Transfer pricing analytics focuses on setting and analyzing prices for transactions between affiliated entities to optimize tax efficiency and regulatory compliance. Responsibility accounting evaluates financial performance by assigning revenues and costs to specific managers or departments, promoting accountability and operational control. Explore the key differences and applications of these accounting approaches to enhance organizational financial strategy.

Why it is important

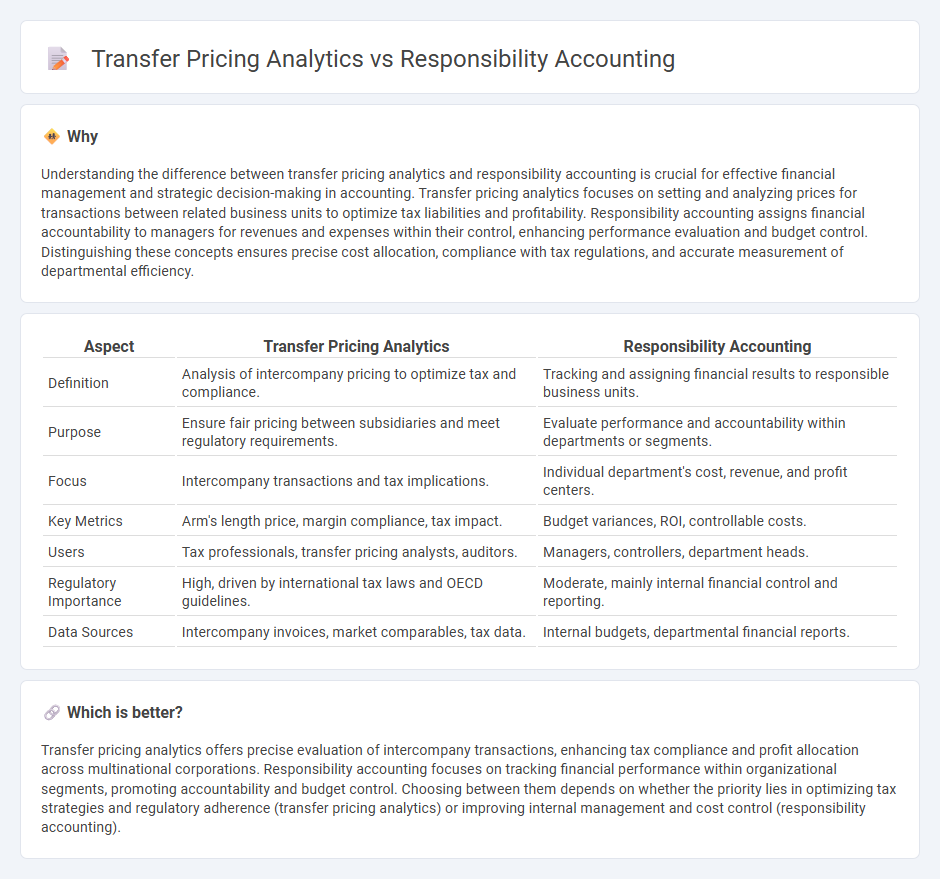

Understanding the difference between transfer pricing analytics and responsibility accounting is crucial for effective financial management and strategic decision-making in accounting. Transfer pricing analytics focuses on setting and analyzing prices for transactions between related business units to optimize tax liabilities and profitability. Responsibility accounting assigns financial accountability to managers for revenues and expenses within their control, enhancing performance evaluation and budget control. Distinguishing these concepts ensures precise cost allocation, compliance with tax regulations, and accurate measurement of departmental efficiency.

Comparison Table

| Aspect | Transfer Pricing Analytics | Responsibility Accounting |

|---|---|---|

| Definition | Analysis of intercompany pricing to optimize tax and compliance. | Tracking and assigning financial results to responsible business units. |

| Purpose | Ensure fair pricing between subsidiaries and meet regulatory requirements. | Evaluate performance and accountability within departments or segments. |

| Focus | Intercompany transactions and tax implications. | Individual department's cost, revenue, and profit centers. |

| Key Metrics | Arm's length price, margin compliance, tax impact. | Budget variances, ROI, controllable costs. |

| Users | Tax professionals, transfer pricing analysts, auditors. | Managers, controllers, department heads. |

| Regulatory Importance | High, driven by international tax laws and OECD guidelines. | Moderate, mainly internal financial control and reporting. |

| Data Sources | Intercompany invoices, market comparables, tax data. | Internal budgets, departmental financial reports. |

Which is better?

Transfer pricing analytics offers precise evaluation of intercompany transactions, enhancing tax compliance and profit allocation across multinational corporations. Responsibility accounting focuses on tracking financial performance within organizational segments, promoting accountability and budget control. Choosing between them depends on whether the priority lies in optimizing tax strategies and regulatory adherence (transfer pricing analytics) or improving internal management and cost control (responsibility accounting).

Connection

Transfer pricing analytics provide critical insights into intercompany transactions, enabling precise allocation of revenues and costs across divisions. Responsibility accounting relies on this data to evaluate the financial performance of decentralized units based on controllable activities. This synergy enhances managerial decision-making by aligning transfer prices with accountability frameworks and corporate tax compliance.

Key Terms

**Responsibility Accounting:**

Responsibility accounting emphasizes tracking financial performance by assigning costs and revenues to specific departments or managers, enabling clearer accountability and control within an organization. Detailed segment reporting and variance analysis facilitate better decision-making and resource allocation aligned with managerial responsibilities. Explore more about how responsibility accounting drives operational efficiency and strategic management.

Cost Center

Responsibility accounting emphasizes tracking and evaluating costs within cost centers to promote efficient resource management and accountability. Transfer pricing analytics involves setting internal prices for goods and services exchanged between divisions, impacting cost center performance measurements and profitability assessments. Explore in-depth how integrating responsibility accounting with transfer pricing analytics enhances cost control and strategic decision-making in cost centers.

Performance Evaluation

Responsibility accounting emphasizes evaluating individual managerial performance by assigning revenues and costs to specific departments or managers, ensuring accountability in financial outcomes. Transfer pricing analytics focus on optimizing the prices charged for goods or services exchanged between divisions of the same company to achieve fair profit allocation and tax efficiency. Explore the nuances of both approaches to enhance your corporate performance evaluation strategies.

Source and External Links

Responsibility Accounting - Features, Examples, Advantages - Responsibility accounting is a management accounting system where specific parts of a company (called responsibility centers) are assigned targets, and managers are held accountable for the performance and budget control of their respective units.

Responsibility Accounting in Management - Lumen Learning - This system collects, summarizes, and reports accounting data based on the responsibilities of individual managers, focusing on items they can control, to evaluate their performance effectively.

Responsibility Accounting: Leveraging Data for Effective Decision-Making - Responsibility accounting assigns accountability for costs, revenues, and investments to specific organizational units (like cost, profit, or investment centers) to enhance performance evaluation and decision-making at a granular level.

dowidth.com

dowidth.com