Tax equity financing leverages tax credits and incentives to attract investors who provide capital in exchange for tax benefits, commonly used in renewable energy projects to reduce upfront costs. Project finance involves raising capital based on the projected cash flows of the project itself, isolating the project's assets and liabilities from the sponsor's balance sheet. Explore detailed comparisons to understand which financing method best suits your accounting strategy and project needs.

Why it is important

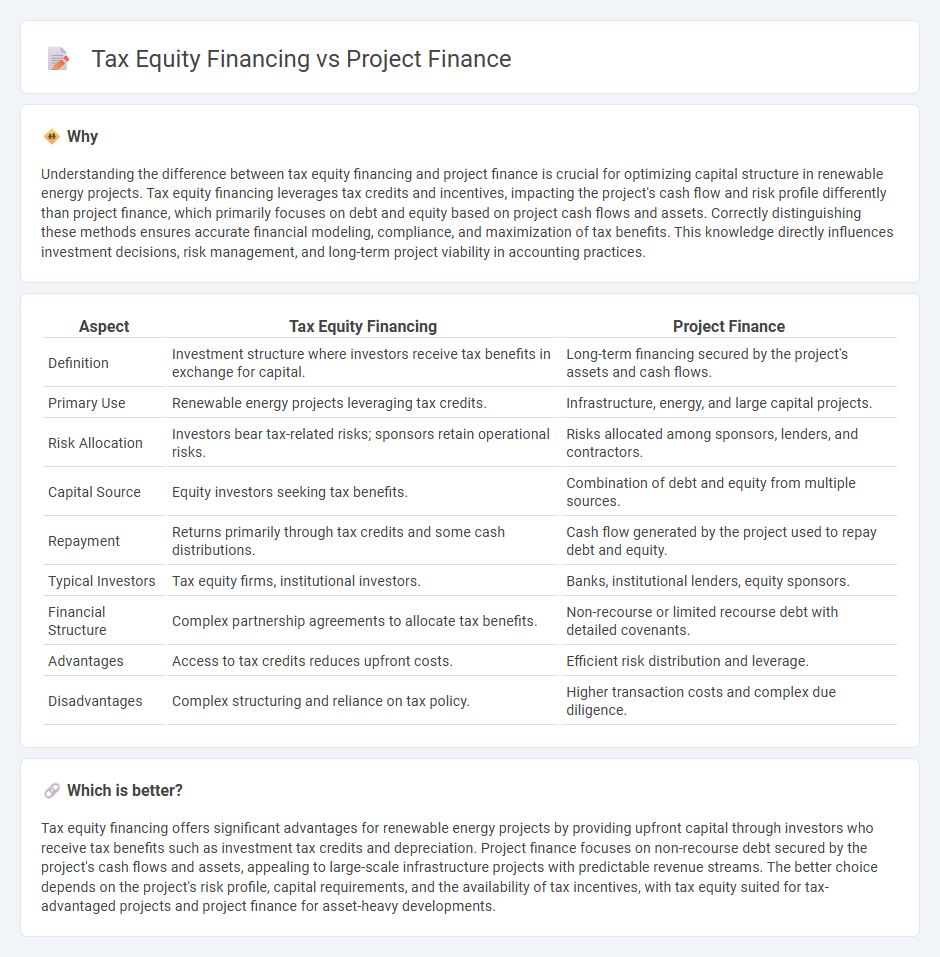

Understanding the difference between tax equity financing and project finance is crucial for optimizing capital structure in renewable energy projects. Tax equity financing leverages tax credits and incentives, impacting the project's cash flow and risk profile differently than project finance, which primarily focuses on debt and equity based on project cash flows and assets. Correctly distinguishing these methods ensures accurate financial modeling, compliance, and maximization of tax benefits. This knowledge directly influences investment decisions, risk management, and long-term project viability in accounting practices.

Comparison Table

| Aspect | Tax Equity Financing | Project Finance |

|---|---|---|

| Definition | Investment structure where investors receive tax benefits in exchange for capital. | Long-term financing secured by the project's assets and cash flows. |

| Primary Use | Renewable energy projects leveraging tax credits. | Infrastructure, energy, and large capital projects. |

| Risk Allocation | Investors bear tax-related risks; sponsors retain operational risks. | Risks allocated among sponsors, lenders, and contractors. |

| Capital Source | Equity investors seeking tax benefits. | Combination of debt and equity from multiple sources. |

| Repayment | Returns primarily through tax credits and some cash distributions. | Cash flow generated by the project used to repay debt and equity. |

| Typical Investors | Tax equity firms, institutional investors. | Banks, institutional lenders, equity sponsors. |

| Financial Structure | Complex partnership agreements to allocate tax benefits. | Non-recourse or limited recourse debt with detailed covenants. |

| Advantages | Access to tax credits reduces upfront costs. | Efficient risk distribution and leverage. |

| Disadvantages | Complex structuring and reliance on tax policy. | Higher transaction costs and complex due diligence. |

Which is better?

Tax equity financing offers significant advantages for renewable energy projects by providing upfront capital through investors who receive tax benefits such as investment tax credits and depreciation. Project finance focuses on non-recourse debt secured by the project's cash flows and assets, appealing to large-scale infrastructure projects with predictable revenue streams. The better choice depends on the project's risk profile, capital requirements, and the availability of tax incentives, with tax equity suited for tax-advantaged projects and project finance for asset-heavy developments.

Connection

Tax equity financing and project finance are interconnected through their mutual focus on funding large-scale infrastructure and renewable energy projects by leveraging tax benefits and structured financial arrangements. Tax equity investors provide capital in exchange for tax credits and depreciation benefits, which enhances the overall cash flow and viability of project finance deals. The collaboration between these financing mechanisms enables developers to access diverse funding sources while optimizing tax efficiency and risk management.

Key Terms

Debt Service Coverage Ratio (DSCR)

Project finance utilizes Debt Service Coverage Ratio (DSCR) as a critical metric to assess a project's ability to generate sufficient cash flow to cover debt payments, typically requiring a DSCR above 1.2 to mitigate lender risk. Tax equity financing, while also concerned with DSCR, places greater emphasis on the sponsor's equity contributions and the structure of tax benefits, often allowing for lower DSCR thresholds due to the dual focus on tax credit returns alongside project cash flows. Explore detailed analyses to understand how DSCR impacts financing structures and risk assessments in both project finance and tax equity scenarios.

Tax Credits

Tax equity financing leverages tax credits, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), enabling investors to offset their tax liabilities by investing in renewable energy projects. Project finance typically relies on debt and equity without directly utilizing tax credits, focusing instead on cash flow from the project's operations for loan repayment. Explore detailed comparisons and benefits of tax credits in financing to optimize renewable energy investments.

Special Purpose Vehicle (SPV)

Project finance structures often utilize a Special Purpose Vehicle (SPV) to isolate financial risk by ring-fencing project assets and liabilities, enabling non-recourse or limited recourse financing. Tax equity financing involves an SPV to attract investors seeking tax benefits, such as Investment Tax Credits (ITC) or Production Tax Credits (PTC), commonly used in renewable energy projects to optimize capital structure. Explore further how SPVs enhance risk management and tax efficiency in project and tax equity finance strategies.

Source and External Links

Project finance - Wikipedia - Project finance is long-term financing for infrastructure and industrial projects based on the project's projected cash flows rather than sponsors' balance sheets, typically involving equity investors and non-recourse loans secured by project assets.

Project Finance - Key Concepts - Public Private Partnership - Project finance allows off-balance-sheet financing, shielding shareholders and governments from credit impact while shifting some project risk to lenders, who benefit from higher margins due to the complexity and risk involved.

Project Finance Jobs: Recruiting, The Job, Salaries, Hours, and ... - Project finance roles include advising clients on debt used in infrastructure investments and lending, involving detailed financial modeling, structuring deals, and working with banks to raise financing primarily through senior debt with risk mitigation via contracts.

dowidth.com

dowidth.com