Crypto asset valuation involves estimating the fair value of digital currencies based on various factors such as market demand, technology, and regulatory environment. Mark-to-market accounting records the value of crypto assets at current market prices, reflecting real-time fluctuations and providing transparency. Explore the differences and implications of each method in crypto accounting practices.

Why it is important

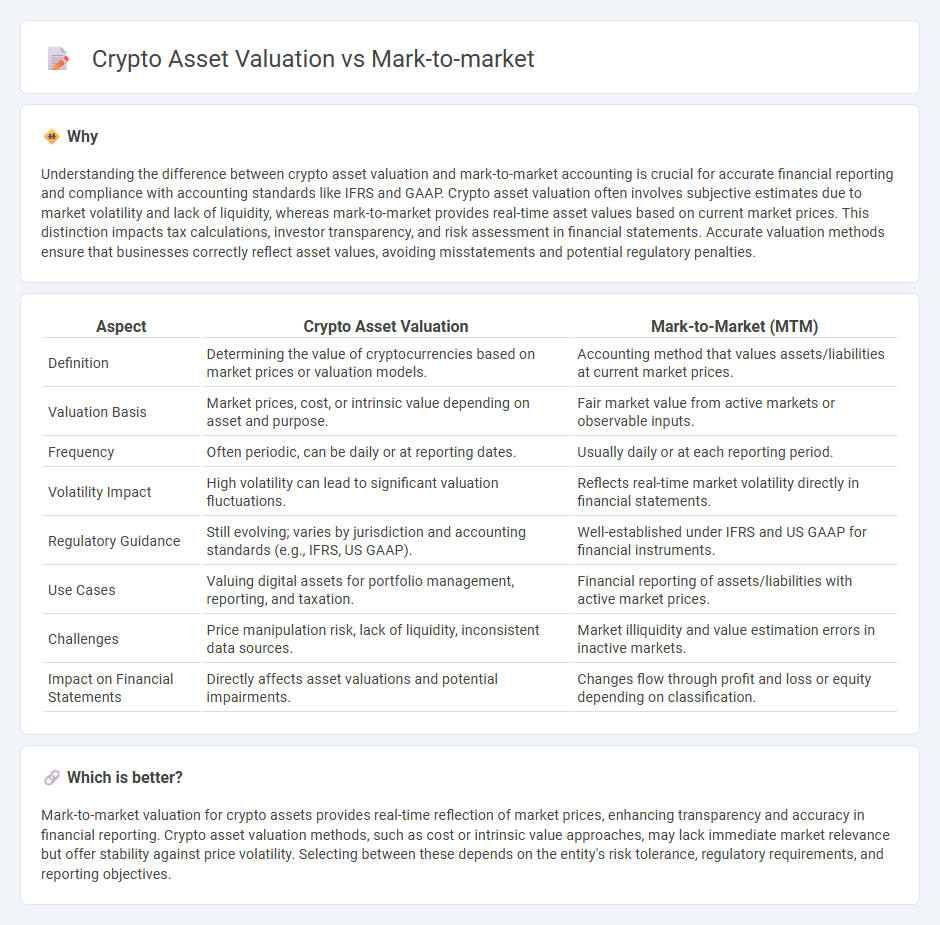

Understanding the difference between crypto asset valuation and mark-to-market accounting is crucial for accurate financial reporting and compliance with accounting standards like IFRS and GAAP. Crypto asset valuation often involves subjective estimates due to market volatility and lack of liquidity, whereas mark-to-market provides real-time asset values based on current market prices. This distinction impacts tax calculations, investor transparency, and risk assessment in financial statements. Accurate valuation methods ensure that businesses correctly reflect asset values, avoiding misstatements and potential regulatory penalties.

Comparison Table

| Aspect | Crypto Asset Valuation | Mark-to-Market (MTM) |

|---|---|---|

| Definition | Determining the value of cryptocurrencies based on market prices or valuation models. | Accounting method that values assets/liabilities at current market prices. |

| Valuation Basis | Market prices, cost, or intrinsic value depending on asset and purpose. | Fair market value from active markets or observable inputs. |

| Frequency | Often periodic, can be daily or at reporting dates. | Usually daily or at each reporting period. |

| Volatility Impact | High volatility can lead to significant valuation fluctuations. | Reflects real-time market volatility directly in financial statements. |

| Regulatory Guidance | Still evolving; varies by jurisdiction and accounting standards (e.g., IFRS, US GAAP). | Well-established under IFRS and US GAAP for financial instruments. |

| Use Cases | Valuing digital assets for portfolio management, reporting, and taxation. | Financial reporting of assets/liabilities with active market prices. |

| Challenges | Price manipulation risk, lack of liquidity, inconsistent data sources. | Market illiquidity and value estimation errors in inactive markets. |

| Impact on Financial Statements | Directly affects asset valuations and potential impairments. | Changes flow through profit and loss or equity depending on classification. |

Which is better?

Mark-to-market valuation for crypto assets provides real-time reflection of market prices, enhancing transparency and accuracy in financial reporting. Crypto asset valuation methods, such as cost or intrinsic value approaches, may lack immediate market relevance but offer stability against price volatility. Selecting between these depends on the entity's risk tolerance, regulatory requirements, and reporting objectives.

Connection

Crypto asset valuation relies heavily on mark-to-market accounting, which records assets at their current market price rather than historical cost. This approach provides real-time insight into the value of volatile crypto holdings, offering transparent financial statements for investors and regulators. Accurate mark-to-market valuations are essential for reflecting true asset liquidity and market risk in accounting reports.

Key Terms

Fair Value

Fair value measurement is crucial in both mark-to-market accounting and crypto asset valuation, providing a transparent and up-to-date reflection of an asset's worth based on current market conditions. In crypto markets, fair value is often derived from real-time trading data on exchanges, considering liquidity, market depth, and volatility, which can differ significantly from traditional assets. Explore our detailed analysis to understand how fair value principles apply uniquely to crypto assets and impact financial reporting accuracy.

Volatility

Mark-to-market valuation reflects the current market price of crypto assets, providing a real-time snapshot influenced by high volatility and liquidity fluctuations. Crypto asset valuation techniques incorporate factors such as market sentiment, historical data, and volatility indices to better anticipate potential price swings. Explore deeper insights into how volatility impacts asset valuation in the dynamic crypto market.

Realized/Unrealized Gains

Mark-to-market accounting values crypto assets at current market prices, providing real-time reflection of unrealized gains or losses on holdings. Realized gains occur when assets are sold, locking in profit or loss based on transaction prices, while unrealized gains represent paper profits from price appreciation without a sale. Explore deeper insights on how these valuation methods impact investment strategy and tax reporting in the crypto sector.

Source and External Links

Mark to Market - Overview, Importance, Practical Example - Mark to market is an accounting method that measures the fair value of assets and liabilities periodically based on current market conditions, providing a more accurate and timely reflection of a company's financial situation compared to historical cost accounting.

Mark-to-Market (MTM) | IBKR Glossary - Mark-to-market refers to recording the value of assets and liabilities at current market prices rather than historical cost, commonly used in trading to assess daily profit or loss on open positions and maintain accurate financial statements.

Mark-to-Market (MTM) | TaxEDU Glossary - Tax Foundation - Mark-to-market taxation taxes accrued capital gains annually instead of upon realization, eliminating tax deferral but posing challenges for illiquid assets and compliance, as taxpayers must pay taxes on unrealized gains yearly.

dowidth.com

dowidth.com