Transfer pricing analytics involves examining financial data to ensure compliance with tax regulations and optimize intercompany transactions within multinational corporations. Management control systems focus on monitoring, measuring, and guiding organizational performance to achieve strategic objectives and operational efficiency. Explore how integrating transfer pricing analytics with management control systems can enhance corporate financial governance and decision-making.

Why it is important

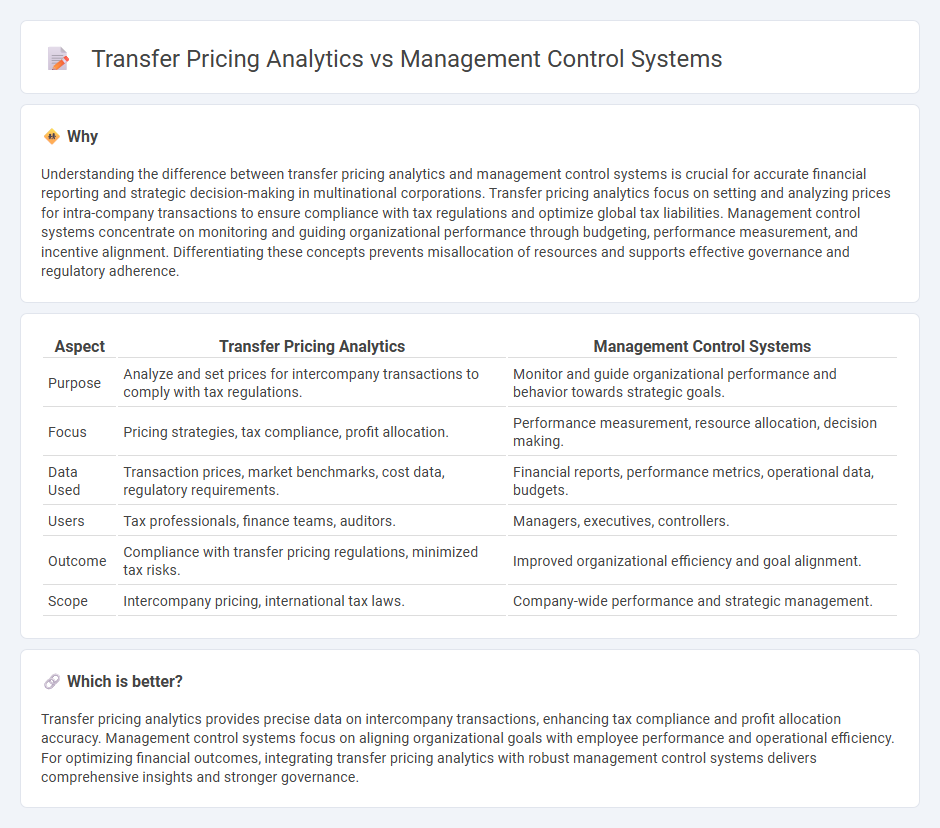

Understanding the difference between transfer pricing analytics and management control systems is crucial for accurate financial reporting and strategic decision-making in multinational corporations. Transfer pricing analytics focus on setting and analyzing prices for intra-company transactions to ensure compliance with tax regulations and optimize global tax liabilities. Management control systems concentrate on monitoring and guiding organizational performance through budgeting, performance measurement, and incentive alignment. Differentiating these concepts prevents misallocation of resources and supports effective governance and regulatory adherence.

Comparison Table

| Aspect | Transfer Pricing Analytics | Management Control Systems |

|---|---|---|

| Purpose | Analyze and set prices for intercompany transactions to comply with tax regulations. | Monitor and guide organizational performance and behavior towards strategic goals. |

| Focus | Pricing strategies, tax compliance, profit allocation. | Performance measurement, resource allocation, decision making. |

| Data Used | Transaction prices, market benchmarks, cost data, regulatory requirements. | Financial reports, performance metrics, operational data, budgets. |

| Users | Tax professionals, finance teams, auditors. | Managers, executives, controllers. |

| Outcome | Compliance with transfer pricing regulations, minimized tax risks. | Improved organizational efficiency and goal alignment. |

| Scope | Intercompany pricing, international tax laws. | Company-wide performance and strategic management. |

Which is better?

Transfer pricing analytics provides precise data on intercompany transactions, enhancing tax compliance and profit allocation accuracy. Management control systems focus on aligning organizational goals with employee performance and operational efficiency. For optimizing financial outcomes, integrating transfer pricing analytics with robust management control systems delivers comprehensive insights and stronger governance.

Connection

Transfer pricing analytics utilize advanced data analysis to optimize pricing strategies for intercompany transactions, directly impacting the accuracy of financial reporting within management control systems. Effective transfer pricing management control systems ensure compliance with tax regulations and enhance decision-making by integrating real-time pricing data and performance metrics. This connection facilitates risk mitigation and promotes transparency across multinational corporations' financial operations.

Key Terms

**Management Control Systems:**

Management Control Systems (MCS) are strategic frameworks used by organizations to monitor performance, align operations with corporate objectives, and enhance decision-making efficiency through financial and non-financial metrics. These systems integrate budgeting, performance measurement, and incentive mechanisms to ensure organizational goals are met effectively. Discover more about how MCS drives organizational success and operational excellence.

Budgeting

Management control systems integrate budgeting processes to monitor organizational performance and align resources with strategic goals, while transfer pricing analytics focus on setting and analyzing internal pricing mechanisms to optimize tax liabilities and profit distribution among subsidiaries. Budgeting within management control emphasizes variance analysis and forecast adjustments to maintain financial discipline. Explore in-depth how these approaches complement each other for effective financial planning and control.

Performance Measurement

Management control systems utilize performance measurement to align organizational goals with operational activities, ensuring resource efficiency and strategic goal attainment. Transfer pricing analytics focus on evaluating intercompany transactions to optimize tax outcomes while maintaining compliance with international regulations and internal performance metrics. Explore in-depth how both frameworks impact financial performance and strategic decision-making.

Source and External Links

Management Control Systems (MCS) Guide: Components and Tips - A management control system (MCS) is an approach businesses use to continuously measure performance against goals of productivity, profitability, or efficiency, helping managers identify obstacles and improve operations by tracking key metrics.

Management control system (MCS) | EBSCO Research Starters - An MCS is a leadership framework that defines, monitors, and evaluates employee performance to align individual efforts with company goals, using controls like results, actions, and personnel to foster productivity and collaboration.

Management control system definition - AccountingTools - A management control system provides detailed oversight on resource usage, facilitating alignment with organizational goals, better decision-making, efficiency improvement, risk management, performance tracking, resource allocation, and enhanced internal communication.

dowidth.com

dowidth.com