Tax equity financing leverages tax benefits to attract investors who provide capital in exchange for tax credits and depreciation deductions, often used in renewable energy projects to optimize financial structure. Retained earnings represent the portion of a company's net income kept within the business to fund operations or growth without incurring additional debt or diluting ownership. Explore how these financing methods impact corporate financial strategies and tax planning.

Why it is important

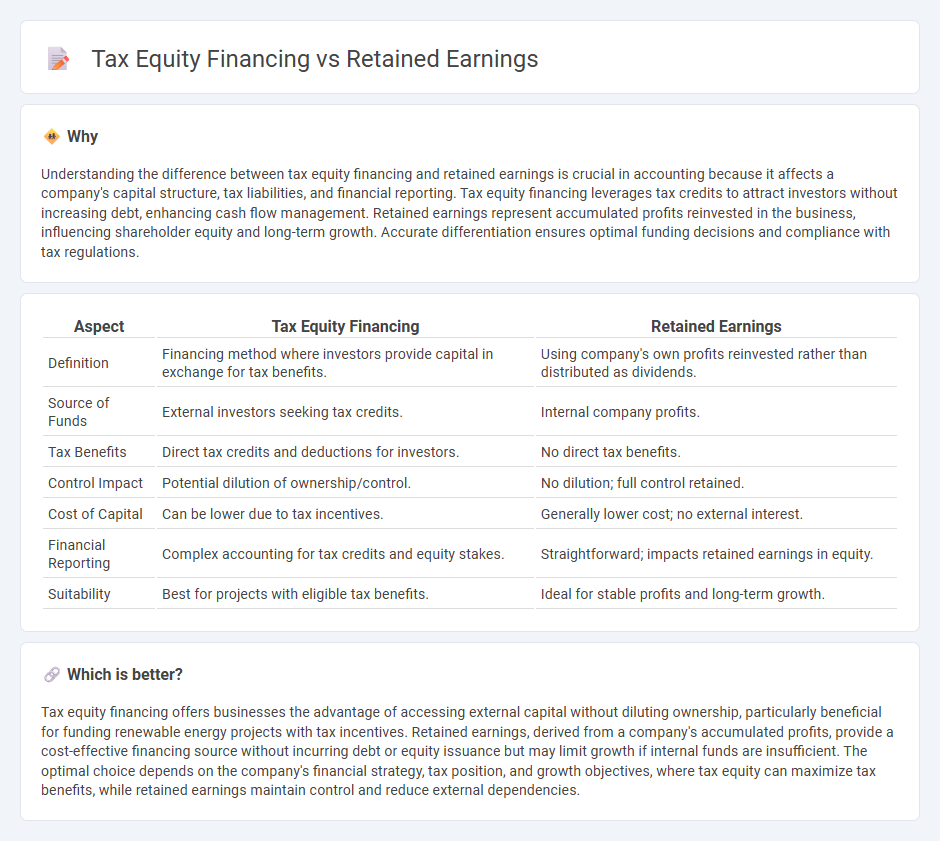

Understanding the difference between tax equity financing and retained earnings is crucial in accounting because it affects a company's capital structure, tax liabilities, and financial reporting. Tax equity financing leverages tax credits to attract investors without increasing debt, enhancing cash flow management. Retained earnings represent accumulated profits reinvested in the business, influencing shareholder equity and long-term growth. Accurate differentiation ensures optimal funding decisions and compliance with tax regulations.

Comparison Table

| Aspect | Tax Equity Financing | Retained Earnings |

|---|---|---|

| Definition | Financing method where investors provide capital in exchange for tax benefits. | Using company's own profits reinvested rather than distributed as dividends. |

| Source of Funds | External investors seeking tax credits. | Internal company profits. |

| Tax Benefits | Direct tax credits and deductions for investors. | No direct tax benefits. |

| Control Impact | Potential dilution of ownership/control. | No dilution; full control retained. |

| Cost of Capital | Can be lower due to tax incentives. | Generally lower cost; no external interest. |

| Financial Reporting | Complex accounting for tax credits and equity stakes. | Straightforward; impacts retained earnings in equity. |

| Suitability | Best for projects with eligible tax benefits. | Ideal for stable profits and long-term growth. |

Which is better?

Tax equity financing offers businesses the advantage of accessing external capital without diluting ownership, particularly beneficial for funding renewable energy projects with tax incentives. Retained earnings, derived from a company's accumulated profits, provide a cost-effective financing source without incurring debt or equity issuance but may limit growth if internal funds are insufficient. The optimal choice depends on the company's financial strategy, tax position, and growth objectives, where tax equity can maximize tax benefits, while retained earnings maintain control and reduce external dependencies.

Connection

Tax equity financing leverages tax credits and incentives, allowing companies to reduce their tax liability while raising capital for projects. Retained earnings, as internally generated funds, can strengthen a company's equity base, improving its creditworthiness and ability to attract tax equity investors. Both mechanisms enhance financial flexibility by optimizing capital structure and supporting long-term investment strategies.

Key Terms

Accumulated Profits

Retained earnings represent accumulated profits reinvested into a company, enhancing internal financing without incurring debt or diluting ownership, while tax equity financing involves external investors providing capital in exchange for tax credits and benefits, primarily used in renewable energy projects. Accumulated profits reflect the company's operational success over time, directly impacting retained earnings and influencing the firm's ability to self-fund growth without reliance on tax equity partnerships. Explore further to understand how leveraging retained earnings versus tax equity financing affects financial strategy and capital structure.

Ownership Structure

Retained earnings represent the accumulated net profits a company reinvests, maintaining full ownership control without diluting equity. Tax equity financing involves investors providing capital in exchange for partial ownership and tax benefits, affecting the company's ownership structure and control distribution. Explore deeper insights into how each financing method shapes corporate governance and investor relations.

Tax Credits

Retained earnings represent accumulated profits reinvested into a company, offering internal financing without diluting ownership, while tax equity financing involves external investors providing capital in exchange for tax credits and other tax benefits. Tax credits, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), are crucial in tax equity financing as they directly reduce tax liability, making this method attractive for renewable energy projects seeking immediate fiscal advantages. Explore how leveraging tax credits through tax equity financing can optimize your capital structure and enhance project returns.

Source and External Links

Retained Earnings Explained | Definition, Formula, & ... - Retained earnings are cumulative profits a company keeps after paying dividends, calculated as beginning retained earnings plus net income minus dividends, and are used for reinvestment or future dividends.

What are retained earnings? - Retained earnings represent the portion of profit left after all costs, taxes, and dividends, contributing to shareholders' equity and used to fund investments like equipment, R&D, or marketing.

What are Retained Earnings? - Retained earnings are accumulated profits not paid out as dividends but reinvested into the business for capital expenditures and debt repayment, reported under shareholders' equity on the balance sheet.

dowidth.com

dowidth.com