Triple entry accounting enhances traditional double entry by incorporating a cryptographic receipt that provides greater transparency and fraud prevention in financial transactions. Fund accounting, primarily used by non-profit organizations and government entities, focuses on tracking and managing resources according to specified purposes or restrictions, ensuring accountability for each fund. Explore these accounting methods to understand their unique applications and advantages in financial management.

Why it is important

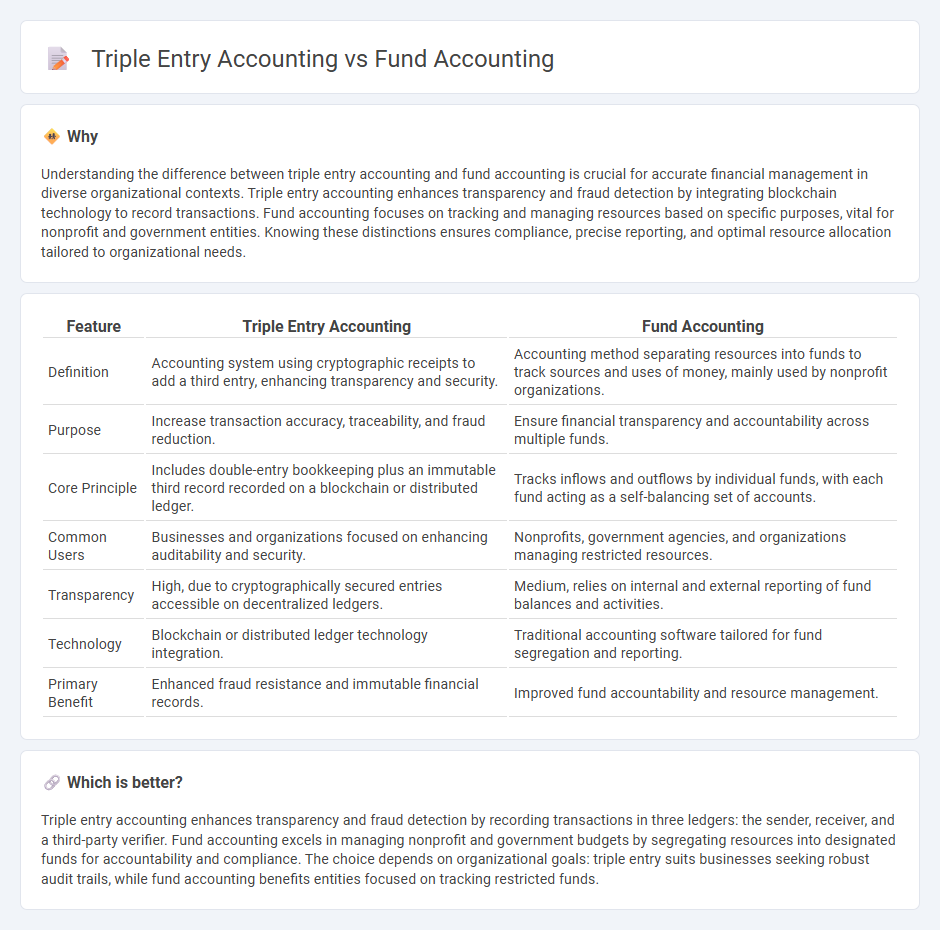

Understanding the difference between triple entry accounting and fund accounting is crucial for accurate financial management in diverse organizational contexts. Triple entry accounting enhances transparency and fraud detection by integrating blockchain technology to record transactions. Fund accounting focuses on tracking and managing resources based on specific purposes, vital for nonprofit and government entities. Knowing these distinctions ensures compliance, precise reporting, and optimal resource allocation tailored to organizational needs.

Comparison Table

| Feature | Triple Entry Accounting | Fund Accounting |

|---|---|---|

| Definition | Accounting system using cryptographic receipts to add a third entry, enhancing transparency and security. | Accounting method separating resources into funds to track sources and uses of money, mainly used by nonprofit organizations. |

| Purpose | Increase transaction accuracy, traceability, and fraud reduction. | Ensure financial transparency and accountability across multiple funds. |

| Core Principle | Includes double-entry bookkeeping plus an immutable third record recorded on a blockchain or distributed ledger. | Tracks inflows and outflows by individual funds, with each fund acting as a self-balancing set of accounts. |

| Common Users | Businesses and organizations focused on enhancing auditability and security. | Nonprofits, government agencies, and organizations managing restricted resources. |

| Transparency | High, due to cryptographically secured entries accessible on decentralized ledgers. | Medium, relies on internal and external reporting of fund balances and activities. |

| Technology | Blockchain or distributed ledger technology integration. | Traditional accounting software tailored for fund segregation and reporting. |

| Primary Benefit | Enhanced fraud resistance and immutable financial records. | Improved fund accountability and resource management. |

Which is better?

Triple entry accounting enhances transparency and fraud detection by recording transactions in three ledgers: the sender, receiver, and a third-party verifier. Fund accounting excels in managing nonprofit and government budgets by segregating resources into designated funds for accountability and compliance. The choice depends on organizational goals: triple entry suits businesses seeking robust audit trails, while fund accounting benefits entities focused on tracking restricted funds.

Connection

Triple entry accounting enhances transparency by recording transactions with a cryptographic receipt, which complements fund accounting's strict tracking of financial resources within separate funds. Both systems promote accountability by providing verifiable audit trails and detailed reporting for stakeholders. Integration of triple entry accounting within fund accounting frameworks improves accuracy in managing restricted funds and ensures compliance with regulatory standards.

Key Terms

Segregation of funds

Fund accounting ensures strict segregation of funds by designating specific resources for particular purposes, maintaining individual fund balances separately to enhance transparency and accountability. Triple entry accounting introduces an additional ledger that records transactions with cryptographic verification, improving accuracy and traceability but does not inherently segregate funds by purpose. Explore the detailed distinctions and benefits of each system to optimize financial management strategies.

Blockchain ledger

Fund accounting organizes financial transactions by specific funds to ensure accountability and compliance in nonprofit and government organizations. Triple entry accounting enhances traditional double-entry systems by incorporating cryptographic verification on a blockchain ledger, creating an immutable and transparent record of all transactions. Explore how blockchain's triple entry accounting revolutionizes fund management with increased security and trust.

Transparency

Fund accounting enhances financial transparency by segregating resources into distinct funds, allowing organizations like nonprofits and government entities to track and report on specific funding sources and their restrictions. Triple entry accounting improves transparency through cryptographic verification of transactions, creating an immutable ledger that reduces fraud and errors in financial records. Explore the benefits of both systems to understand how they each contribute to clearer and more reliable financial reporting.

Source and External Links

What Is Fund Accounting? | Xero US - Fund accounting is a method primarily used by nonprofit organizations to track funds separately and ensure each dollar is used for its intended purpose, using accrual accounting to record transactions accurately.

Fund accounting - Wikipedia - Fund accounting records resources restricted by donors or authorities, emphasizing accountability over profitability, and is commonly used by nonprofits and governments with funds classified as unrestricted, temporarily restricted, or permanently restricted.

What Is Fund Accounting? A Guide to Basics & Best Practices - Jitasa - Fund accounting tracks money allocated to various tax-exempt organizational operations, ensuring funds are used according to donor restrictions and contributing to mission-focused reinvestment instead of profit generation.

dowidth.com

dowidth.com