Cryptocurrency valuation involves determining the fair value of digital assets based on factors like market demand, technology adoption, and regulatory environment, contrasting with mark-to-market accounting that records assets at current market prices. Mark-to-market valuation provides real-time financial statements reflecting asset fluctuations, while cryptocurrency valuation requires models accommodating volatility and limited historical data. Explore deeper insights into how these valuation methods impact financial reporting and investment decisions.

Why it is important

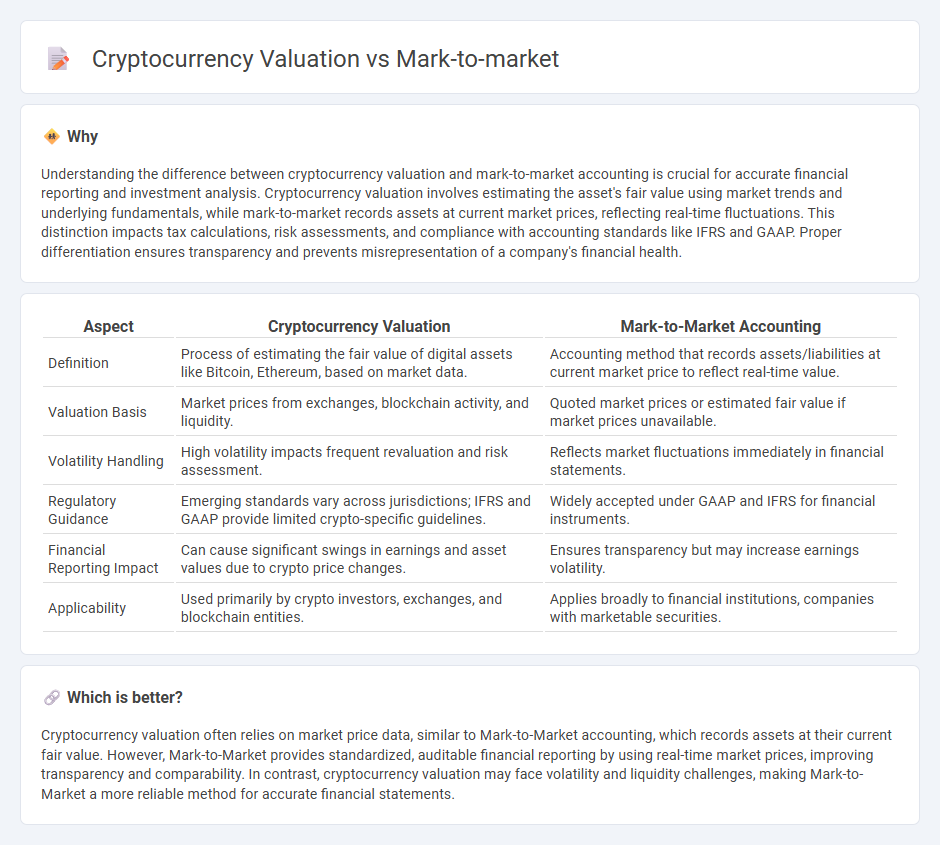

Understanding the difference between cryptocurrency valuation and mark-to-market accounting is crucial for accurate financial reporting and investment analysis. Cryptocurrency valuation involves estimating the asset's fair value using market trends and underlying fundamentals, while mark-to-market records assets at current market prices, reflecting real-time fluctuations. This distinction impacts tax calculations, risk assessments, and compliance with accounting standards like IFRS and GAAP. Proper differentiation ensures transparency and prevents misrepresentation of a company's financial health.

Comparison Table

| Aspect | Cryptocurrency Valuation | Mark-to-Market Accounting |

|---|---|---|

| Definition | Process of estimating the fair value of digital assets like Bitcoin, Ethereum, based on market data. | Accounting method that records assets/liabilities at current market price to reflect real-time value. |

| Valuation Basis | Market prices from exchanges, blockchain activity, and liquidity. | Quoted market prices or estimated fair value if market prices unavailable. |

| Volatility Handling | High volatility impacts frequent revaluation and risk assessment. | Reflects market fluctuations immediately in financial statements. |

| Regulatory Guidance | Emerging standards vary across jurisdictions; IFRS and GAAP provide limited crypto-specific guidelines. | Widely accepted under GAAP and IFRS for financial instruments. |

| Financial Reporting Impact | Can cause significant swings in earnings and asset values due to crypto price changes. | Ensures transparency but may increase earnings volatility. |

| Applicability | Used primarily by crypto investors, exchanges, and blockchain entities. | Applies broadly to financial institutions, companies with marketable securities. |

Which is better?

Cryptocurrency valuation often relies on market price data, similar to Mark-to-Market accounting, which records assets at their current fair value. However, Mark-to-Market provides standardized, auditable financial reporting by using real-time market prices, improving transparency and comparability. In contrast, cryptocurrency valuation may face volatility and liquidity challenges, making Mark-to-Market a more reliable method for accurate financial statements.

Connection

Cryptocurrency valuation relies heavily on mark-to-market accounting, which records assets at their current market price, reflecting real-time value fluctuations. This method ensures transparency and accuracy in financial statements by aligning the reported value of cryptocurrencies with their volatile market prices. Investors and firms can better assess risk and make informed decisions through mark-to-market valuation applied to digital assets.

Key Terms

Fair Value

Mark-to-market valuation reflects the current market price of an asset, providing real-time insights into its Fair Value based on actual trading data. Cryptocurrency valuation poses challenges due to market volatility, liquidity variations, and the decentralized nature of exchanges, which can cause discrepancies in determining an accurate Fair Value. Explore further to understand how these factors influence valuation methods and impact investment strategies in digital assets.

Volatility

Mark-to-market valuation reflects the current market price of a cryptocurrency, providing a real-time measurement influenced heavily by high volatility and rapid price fluctuations. Cryptocurrency valuation must account for this inherent volatility, making accurate and timely pricing models crucial for investors and risk management. Explore detailed strategies to navigate cryptocurrency volatility for better valuation insights.

Realized Gains/Losses

Mark-to-market valuation calculates cryptocurrency value based on current market prices, reflecting unrealized gains or losses in real-time financial statements. Realized gains or losses occur when cryptocurrency assets are sold, capturing the actual profit or loss from the transaction. Explore detailed methodologies and implications of both valuation approaches for comprehensive understanding.

Source and External Links

MarktoMarket - A data platform providing intelligence and connections for SME markets.

Mark to Market - Overview, Importance, Practical Example - This webpage provides an overview of the mark to market method, its importance, and a practical example of how it is used in financial markets.

Mark to Market: Accounting and Finance Definition & Example - This webpage defines mark to market as an accounting method used to measure the current value of assets or liabilities that change over time.

dowidth.com

dowidth.com