Forensic data analytics focuses on detecting and investigating fraudulent activities by analyzing financial transactions and identifying anomalies within accounting records. Risk assessment in accounting involves evaluating potential financial risks and vulnerabilities to prevent errors, fraud, and compliance issues. Explore how integrating these approaches enhances organizational financial security and integrity.

Why it is important

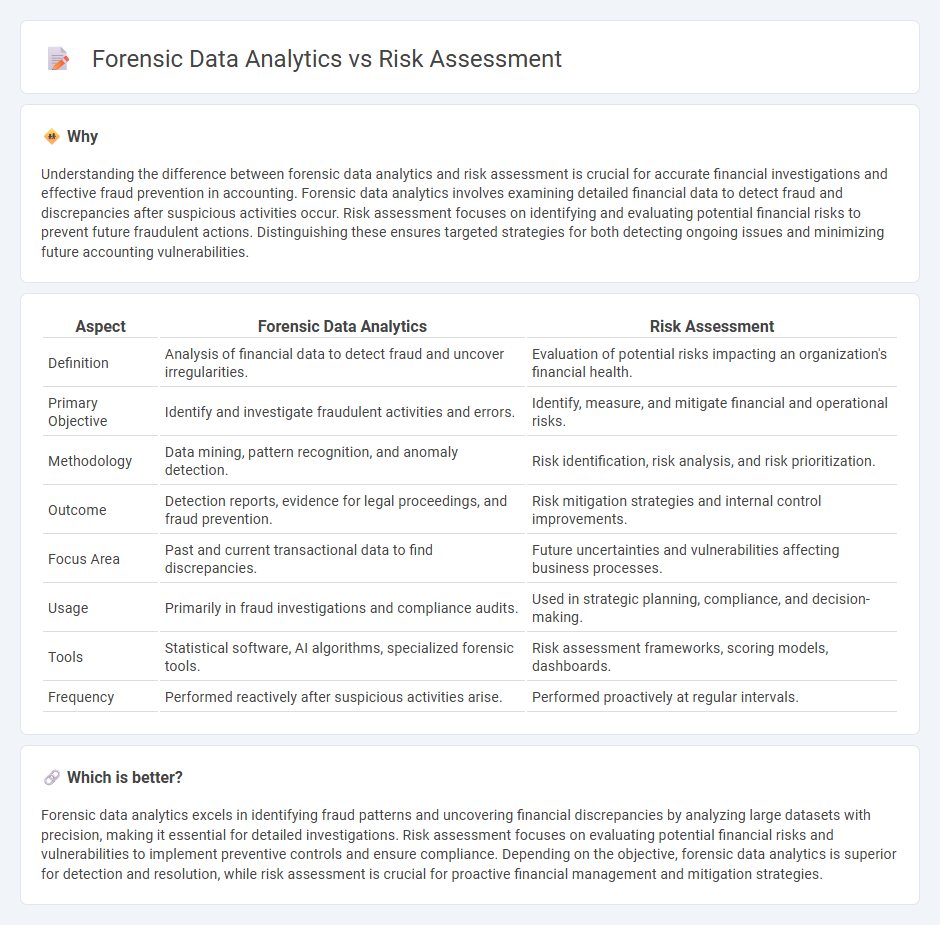

Understanding the difference between forensic data analytics and risk assessment is crucial for accurate financial investigations and effective fraud prevention in accounting. Forensic data analytics involves examining detailed financial data to detect fraud and discrepancies after suspicious activities occur. Risk assessment focuses on identifying and evaluating potential financial risks to prevent future fraudulent actions. Distinguishing these ensures targeted strategies for both detecting ongoing issues and minimizing future accounting vulnerabilities.

Comparison Table

| Aspect | Forensic Data Analytics | Risk Assessment |

|---|---|---|

| Definition | Analysis of financial data to detect fraud and uncover irregularities. | Evaluation of potential risks impacting an organization's financial health. |

| Primary Objective | Identify and investigate fraudulent activities and errors. | Identify, measure, and mitigate financial and operational risks. |

| Methodology | Data mining, pattern recognition, and anomaly detection. | Risk identification, risk analysis, and risk prioritization. |

| Outcome | Detection reports, evidence for legal proceedings, and fraud prevention. | Risk mitigation strategies and internal control improvements. |

| Focus Area | Past and current transactional data to find discrepancies. | Future uncertainties and vulnerabilities affecting business processes. |

| Usage | Primarily in fraud investigations and compliance audits. | Used in strategic planning, compliance, and decision-making. |

| Tools | Statistical software, AI algorithms, specialized forensic tools. | Risk assessment frameworks, scoring models, dashboards. |

| Frequency | Performed reactively after suspicious activities arise. | Performed proactively at regular intervals. |

Which is better?

Forensic data analytics excels in identifying fraud patterns and uncovering financial discrepancies by analyzing large datasets with precision, making it essential for detailed investigations. Risk assessment focuses on evaluating potential financial risks and vulnerabilities to implement preventive controls and ensure compliance. Depending on the objective, forensic data analytics is superior for detection and resolution, while risk assessment is crucial for proactive financial management and mitigation strategies.

Connection

Forensic data analytics enhances risk assessment by identifying irregular patterns and anomalies in financial data that indicate potential fraud or compliance risks. Integrating forensic techniques with risk management frameworks allows organizations to proactively detect and mitigate financial crimes before they escalate. Leveraging advanced analytics tools improves accuracy in evaluating risk exposure and strengthens internal controls.

Key Terms

**Risk assessment:**

Risk assessment involves identifying, evaluating, and prioritizing potential risks that could impact an organization's operations, financial status, or security. It uses quantitative and qualitative techniques to predict the likelihood and impact of threats, helping businesses implement effective mitigation strategies. Explore more to understand how risk assessment enhances organizational resilience.

Internal Controls

Risk assessment evaluates potential vulnerabilities within internal controls to prevent fraud, errors, and inefficiencies by analyzing processes and controls' effectiveness. Forensic data analytics involves in-depth examination of transactional data to detect anomalies, patterns, and instances of fraud, providing evidence for investigative purposes. Explore more about strengthening internal controls with these critical approaches to risk management and fraud detection.

Inherent Risk

Risk assessment quantifies inherent risk by evaluating the probability and impact of potential threats before controls are applied, emphasizing vulnerability analysis in financial and operational processes. Forensic data analytics examines data to uncover evidence of fraud or misconduct, often during or after incidents, focusing on anomaly detection and pattern recognition within transaction records. Explore detailed methodologies and case studies to deepen your understanding of the relationship between inherent risk and forensic analytics.

Source and External Links

Risk assessment - Wikipedia - Risk assessment is a process for identifying hazards and potential events that may negatively impact individuals or assets, analyzing their likelihood and consequences, and determining mitigation actions as part of a broader risk management strategy.

Risk Assessment: Process, Tools, & Techniques | SafetyCulture - A risk assessment is a systematic process used to identify hazards and analyze their potential impacts to decide on measures to eliminate or control risks, supporting workplace safety and regulatory compliance.

Risk assessment: An overview - Thomson Reuters Legal Solutions - Risk assessment involves identifying, analyzing, and evaluating risks for activities or projects, helping organizations prioritize risks and implement mitigation strategies using tools like risk matrices and quantitative methods.

dowidth.com

dowidth.com