Microtransaction accounting involves recording small, frequent transactions, requiring precise tracking of minimal revenue streams to ensure accurate financial reporting. User credit liability reflects the obligation of a company to recognize and manage outstanding balances credited to users, essential for compliance with accounting standards and transparent financial statements. Explore detailed methodologies and best practices to optimize microtransaction accounting and user credit liability management.

Why it is important

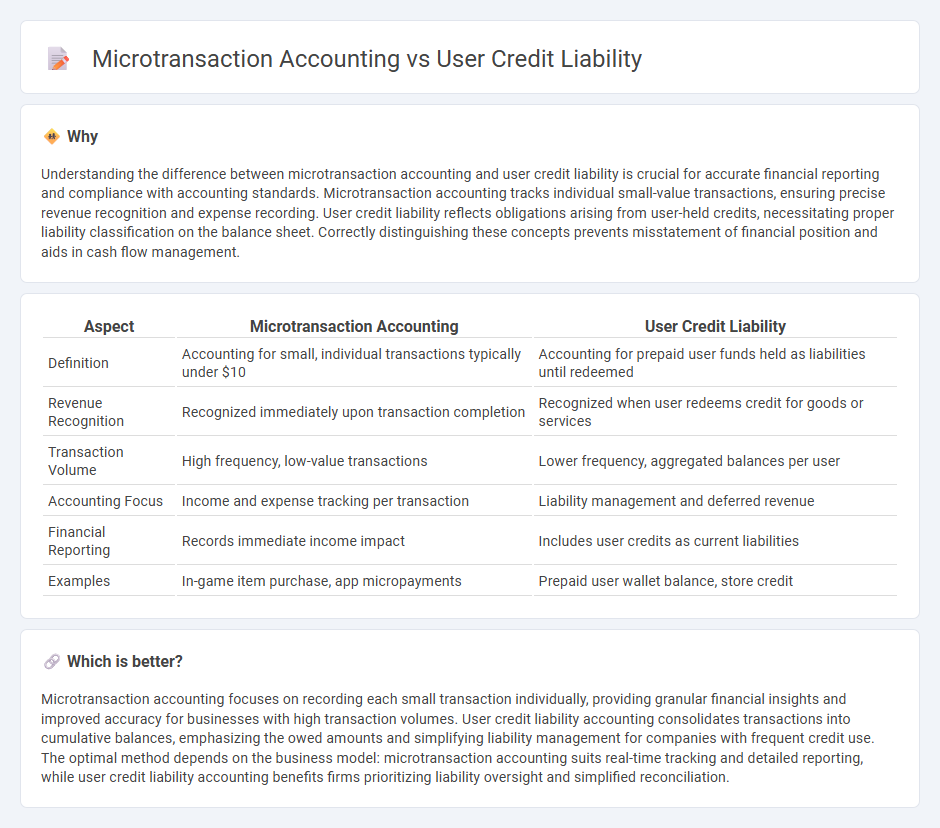

Understanding the difference between microtransaction accounting and user credit liability is crucial for accurate financial reporting and compliance with accounting standards. Microtransaction accounting tracks individual small-value transactions, ensuring precise revenue recognition and expense recording. User credit liability reflects obligations arising from user-held credits, necessitating proper liability classification on the balance sheet. Correctly distinguishing these concepts prevents misstatement of financial position and aids in cash flow management.

Comparison Table

| Aspect | Microtransaction Accounting | User Credit Liability |

|---|---|---|

| Definition | Accounting for small, individual transactions typically under $10 | Accounting for prepaid user funds held as liabilities until redeemed |

| Revenue Recognition | Recognized immediately upon transaction completion | Recognized when user redeems credit for goods or services |

| Transaction Volume | High frequency, low-value transactions | Lower frequency, aggregated balances per user |

| Accounting Focus | Income and expense tracking per transaction | Liability management and deferred revenue |

| Financial Reporting | Records immediate income impact | Includes user credits as current liabilities |

| Examples | In-game item purchase, app micropayments | Prepaid user wallet balance, store credit |

Which is better?

Microtransaction accounting focuses on recording each small transaction individually, providing granular financial insights and improved accuracy for businesses with high transaction volumes. User credit liability accounting consolidates transactions into cumulative balances, emphasizing the owed amounts and simplifying liability management for companies with frequent credit use. The optimal method depends on the business model: microtransaction accounting suits real-time tracking and detailed reporting, while user credit liability accounting benefits firms prioritizing liability oversight and simplified reconciliation.

Connection

Microtransaction accounting meticulously tracks individual small-value transactions to ensure accurate revenue recognition and financial reporting. User credit liability represents the outstanding balance owed to users, recorded as a liability on the balance sheet until redeemed or expired. Proper integration of microtransaction data with user credit liability accounting enables precise monitoring of financial obligations and enhances compliance with revenue recognition standards like IFRS 15 and ASC 606.

Key Terms

Deferred Revenue

User credit liability represents the obligation recorded when users purchase credits or in-app currency that have not yet been spent, classified as Deferred Revenue on the balance sheet until the credits are redeemed. Microtransaction accounting recognizes revenue at the point of sale or usage, transitioning the deferred amount to earned revenue aligned with specific goods or services delivered. Explore the nuances between these accounting approaches to better manage revenue recognition strategies and compliance.

Unearned Income

User credit liability represents the obligation a company bears when users deposit funds or receive credits before accessing services, often recorded as unearned income on balance sheets. Microtransaction accounting tracks individual small payments, recognizing revenue only when the transaction is fulfilled, thereby reducing the amount classified as unearned income at any given time. Explore how mastering the distinction between these concepts enhances financial accuracy and compliance.

Breakage

User credit liability refers to the obligation a company has when users purchase credits or tokens that have not yet been redeemed, while microtransaction accounting manages the revenue recognition for small, often digital, purchases. Breakage, the portion of purchased credits or tokens that users never redeem, plays a critical role in both frameworks by allowing companies to recognize revenue from unused credits, thereby improving financial forecasting and profitability metrics. Explore how innovative accounting strategies for breakage can optimize revenue recognition and compliance in digital economies.

Source and External Links

Credit Card Liability Limits, How Card Issuers Are the Big Loser - Regulation Z limits a cardholder's liability for unauthorized credit card use to the lesser of $50 or the amount of unauthorized charges before the card issuer is notified, provided certain conditions are met by the issuer to impose liability.

15 U.S. Code SS 1643 - Liability of holder of credit card - A cardholder generally incurs no liability for unauthorized credit card use unless the issuer proves the cardholder authorized the use or meets legal conditions to impose liability, with liability limits governed by applicable laws.

Are Authorized Users Responsible for Credit Card Debt? - Authorized users are typically not legally responsible for credit card debt, although their credit scores can be affected by the account's activity, and they have limited control and rights over the credit account.

dowidth.com

dowidth.com