Sustainability assurance focuses on verifying the accuracy and reliability of environmental, social, and governance (ESG) disclosures to enhance corporate transparency and stakeholder trust. Risk assurance emphasizes identifying, assessing, and mitigating financial and operational risks to safeguard organizational assets and ensure regulatory compliance. Explore further to understand how these assurance services impact accounting practices and corporate governance.

Why it is important

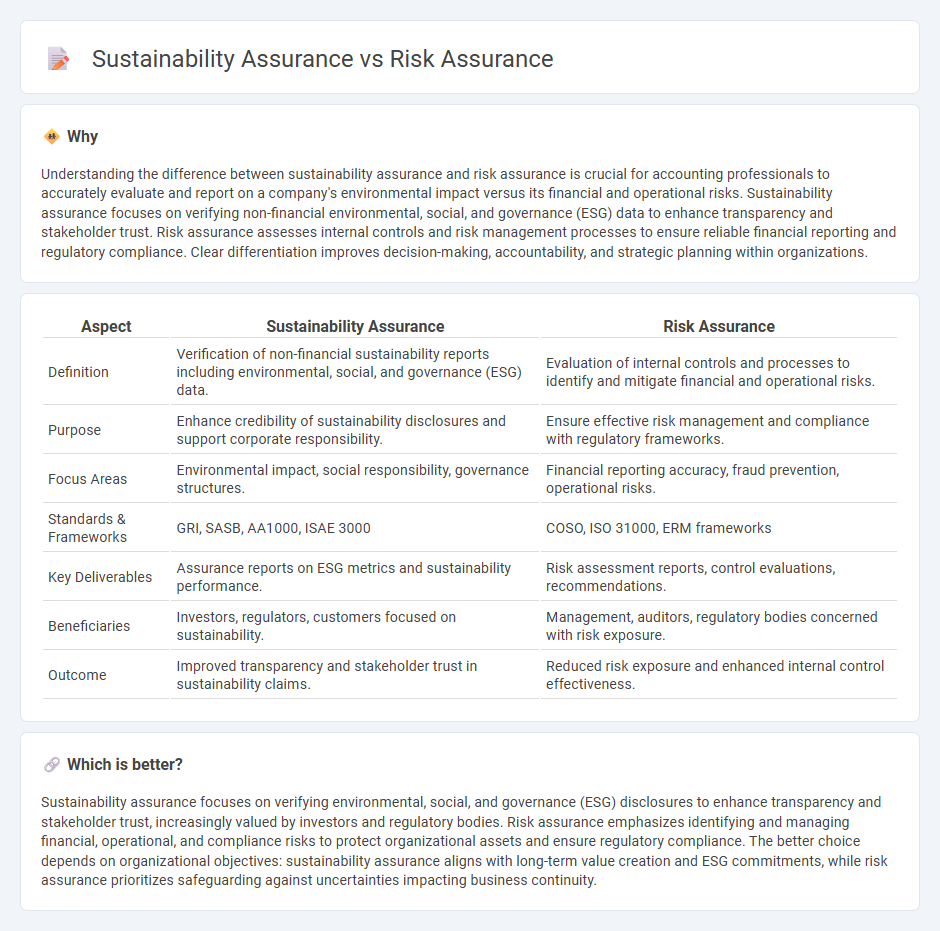

Understanding the difference between sustainability assurance and risk assurance is crucial for accounting professionals to accurately evaluate and report on a company's environmental impact versus its financial and operational risks. Sustainability assurance focuses on verifying non-financial environmental, social, and governance (ESG) data to enhance transparency and stakeholder trust. Risk assurance assesses internal controls and risk management processes to ensure reliable financial reporting and regulatory compliance. Clear differentiation improves decision-making, accountability, and strategic planning within organizations.

Comparison Table

| Aspect | Sustainability Assurance | Risk Assurance |

|---|---|---|

| Definition | Verification of non-financial sustainability reports including environmental, social, and governance (ESG) data. | Evaluation of internal controls and processes to identify and mitigate financial and operational risks. |

| Purpose | Enhance credibility of sustainability disclosures and support corporate responsibility. | Ensure effective risk management and compliance with regulatory frameworks. |

| Focus Areas | Environmental impact, social responsibility, governance structures. | Financial reporting accuracy, fraud prevention, operational risks. |

| Standards & Frameworks | GRI, SASB, AA1000, ISAE 3000 | COSO, ISO 31000, ERM frameworks |

| Key Deliverables | Assurance reports on ESG metrics and sustainability performance. | Risk assessment reports, control evaluations, recommendations. |

| Beneficiaries | Investors, regulators, customers focused on sustainability. | Management, auditors, regulatory bodies concerned with risk exposure. |

| Outcome | Improved transparency and stakeholder trust in sustainability claims. | Reduced risk exposure and enhanced internal control effectiveness. |

Which is better?

Sustainability assurance focuses on verifying environmental, social, and governance (ESG) disclosures to enhance transparency and stakeholder trust, increasingly valued by investors and regulatory bodies. Risk assurance emphasizes identifying and managing financial, operational, and compliance risks to protect organizational assets and ensure regulatory compliance. The better choice depends on organizational objectives: sustainability assurance aligns with long-term value creation and ESG commitments, while risk assurance prioritizes safeguarding against uncertainties impacting business continuity.

Connection

Sustainability assurance and risk assurance intersect in evaluating and verifying the reliability of non-financial and financial information, respectively, to enhance organizational transparency and stakeholder trust. Both processes identify potential risks--environmental, social, governance (ESG), or operational--that could impact company performance and compliance. Integrating sustainability assurance with risk assurance ensures comprehensive risk management by addressing emerging sustainability-related threats alongside traditional financial risks.

Key Terms

**Risk Assurance:**

Risk assurance centers on identifying, evaluating, and mitigating financial, operational, and compliance risks to ensure organizational resilience and reliability. It involves rigorous audits, control assessments, and continuous monitoring to safeguard against fraud, errors, and regulatory breaches. Discover how risk assurance can strengthen your business's risk management framework and drive sustainable success.

Internal Controls

Risk assurance primarily centers on evaluating the effectiveness of internal controls to manage financial, operational, and compliance risks within an organization. Sustainability assurance, however, emphasizes verifying internal controls related to environmental, social, and governance (ESG) data accuracy, ensuring transparent and reliable sustainability reporting. Explore further to understand how these distinct assurance types enhance organizational integrity and stakeholder confidence.

Risk Assessment

Risk assurance emphasizes identifying, evaluating, and managing potential threats that could impact an organization's operational, financial, or compliance objectives. Sustainability assurance, while also assessing risks, centers specifically on environmental, social, and governance (ESG) factors to ensure transparency and accountability in corporate sustainability practices. Explore deeper insights into how risk assessment frameworks differ between these assurance types to enhance organizational resilience.

Source and External Links

The Ultimate Guide to Risk Assurance - Metricstream - Risk assurance is the systematic process of evaluating and verifying that an organization's risk management strategies are effective and aligned with its objectives, involving regular risk assessments, monitoring, and reporting to ensure resilience against uncertainties.

Risk assurance - Wikipedia - Risk assurance creates a "checks and balances" system through internal processes like management controls, compliance, and audits to identify and mitigate business risks including strategic, compliance, financial, and operational risks.

The Seven Types of Risk Assurance Professionals - Hyperproof - Risk assurance is a team effort involving roles such as CISO, internal and external auditors, compliance officers, and risk officers, each responsible for specific tasks to manage cybersecurity and compliance risks effectively.

dowidth.com

dowidth.com