Embedded lease accounting involves identifying lease components within service contracts to accurately allocate costs and comply with IFRS 16 and ASC 842 standards. Right-of-use asset accounting records the lessee's right to use an asset over the lease term, reflecting lease liabilities and corresponding assets on the balance sheet. Explore more to understand the financial impacts and regulatory requirements of both accounting methods.

Why it is important

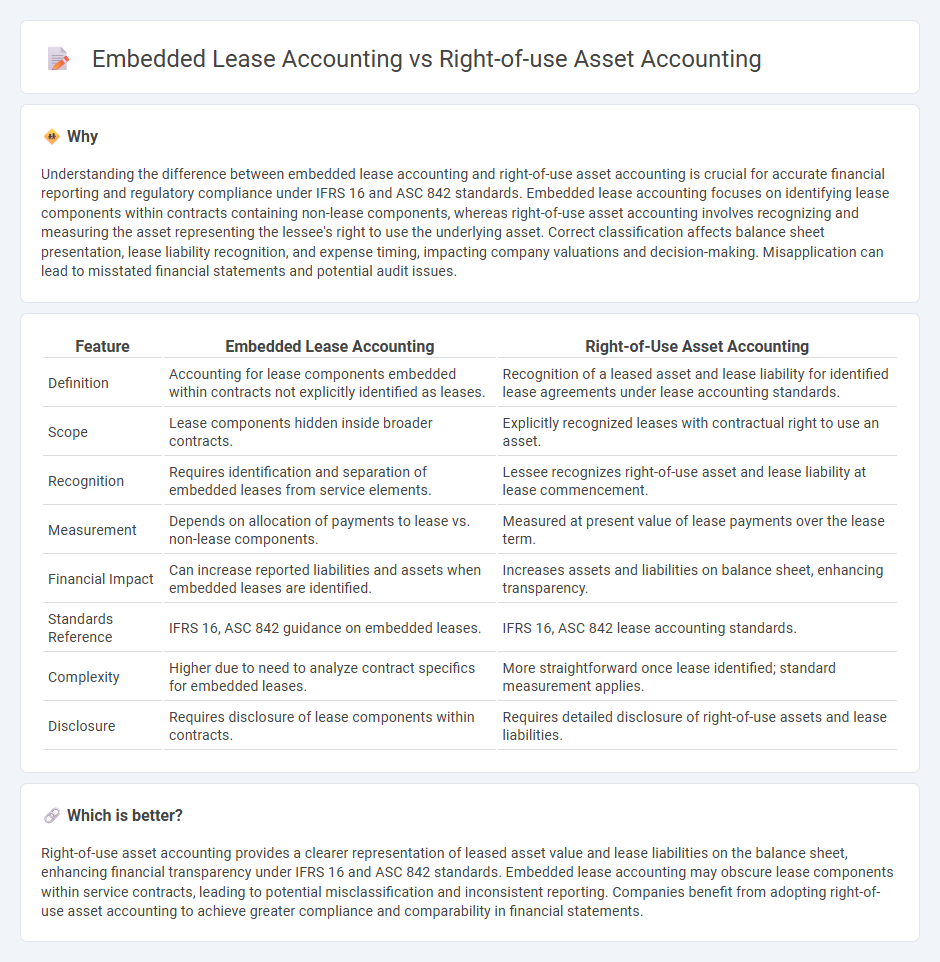

Understanding the difference between embedded lease accounting and right-of-use asset accounting is crucial for accurate financial reporting and regulatory compliance under IFRS 16 and ASC 842 standards. Embedded lease accounting focuses on identifying lease components within contracts containing non-lease components, whereas right-of-use asset accounting involves recognizing and measuring the asset representing the lessee's right to use the underlying asset. Correct classification affects balance sheet presentation, lease liability recognition, and expense timing, impacting company valuations and decision-making. Misapplication can lead to misstated financial statements and potential audit issues.

Comparison Table

| Feature | Embedded Lease Accounting | Right-of-Use Asset Accounting |

|---|---|---|

| Definition | Accounting for lease components embedded within contracts not explicitly identified as leases. | Recognition of a leased asset and lease liability for identified lease agreements under lease accounting standards. |

| Scope | Lease components hidden inside broader contracts. | Explicitly recognized leases with contractual right to use an asset. |

| Recognition | Requires identification and separation of embedded leases from service elements. | Lessee recognizes right-of-use asset and lease liability at lease commencement. |

| Measurement | Depends on allocation of payments to lease vs. non-lease components. | Measured at present value of lease payments over the lease term. |

| Financial Impact | Can increase reported liabilities and assets when embedded leases are identified. | Increases assets and liabilities on balance sheet, enhancing transparency. |

| Standards Reference | IFRS 16, ASC 842 guidance on embedded leases. | IFRS 16, ASC 842 lease accounting standards. |

| Complexity | Higher due to need to analyze contract specifics for embedded leases. | More straightforward once lease identified; standard measurement applies. |

| Disclosure | Requires disclosure of lease components within contracts. | Requires detailed disclosure of right-of-use assets and lease liabilities. |

Which is better?

Right-of-use asset accounting provides a clearer representation of leased asset value and lease liabilities on the balance sheet, enhancing financial transparency under IFRS 16 and ASC 842 standards. Embedded lease accounting may obscure lease components within service contracts, leading to potential misclassification and inconsistent reporting. Companies benefit from adopting right-of-use asset accounting to achieve greater compliance and comparability in financial statements.

Connection

Embedded lease accounting involves identifying lease components within larger contracts, ensuring accurate recognition of lease liabilities and right-of-use (ROU) assets in financial statements. The right-of-use asset accounting records the lessee's control over the leased asset, reflecting its initial measurement at the present value of lease payments and subsequent amortization. Together, these processes ensure compliance with IFRS 16 and ASC 842 standards by accurately capturing the financial impact of leases on balance sheets and income statements.

Key Terms

Lease Liability

Right-of-use asset accounting records the leased asset on the balance sheet along with a corresponding lease liability representing the present value of lease payments, reflecting lease term and discount rate per IFRS 16 or ASC 842. Embedded lease accounting identifies lease components within larger contracts to separate and measure lease liabilities accurately, ensuring precise recognition of lease obligations. Explore detailed comparisons to understand how lease liability measurement impacts financial reporting and compliance.

Recognition Criteria

Right-of-use asset accounting recognizes leases based on control and the right to use an identified asset for a period in exchange for consideration, aligning with IFRS 16 criteria requiring identification, lease term, and payment assessment. Embedded lease accounting evaluates whether a contract includes a lease component by assessing the asset's specificity, the lessee's right to control its use, and separate identification from non-lease components within a broader service agreement. Explore detailed recognition criteria and nuanced distinctions between these approaches to enhance accurate financial reporting and compliance.

Separate Components

Right-of-use asset accounting requires lessees to recognize separate components of a lease, such as leasehold improvements and service contracts, when these are distinct and measurable, ensuring precise allocation of lease liabilities and assets. Embedded lease accounting identifies lease elements embedded within larger contracts and separates lease components from non-lease components for accurate financial reporting under ASC 842 or IFRS 16. Explore detailed guidance and practical examples to better understand the implications of separate components in lease accounting.

Source and External Links

How to record the lease liability and corresponding asset - The right-of-use asset is recorded as the lease liability plus initial direct costs and prepayments, minus lease incentives, with the lease liability calculated as the present value of lease payments discounted at the incremental borrowing rate.

Guide to right-of-use assets (ROU) and lease liabilities under ASC 842 - A right-of-use asset is an intangible asset representing the lessee's right to use a leased asset during the lease term, recorded on the balance sheet along with a lease liability calculated at the present value of future lease payments discounted at the appropriate rate.

Right-of-Use Asset & Lease Liability Explained w/ Example - FinQuery - The right-of-use asset accounting involves calculating lease liability by discounting contractual lease payments and then adjusting this amount by initial direct costs and incentives to arrive at the asset value on the balance sheet under ASC 842.

dowidth.com

dowidth.com