Outcome-based budgeting focuses on allocating resources based on measurable results and performance objectives, ensuring funds directly support strategic goals. Incremental budgeting adjusts previous budgets by a set percentage, emphasizing historical spending patterns rather than outcomes. Explore detailed comparisons to understand which budgeting method best aligns with your financial management needs.

Why it is important

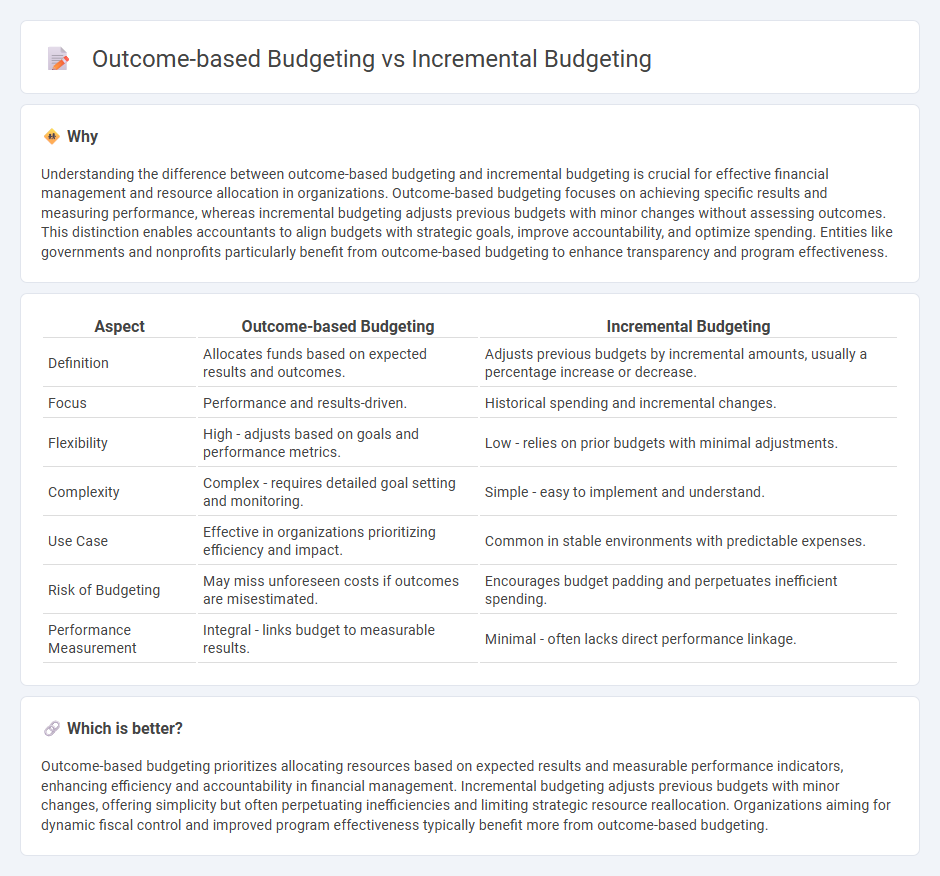

Understanding the difference between outcome-based budgeting and incremental budgeting is crucial for effective financial management and resource allocation in organizations. Outcome-based budgeting focuses on achieving specific results and measuring performance, whereas incremental budgeting adjusts previous budgets with minor changes without assessing outcomes. This distinction enables accountants to align budgets with strategic goals, improve accountability, and optimize spending. Entities like governments and nonprofits particularly benefit from outcome-based budgeting to enhance transparency and program effectiveness.

Comparison Table

| Aspect | Outcome-based Budgeting | Incremental Budgeting |

|---|---|---|

| Definition | Allocates funds based on expected results and outcomes. | Adjusts previous budgets by incremental amounts, usually a percentage increase or decrease. |

| Focus | Performance and results-driven. | Historical spending and incremental changes. |

| Flexibility | High - adjusts based on goals and performance metrics. | Low - relies on prior budgets with minimal adjustments. |

| Complexity | Complex - requires detailed goal setting and monitoring. | Simple - easy to implement and understand. |

| Use Case | Effective in organizations prioritizing efficiency and impact. | Common in stable environments with predictable expenses. |

| Risk of Budgeting | May miss unforeseen costs if outcomes are misestimated. | Encourages budget padding and perpetuates inefficient spending. |

| Performance Measurement | Integral - links budget to measurable results. | Minimal - often lacks direct performance linkage. |

Which is better?

Outcome-based budgeting prioritizes allocating resources based on expected results and measurable performance indicators, enhancing efficiency and accountability in financial management. Incremental budgeting adjusts previous budgets with minor changes, offering simplicity but often perpetuating inefficiencies and limiting strategic resource reallocation. Organizations aiming for dynamic fiscal control and improved program effectiveness typically benefit more from outcome-based budgeting.

Connection

Outcome-based budgeting and incremental budgeting are connected through their shared goal of improving financial management in accounting by aligning expenditures with measurable results and previous budgets. Incremental budgeting adjusts funding based on prior periods, while outcome-based budgeting reallocates resources to achieve specific performance outcomes, enabling more strategic financial planning. Both approaches complement each other by balancing historical financial data with future-oriented goals to enhance organizational accountability and resource efficiency.

Key Terms

Baseline

Incremental budgeting allocates resources based on previous period expenditures, adjusting the baseline slightly to account for new needs or inflation, ensuring financial stability and predictability. Outcome-based budgeting shifts focus from historical spending to program results, setting baselines according to expected outcomes to enhance accountability and efficiency. Explore the differences in baseline approaches to optimize your budgeting strategy.

Performance Metrics

Incremental budgeting allocates resources based on previous years' budgets with slight adjustments, prioritizing historical expenditure patterns, whereas outcome-based budgeting focuses on allocating funds according to specific performance metrics and measurable results. Performance metrics in outcome-based budgeting include key indicators such as efficiency, effectiveness, and impact, which help organizations track progress toward strategic goals. Discover how these budgeting approaches shape financial planning and drive organizational success.

Resource Allocation

Incremental budgeting allocates resources based on previous budgets with slight adjustments, emphasizing historical expenditure patterns. Outcome-based budgeting prioritizes funding allocation based on achieving specific performance goals and measurable results, driving efficiency and strategic impact. Explore how these budgeting methods optimize resource allocation to enhance financial planning and organizational effectiveness.

Source and External Links

Who Should & Shouldn't Use Incremental Budgeting - Mosaic.tech - This webpage explains the concept of incremental budgeting, its process, and its application in business settings.

What is Incremental Budgeting? - The Finance Weekly - This article provides an overview of incremental budgeting as a budgeting approach that builds on the previous year's budget with minor adjustments.

Incremental Budgeting - Overview, Advantages, Disadvantages - This resource details the method of incremental budgeting, highlighting its simplicity and common use in stable business environments.

dowidth.com

dowidth.com