Predictive close leverages advanced analytics and historical data to forecast financial outcomes before the actual month-end process, enhancing accuracy and decision-making speed. Monthly close, a traditional accounting procedure, involves finalizing all financial transactions and reconciliations at the end of each month to produce accurate financial statements. Explore the advantages and implementation strategies of predictive close compared to monthly close for optimized financial management.

Why it is important

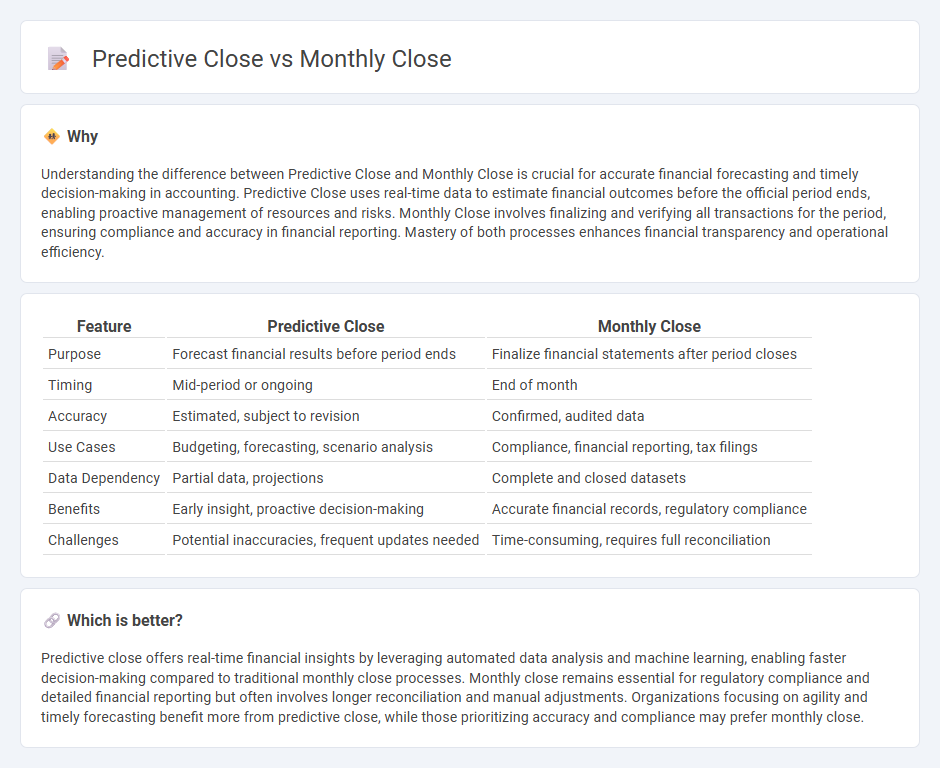

Understanding the difference between Predictive Close and Monthly Close is crucial for accurate financial forecasting and timely decision-making in accounting. Predictive Close uses real-time data to estimate financial outcomes before the official period ends, enabling proactive management of resources and risks. Monthly Close involves finalizing and verifying all transactions for the period, ensuring compliance and accuracy in financial reporting. Mastery of both processes enhances financial transparency and operational efficiency.

Comparison Table

| Feature | Predictive Close | Monthly Close |

|---|---|---|

| Purpose | Forecast financial results before period ends | Finalize financial statements after period closes |

| Timing | Mid-period or ongoing | End of month |

| Accuracy | Estimated, subject to revision | Confirmed, audited data |

| Use Cases | Budgeting, forecasting, scenario analysis | Compliance, financial reporting, tax filings |

| Data Dependency | Partial data, projections | Complete and closed datasets |

| Benefits | Early insight, proactive decision-making | Accurate financial records, regulatory compliance |

| Challenges | Potential inaccuracies, frequent updates needed | Time-consuming, requires full reconciliation |

Which is better?

Predictive close offers real-time financial insights by leveraging automated data analysis and machine learning, enabling faster decision-making compared to traditional monthly close processes. Monthly close remains essential for regulatory compliance and detailed financial reporting but often involves longer reconciliation and manual adjustments. Organizations focusing on agility and timely forecasting benefit more from predictive close, while those prioritizing accuracy and compliance may prefer monthly close.

Connection

Predictive close leverages advanced analytics and historical financial data to forecast potential variances and expedite the Monthly close process. By identifying discrepancies early, predictive close enhances accuracy and reduces the time required for finalizing financial statements. This integration streamlines accounting workflows, improves compliance, and supports more timely decision-making.

Key Terms

Accruals

Monthly close processes ensure accurate financial statements by systematically recording accruals for expenses and revenues incurred but not yet paid or received, maintaining compliance with GAAP standards. Predictive close leverages data analytics and automation to forecast and estimate accruals ahead of actual transactions, reducing close cycle time and improving forecast accuracy. Explore how integrating predictive close methods can optimize your accrual management and accelerate financial closing.

Forecasting

Monthly close processes provide historical financial data essential for accurate forecasting by capturing actual revenue and expenses within a defined period. Predictive close techniques leverage real-time data and advanced analytics to generate forward-looking financial insights, enabling more proactive decision-making. Explore detailed strategies to enhance forecasting accuracy through optimized monthly and predictive close methods.

Variance Analysis

Monthly close involves finalizing financial records at the end of a period to ensure accuracy in reported figures, while predictive close uses forecasting models to estimate financial outcomes before the period ends. Variance analysis in monthly close identifies discrepancies between actual and budgeted results, highlighting operational inefficiencies, whereas predictive close variance analysis anticipates potential budget deviations, enabling proactive decision-making. Explore in-depth methodologies and tools that enhance variance analysis accuracy in both monthly and predictive close processes.

Source and External Links

What is the monthly close? | AccountingCoach - Monthly close is a series of steps and procedures ensuring a company's monthly financial statements comply with the accrual accounting method, involving cut-offs between end-of-month transactions and the next month, and review of financial statements for anomalies before release.

What is the Month-End Close? | F&A Glossary - BlackLine - The month-end close finalizes all financial activity for the preceding month by reviewing, documenting, and reconciling transactions, ensuring accuracy and reliability of financial data for consistent reporting and informed business decisions.

What is the Month-End Close Process? | FloQast - The month-end close verifies and adjusts account balances to produce accurate financial reports, including closing revenue and expense accounts to Income Summary, then to Retained Earnings, enabling reliable monthly financial statements for business management.

dowidth.com

dowidth.com