Cryptotax involves reporting cryptocurrency transactions for tax compliance, focusing on gains and losses from buying, selling, and trading digital assets. Tax loss harvesting strategically sells investments at a loss to offset capital gains and reduce taxable income, applicable to both traditional and crypto portfolios. Explore detailed strategies to optimize your tax outcomes in the evolving landscape of digital asset accounting.

Why it is important

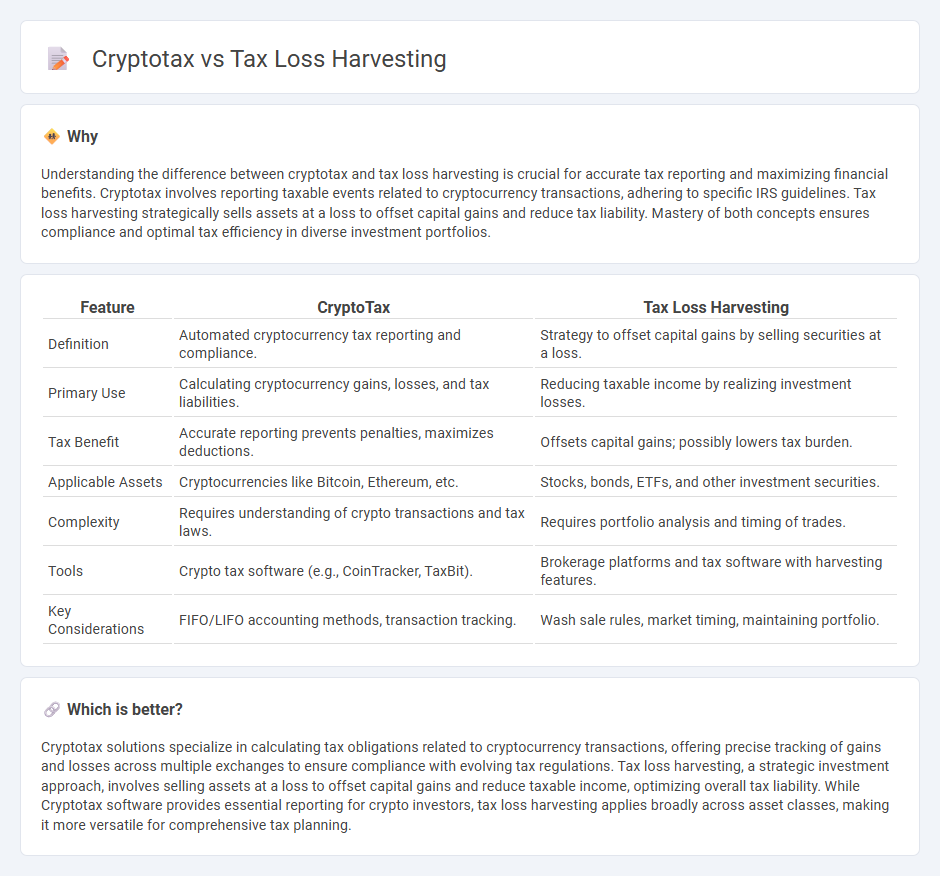

Understanding the difference between cryptotax and tax loss harvesting is crucial for accurate tax reporting and maximizing financial benefits. Cryptotax involves reporting taxable events related to cryptocurrency transactions, adhering to specific IRS guidelines. Tax loss harvesting strategically sells assets at a loss to offset capital gains and reduce tax liability. Mastery of both concepts ensures compliance and optimal tax efficiency in diverse investment portfolios.

Comparison Table

| Feature | CryptoTax | Tax Loss Harvesting |

|---|---|---|

| Definition | Automated cryptocurrency tax reporting and compliance. | Strategy to offset capital gains by selling securities at a loss. |

| Primary Use | Calculating cryptocurrency gains, losses, and tax liabilities. | Reducing taxable income by realizing investment losses. |

| Tax Benefit | Accurate reporting prevents penalties, maximizes deductions. | Offsets capital gains; possibly lowers tax burden. |

| Applicable Assets | Cryptocurrencies like Bitcoin, Ethereum, etc. | Stocks, bonds, ETFs, and other investment securities. |

| Complexity | Requires understanding of crypto transactions and tax laws. | Requires portfolio analysis and timing of trades. |

| Tools | Crypto tax software (e.g., CoinTracker, TaxBit). | Brokerage platforms and tax software with harvesting features. |

| Key Considerations | FIFO/LIFO accounting methods, transaction tracking. | Wash sale rules, market timing, maintaining portfolio. |

Which is better?

Cryptotax solutions specialize in calculating tax obligations related to cryptocurrency transactions, offering precise tracking of gains and losses across multiple exchanges to ensure compliance with evolving tax regulations. Tax loss harvesting, a strategic investment approach, involves selling assets at a loss to offset capital gains and reduce taxable income, optimizing overall tax liability. While Cryptotax software provides essential reporting for crypto investors, tax loss harvesting applies broadly across asset classes, making it more versatile for comprehensive tax planning.

Connection

Cryptotax regulations require accurate reporting of cryptocurrency transactions, directly impacting tax loss harvesting strategies. Tax loss harvesting involves selling digital assets at a loss to offset capital gains, minimizing overall tax liability. Effective accounting ensures that these losses are properly documented and compliant with IRS guidelines, enhancing tax efficiency for investors.

Key Terms

Capital Gains

Tax loss harvesting strategically offsets capital gains by selling underperforming assets to minimize tax liability on profitable investments. Crypto tax, particularly for capital gains, involves reporting gains from digital asset transactions, which can be complex due to fluctuating valuations and regulatory nuances. Explore detailed strategies to optimize tax outcomes with both tax loss harvesting and crypto tax compliance.

Cost Basis

Tax loss harvesting involves strategically selling investments at a loss to offset gains and reduce tax liability, focusing heavily on accurately identifying the cost basis of assets. CryptoTax solutions automate the tracking of complex cost basis calculations for cryptocurrencies, accounting for variables like FIFO, LIFO, and specific identification methods. Explore our comprehensive guide to understand how precise cost basis management can maximize your tax efficiency.

Taxable Events

Tax loss harvesting targets taxable events by strategically selling investments at a loss to offset capital gains, reducing overall tax liability. CryptoTax involves tracking a wide range of taxable events including trades, conversions, and spending of cryptocurrencies, each triggering potential tax consequences based on IRS guidelines. Discover how understanding these taxable events can optimize your tax strategy and compliance with both traditional and crypto assets.

Source and External Links

Tax-Loss Harvesting | Vanguard - Tax-loss harvesting is a strategy that involves selling investments at a loss to offset gains in other investments and reduce tax liabilities.

Tax Loss Harvesting - Wikipedia - Tax loss harvesting is an investment strategy used to generate capital losses for tax benefits by selling depreciated securities.

How Does Tax-Loss Harvesting Work? - Tax-loss harvesting involves selling investments at a loss to offset capital gains and potentially lower tax liability by using similar but not identical investments.

dowidth.com

dowidth.com