Data lake reconciliation involves consolidating and verifying vast volumes of unstructured and structured financial data from multiple sources to ensure accuracy and consistency in accounting records. Fixed assets reconciliation focuses on validating the physical and accounting records of tangible assets like machinery and property, ensuring asset registers match financial statements. Explore the key differences and benefits of each reconciliation method to enhance your accounting accuracy.

Why it is important

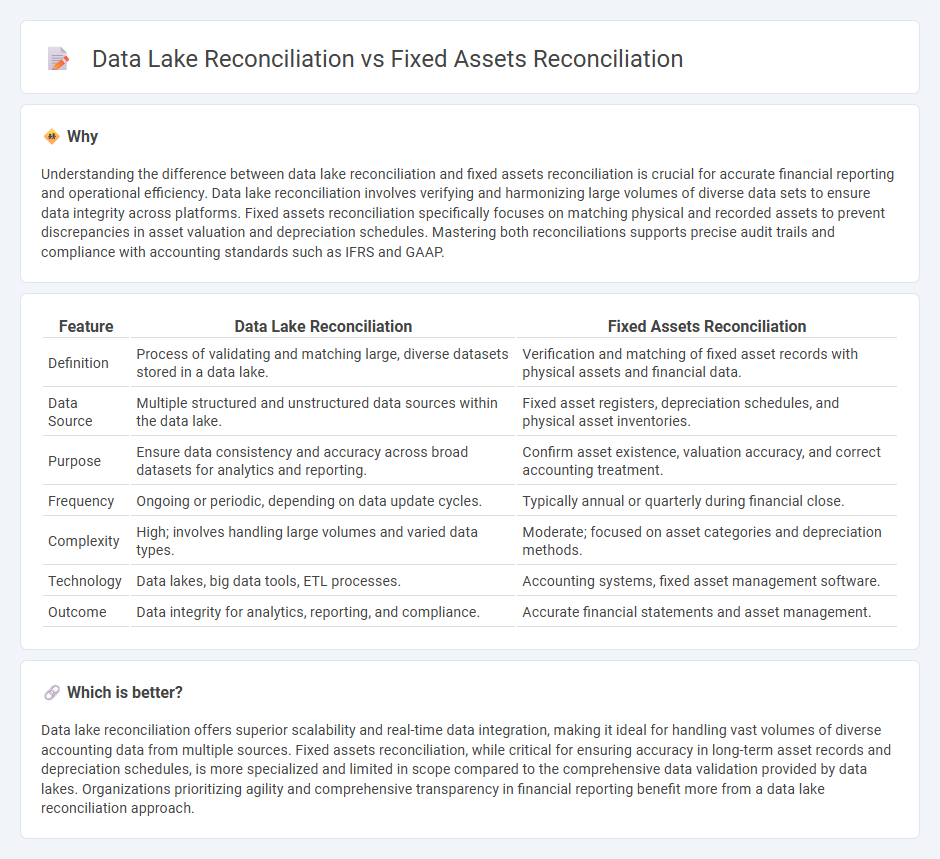

Understanding the difference between data lake reconciliation and fixed assets reconciliation is crucial for accurate financial reporting and operational efficiency. Data lake reconciliation involves verifying and harmonizing large volumes of diverse data sets to ensure data integrity across platforms. Fixed assets reconciliation specifically focuses on matching physical and recorded assets to prevent discrepancies in asset valuation and depreciation schedules. Mastering both reconciliations supports precise audit trails and compliance with accounting standards such as IFRS and GAAP.

Comparison Table

| Feature | Data Lake Reconciliation | Fixed Assets Reconciliation |

|---|---|---|

| Definition | Process of validating and matching large, diverse datasets stored in a data lake. | Verification and matching of fixed asset records with physical assets and financial data. |

| Data Source | Multiple structured and unstructured data sources within the data lake. | Fixed asset registers, depreciation schedules, and physical asset inventories. |

| Purpose | Ensure data consistency and accuracy across broad datasets for analytics and reporting. | Confirm asset existence, valuation accuracy, and correct accounting treatment. |

| Frequency | Ongoing or periodic, depending on data update cycles. | Typically annual or quarterly during financial close. |

| Complexity | High; involves handling large volumes and varied data types. | Moderate; focused on asset categories and depreciation methods. |

| Technology | Data lakes, big data tools, ETL processes. | Accounting systems, fixed asset management software. |

| Outcome | Data integrity for analytics, reporting, and compliance. | Accurate financial statements and asset management. |

Which is better?

Data lake reconciliation offers superior scalability and real-time data integration, making it ideal for handling vast volumes of diverse accounting data from multiple sources. Fixed assets reconciliation, while critical for ensuring accuracy in long-term asset records and depreciation schedules, is more specialized and limited in scope compared to the comprehensive data validation provided by data lakes. Organizations prioritizing agility and comprehensive transparency in financial reporting benefit more from a data lake reconciliation approach.

Connection

Data lake reconciliation centralizes diverse financial records including fixed asset data, ensuring consistency and accuracy across large volumes of transactional and master data. Fixed assets reconciliation verifies the accuracy of asset values and depreciation recorded in the general ledger against physical and detailed asset registers stored within the data lake. This integration enhances audit readiness, minimizes discrepancies, and supports precise financial reporting within accounting processes.

Key Terms

Depreciation schedules

Fixed assets reconciliation involves verifying the accuracy and completeness of asset registers and depreciation schedules to ensure financial statements reflect true asset values and accumulated depreciation. Data lake reconciliation compares large volumes of raw data from multiple sources, including depreciation schedules, to identify discrepancies and ensure data consistency across systems for comprehensive asset management. Explore the nuances of these reconciliation processes to optimize your asset accounting and data integration strategies.

Ledger balances

Fixed assets reconciliation ensures accuracy by matching asset records with the general ledger balances, identifying discrepancies such as depreciation errors or asset misclassification. Data lake reconciliation involves consolidating and verifying large volumes of financial data from multiple sources to enhance ledger accuracy and completeness. Explore deeper insights into optimizing reconciliation processes for reliable ledger balances.

Source system extraction

Fixed assets reconciliation involves verifying asset records against financial ledgers to ensure accuracy in depreciation and valuation, primarily extracting data from ERP and accounting systems. Data lake reconciliation focuses on aggregating vast unstructured source system extraction from multiple enterprise data repositories, enabling comprehensive cross-platform consistency checks. Explore the methodologies behind both reconciliations to optimize source system extraction processes.

Source and External Links

What is Fixed Asset Reconciliation? - SolveXia - Fixed asset reconciliation is the accounting process verifying the accuracy of fixed asset records by comparing balances from the general ledger with the fixed asset register, checking costs, accumulated depreciation, net book value, documenting discrepancies, and reporting results to management and auditors.

How to reconcile fixed assets? - CPCON - The process involves gathering general ledger and subsidiary ledger data, comparing balances, investigating discrepancies, verifying asset use and depreciation accuracy, making adjustments, and preparing a reconciliation report to ensure accurate financial reporting.

Fixed Asset Reconciliation: The Complete Guide (+ free template!) - Fixed asset reconciliation includes compiling purchase and sales documents, comparing trial balance to fixed asset workpapers, confirming depreciation accuracy, and ensuring transactions for new and sold assets are properly recorded, with the frequency depending on company size and audit needs.

dowidth.com

dowidth.com