Embedded finance accounting integrates financial services directly into non-financial platforms, streamlining transactions and enhancing real-time financial data accuracy compared to traditional accounting systems that rely on separate, manual processes. This approach optimizes cash flow management, reduces reconciliation errors, and improves operational efficiency by leveraging APIs and automated data capture. Explore how embedded finance accounting transforms financial reporting and decision-making in modern businesses.

Why it is important

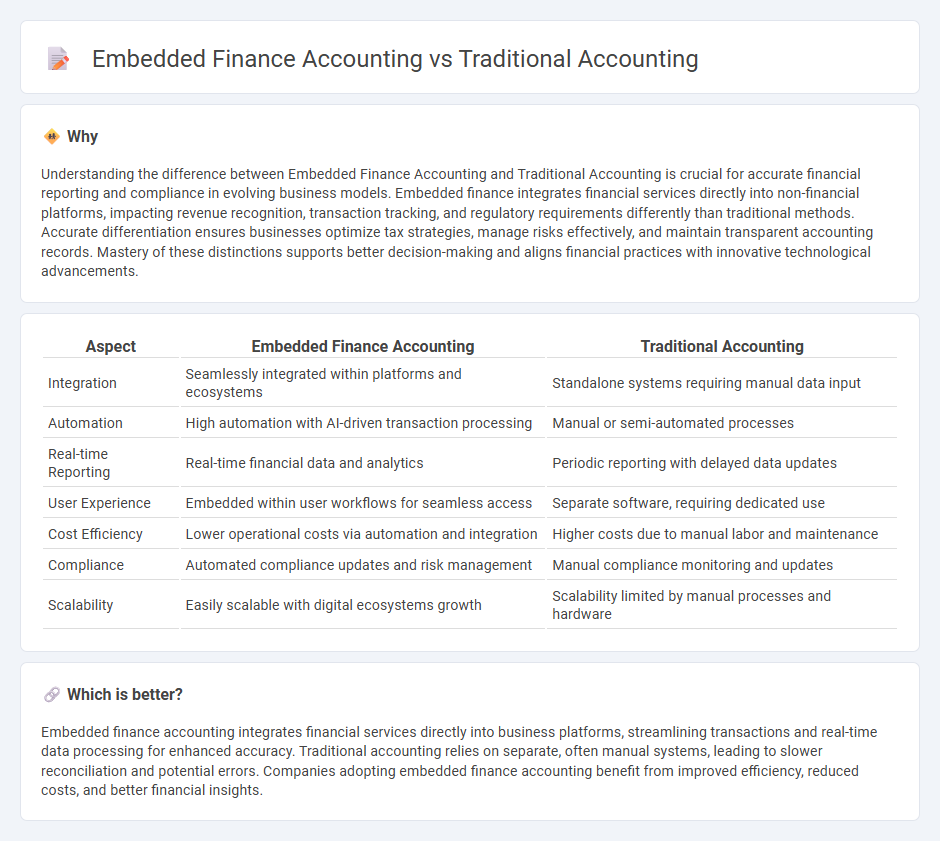

Understanding the difference between Embedded Finance Accounting and Traditional Accounting is crucial for accurate financial reporting and compliance in evolving business models. Embedded finance integrates financial services directly into non-financial platforms, impacting revenue recognition, transaction tracking, and regulatory requirements differently than traditional methods. Accurate differentiation ensures businesses optimize tax strategies, manage risks effectively, and maintain transparent accounting records. Mastery of these distinctions supports better decision-making and aligns financial practices with innovative technological advancements.

Comparison Table

| Aspect | Embedded Finance Accounting | Traditional Accounting |

|---|---|---|

| Integration | Seamlessly integrated within platforms and ecosystems | Standalone systems requiring manual data input |

| Automation | High automation with AI-driven transaction processing | Manual or semi-automated processes |

| Real-time Reporting | Real-time financial data and analytics | Periodic reporting with delayed data updates |

| User Experience | Embedded within user workflows for seamless access | Separate software, requiring dedicated use |

| Cost Efficiency | Lower operational costs via automation and integration | Higher costs due to manual labor and maintenance |

| Compliance | Automated compliance updates and risk management | Manual compliance monitoring and updates |

| Scalability | Easily scalable with digital ecosystems growth | Scalability limited by manual processes and hardware |

Which is better?

Embedded finance accounting integrates financial services directly into business platforms, streamlining transactions and real-time data processing for enhanced accuracy. Traditional accounting relies on separate, often manual systems, leading to slower reconciliation and potential errors. Companies adopting embedded finance accounting benefit from improved efficiency, reduced costs, and better financial insights.

Connection

Embedded finance accounting integrates financial services directly into business platforms, streamlining transaction recording and real-time data processing, which complements traditional accounting practices focused on periodic financial reporting and compliance. Both systems rely on accurate data capture, ledger management, and reconciliation to ensure financial transparency and regulatory adherence. The synergy between embedded finance accounting and traditional accounting enhances efficiency, accuracy, and financial insight for businesses.

Key Terms

Chart of Accounts

Traditional accounting relies on a static Chart of Accounts (CoA) organized by predefined categories such as assets, liabilities, income, and expenses, enabling systematic financial reporting. Embedded finance accounting integrates the CoA with real-time transactional data from financial services within non-financial platforms, enhancing flexibility and granularity in tracking revenue streams and operational costs. Explore the evolving dynamics between traditional and embedded finance accounting for a comprehensive understanding of modern financial management.

Revenue Recognition

Traditional accounting recognizes revenue based on completed sales or service delivery events following GAAP principles, often resulting in time-lagged reporting. Embedded finance accounting integrates financial services within non-financial platforms, requiring real-time revenue recognition aligned with transaction flows and platform usage patterns. Explore how embedded finance revolutionizes revenue recognition for enhanced accuracy and compliance.

Real-time Data Integration

Traditional accounting relies on periodic data updates and batch processing, which often delays financial insights. Embedded finance accounting integrates real-time data via APIs, enabling immediate transaction verification and dynamic financial reporting. Explore how real-time data integration transforms financial accuracy and decision-making.

Source and External Links

Cash Basis vs Traditional Accounting for Inventory - Traditional accounting, also known as accrual accounting, records revenue and expenses when they are earned or incurred, not when cash is exchanged, providing a clearer picture of a company's financial health but being more complex and costly to implement.

The Pros and Cons of Traditional vs. Digital Accounting for Event Companies - Traditional accounting relies on physical ledgers, journals, and manual double-entry bookkeeping to track financial transactions, contrasting with digital accounting's use of automated, computerized systems.

What is Traditional Accounting? And Why It's Failing You - Outmin - Traditional accounting can also refer more broadly to outdated, fragmented processes involving manual tasks and multiple disparate systems, which can be inefficient and costly, especially for complex businesses.

dowidth.com

dowidth.com