Cryptocurrency auditing involves verifying digital asset transactions and blockchain records to ensure compliance with regulatory and security standards, leveraging specialized tools for transparency and fraud detection. Statutory auditing focuses on examining traditional financial statements to confirm accuracy, adherence to accounting principles, and legal requirements set by governing bodies. Explore further to understand the distinct methodologies and challenges in cryptocurrency auditing compared to statutory auditing.

Why it is important

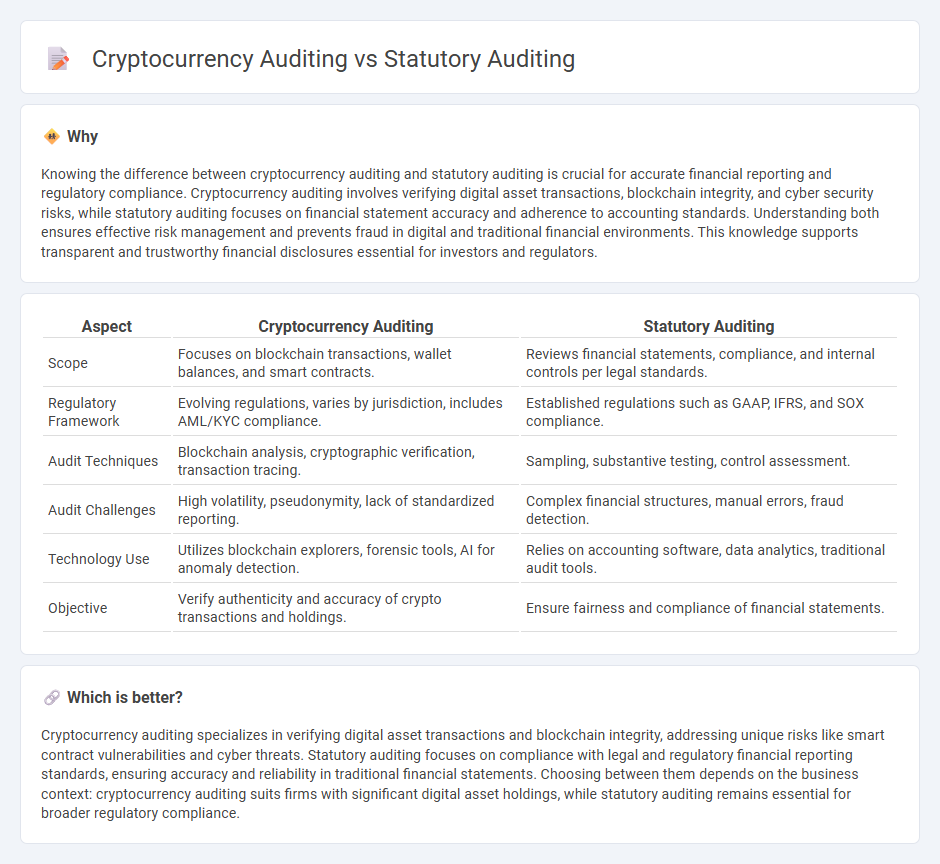

Knowing the difference between cryptocurrency auditing and statutory auditing is crucial for accurate financial reporting and regulatory compliance. Cryptocurrency auditing involves verifying digital asset transactions, blockchain integrity, and cyber security risks, while statutory auditing focuses on financial statement accuracy and adherence to accounting standards. Understanding both ensures effective risk management and prevents fraud in digital and traditional financial environments. This knowledge supports transparent and trustworthy financial disclosures essential for investors and regulators.

Comparison Table

| Aspect | Cryptocurrency Auditing | Statutory Auditing |

|---|---|---|

| Scope | Focuses on blockchain transactions, wallet balances, and smart contracts. | Reviews financial statements, compliance, and internal controls per legal standards. |

| Regulatory Framework | Evolving regulations, varies by jurisdiction, includes AML/KYC compliance. | Established regulations such as GAAP, IFRS, and SOX compliance. |

| Audit Techniques | Blockchain analysis, cryptographic verification, transaction tracing. | Sampling, substantive testing, control assessment. |

| Audit Challenges | High volatility, pseudonymity, lack of standardized reporting. | Complex financial structures, manual errors, fraud detection. |

| Technology Use | Utilizes blockchain explorers, forensic tools, AI for anomaly detection. | Relies on accounting software, data analytics, traditional audit tools. |

| Objective | Verify authenticity and accuracy of crypto transactions and holdings. | Ensure fairness and compliance of financial statements. |

Which is better?

Cryptocurrency auditing specializes in verifying digital asset transactions and blockchain integrity, addressing unique risks like smart contract vulnerabilities and cyber threats. Statutory auditing focuses on compliance with legal and regulatory financial reporting standards, ensuring accuracy and reliability in traditional financial statements. Choosing between them depends on the business context: cryptocurrency auditing suits firms with significant digital asset holdings, while statutory auditing remains essential for broader regulatory compliance.

Connection

Cryptocurrency auditing and statutory auditing intersect through the verification of financial transactions and compliance with regulatory standards. Both processes involve examining blockchain records or traditional financial statements to ensure accuracy, transparency, and fraud prevention. Integration of cryptocurrency data into statutory audits enhances the reliability of financial reporting in businesses dealing with digital assets.

Key Terms

Compliance

Statutory auditing involves verifying a company's financial statements to ensure compliance with established accounting standards and regulations, providing assurance to stakeholders. Cryptocurrency auditing focuses on the compliance of digital asset transactions and blockchain smart contracts with regulatory frameworks, emphasizing transparency and fraud prevention. Explore detailed comparisons to understand the unique compliance challenges in both auditing types.

Blockchain

Statutory auditing involves examining financial statements to ensure compliance with legal standards and accuracy, whereas cryptocurrency auditing centers on verifying blockchain transactions and assessing the security of digital wallets and smart contracts. Blockchain's decentralized ledger technology creates transparent and immutable records, transforming traditional audit trails by enabling real-time transaction verification and fraud detection. Discover more about how blockchain is revolutionizing audit practices in the digital asset era.

Financial Statements

Statutory auditing involves the examination of financial statements to ensure accuracy and compliance with legal standards, primarily focusing on verifying assets, liabilities, revenues, and expenses according to GAAP or IFRS. Cryptocurrency auditing differs by incorporating blockchain technology analysis, digital asset valuation, and transaction verification on distributed ledgers, addressing the unique risks and volatility inherent in crypto holdings. Explore further to understand how auditing frameworks adapt to the evolving landscape of digital finance.

Source and External Links

What is a Statutory Audit? - Vintti - A statutory audit is a legally required review by an independent auditor of a company's financial statements to ensure accuracy and protect stakeholder interests, typically involving planning, execution, and reporting phases.

Statutory audits demystified: what to expect & how to prepare - A statutory audit is a mandated audit to verify a company's financial statements fairly represent its position, enhancing credibility, internal controls, and regulatory compliance, with specific size and turnover thresholds determining the requirement.

What is a Statutory Audit? | Pilot Glossary - A statutory audit is an external, legally required audit of financial statements conducted by an independent auditor to assure fair and accurate financial reporting, improve governance, and maintain trust.

dowidth.com

dowidth.com