Continuous assurance offers real-time monitoring of financial transactions and controls, enhancing accuracy and early detection of discrepancies. Interim audit provides a periodic review of financial statements and internal controls, typically conducted before the fiscal year-end to identify risks and correct errors. Explore the detailed differences and benefits of each approach to optimize your auditing strategy.

Why it is important

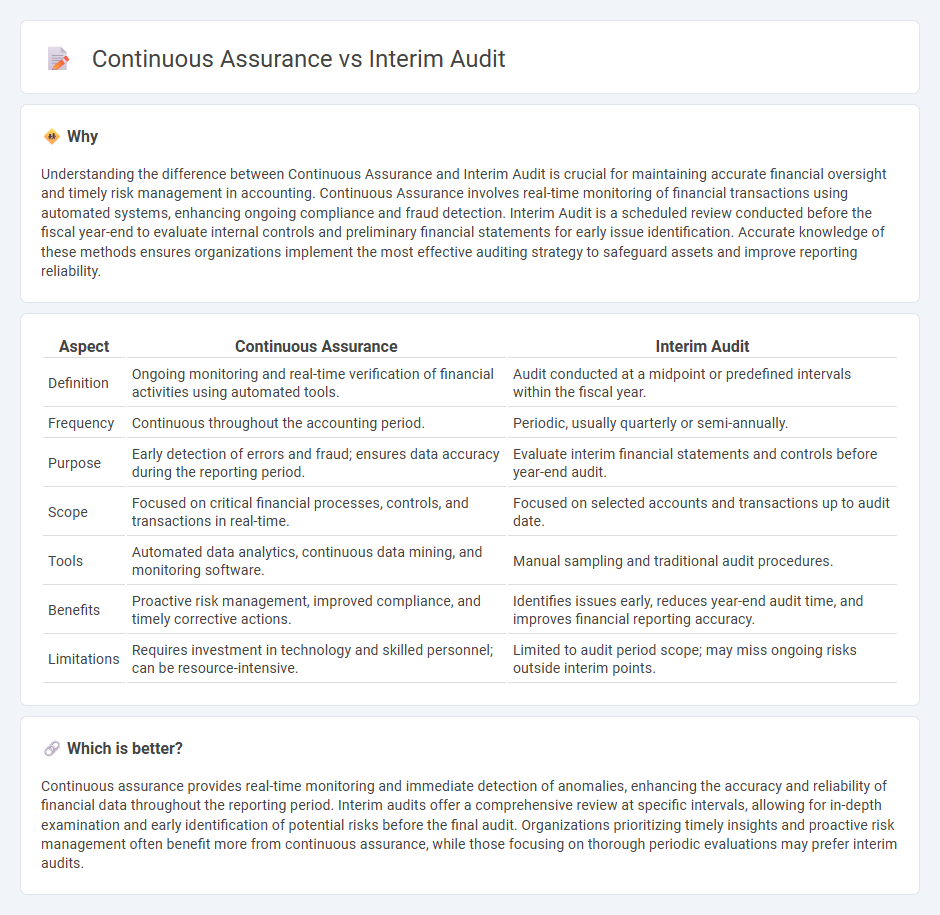

Understanding the difference between Continuous Assurance and Interim Audit is crucial for maintaining accurate financial oversight and timely risk management in accounting. Continuous Assurance involves real-time monitoring of financial transactions using automated systems, enhancing ongoing compliance and fraud detection. Interim Audit is a scheduled review conducted before the fiscal year-end to evaluate internal controls and preliminary financial statements for early issue identification. Accurate knowledge of these methods ensures organizations implement the most effective auditing strategy to safeguard assets and improve reporting reliability.

Comparison Table

| Aspect | Continuous Assurance | Interim Audit |

|---|---|---|

| Definition | Ongoing monitoring and real-time verification of financial activities using automated tools. | Audit conducted at a midpoint or predefined intervals within the fiscal year. |

| Frequency | Continuous throughout the accounting period. | Periodic, usually quarterly or semi-annually. |

| Purpose | Early detection of errors and fraud; ensures data accuracy during the reporting period. | Evaluate interim financial statements and controls before year-end audit. |

| Scope | Focused on critical financial processes, controls, and transactions in real-time. | Focused on selected accounts and transactions up to audit date. |

| Tools | Automated data analytics, continuous data mining, and monitoring software. | Manual sampling and traditional audit procedures. |

| Benefits | Proactive risk management, improved compliance, and timely corrective actions. | Identifies issues early, reduces year-end audit time, and improves financial reporting accuracy. |

| Limitations | Requires investment in technology and skilled personnel; can be resource-intensive. | Limited to audit period scope; may miss ongoing risks outside interim points. |

Which is better?

Continuous assurance provides real-time monitoring and immediate detection of anomalies, enhancing the accuracy and reliability of financial data throughout the reporting period. Interim audits offer a comprehensive review at specific intervals, allowing for in-depth examination and early identification of potential risks before the final audit. Organizations prioritizing timely insights and proactive risk management often benefit more from continuous assurance, while those focusing on thorough periodic evaluations may prefer interim audits.

Connection

Continuous assurance and interim audit both focus on timely evaluation of financial information, enhancing the accuracy of financial reporting throughout the fiscal period. Continuous assurance employs automated technologies to monitor transactions in real-time, allowing for early detection of anomalies, while interim audit involves periodic review procedures conducted before the final audit to assess internal controls and identify risks. Integrating continuous assurance into interim audits improves audit efficiency by providing up-to-date data and reducing the scope of substantive testing during year-end audits.

Key Terms

Timing

Interim audits occur at a specific point within the fiscal year, providing a snapshot of financial health before year-end, while continuous assurance involves ongoing monitoring throughout the entire accounting period to detect issues in real-time. The timing of interim audits allows identification of potential risks early, but continuous assurance offers real-time insights that improve timely decision-making and operational efficiency. Explore more to understand how the timing of these audit approaches impacts financial accuracy and organizational control.

Frequency

Interim audit typically occurs at specific intervals during the fiscal year, offering periodic financial assessment and control verification. Continuous assurance employs real-time monitoring technologies to provide ongoing evaluation and immediate identification of discrepancies. Explore how these approaches impact audit quality and operational efficiency in dynamic business environments.

Scope

Interim audit primarily focuses on evaluating financial statements for a specific period, ensuring accuracy and compliance with accounting standards before the fiscal year-end. Continuous assurance extends this scope by providing ongoing monitoring of business processes, controls, and risks throughout the year, enabling real-time detection and mitigation of issues. Explore more about how these approaches differ in scope and impact on organizational risk management.

Source and External Links

Interim audit definition - AccountingTools - An interim audit is preliminary audit work conducted before the fiscal year-end to identify issues early, strengthen internal controls, and compress the final audit timeline, though it is not mandatory under most frameworks.

What is an Interim Audit | ACC Consulting Service - An interim audit reviews six to nine months of financial data before year-end, focusing on early issue identification, reducing final audit work, and facilitating quicker annual reporting, especially useful for large clients with strong internal controls.

AS 4105: Reviews of Interim Financial Information - PCAOB - This standard guides reviews of interim financial information aiming to identify material modifications needed for compliance with generally accepted accounting principles, focusing on inquiries and analytical procedures without providing assurance on internal control.

dowidth.com

dowidth.com