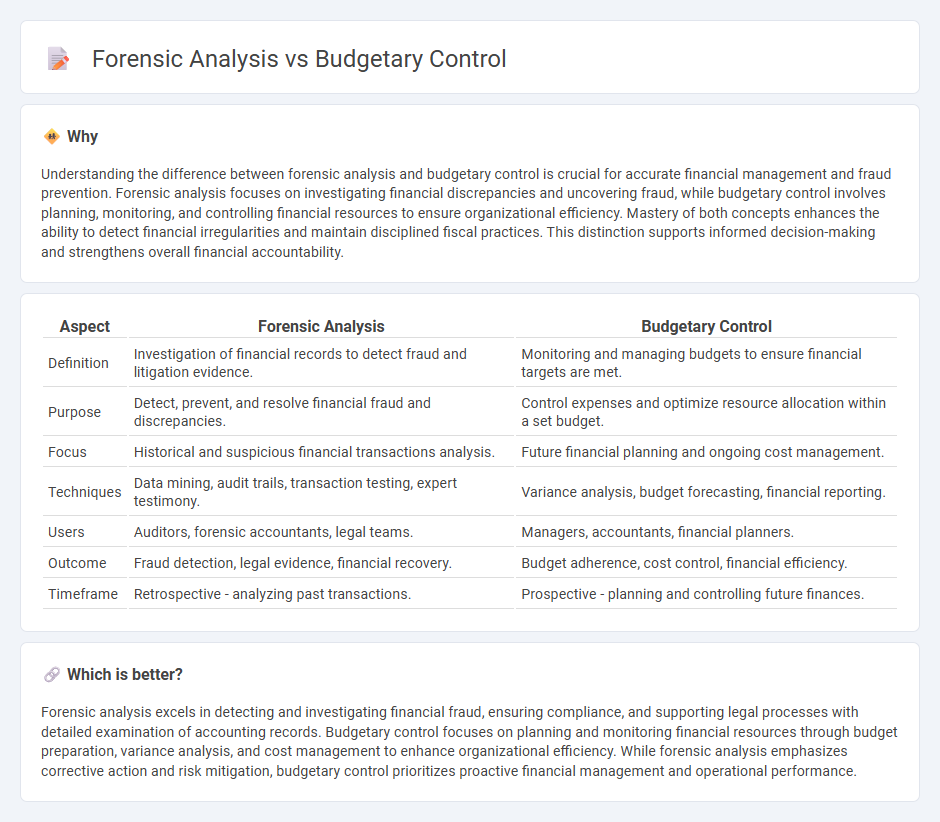

Understanding the difference between forensic analysis and budgetary control is crucial for accurate financial management and fraud prevention. Forensic analysis focuses on investigating financial discrepancies and uncovering fraud, while budgetary control involves planning, monitoring, and controlling financial resources to ensure organizational efficiency. Mastery of both concepts enhances the ability to detect financial irregularities and maintain disciplined fiscal practices. This distinction supports informed decision-making and strengthens overall financial accountability.

Comparison Table

| Aspect | Forensic Analysis | Budgetary Control |

|---|---|---|

| Definition | Investigation of financial records to detect fraud and litigation evidence. | Monitoring and managing budgets to ensure financial targets are met. |

| Purpose | Detect, prevent, and resolve financial fraud and discrepancies. | Control expenses and optimize resource allocation within a set budget. |

| Focus | Historical and suspicious financial transactions analysis. | Future financial planning and ongoing cost management. |

| Techniques | Data mining, audit trails, transaction testing, expert testimony. | Variance analysis, budget forecasting, financial reporting. |

| Users | Auditors, forensic accountants, legal teams. | Managers, accountants, financial planners. |

| Outcome | Fraud detection, legal evidence, financial recovery. | Budget adherence, cost control, financial efficiency. |

| Timeframe | Retrospective - analyzing past transactions. | Prospective - planning and controlling future finances. |

Which is better?

Forensic analysis excels in detecting and investigating financial fraud, ensuring compliance, and supporting legal processes with detailed examination of accounting records. Budgetary control focuses on planning and monitoring financial resources through budget preparation, variance analysis, and cost management to enhance organizational efficiency. While forensic analysis emphasizes corrective action and risk mitigation, budgetary control prioritizes proactive financial management and operational performance.

Connection

Forensic analysis and budgetary control are interconnected through their focus on financial accuracy and fraud prevention within organizations. Forensic analysis involves examining accounting records to detect discrepancies, embezzlement, or financial misstatements, while budgetary control ensures resources are allocated effectively and variances are monitored. Integrating forensic techniques within budgetary control processes enhances the identification of irregularities, promoting financial integrity and operational efficiency.

Key Terms

**Budgetary Control:**

Budgetary control involves the systematic monitoring and management of organizational expenses against predefined budgets to ensure financial discipline and prevent overspending. It uses variance analysis to compare actual costs with budgeted costs, helping managers take corrective actions in real-time. Explore more insights to optimize your organization's budgetary control strategies.

Variance Analysis

Variance analysis in budgetary control involves comparing actual financial performance against budgeted figures to identify deviations and ensure efficient resource allocation. Forensic analysis uses variance analysis to detect discrepancies indicative of fraud, financial misstatement, or irregular activities by scrutinizing unexplained variances more deeply. Explore detailed methodologies and applications of variance analysis in both fields to enhance financial oversight and fraud detection.

Budget Allocation

Budgetary control ensures efficient budget allocation by monitoring expenditures against planned financial limits, preventing overspending and resource mismanagement. Forensic analysis investigates anomalies in budget allocation to detect fraud, embezzlement, or financial discrepancies through detailed examination of financial records. Explore how combining budgetary control with forensic analysis strengthens organizational financial integrity and accountability.

Source and External Links

What do we mean by budgetary control? - Budgetary control involves managing income and expenditure by comparing actual transactions with planned figures to ensure corrective actions are taken when needed.

Budgetary Control: Meaning, Objectives, Advantages and Limitations - Budgetary control is a process of planning, controlling, and monitoring revenues and expenses to align them with the budget, ensuring efficient resource use.

Budgetary control definition - Budgetary control is a system used to ensure actual revenues and expenditures adhere to the financial plan, involving goal setting and corrective actions.

dowidth.com

dowidth.com