Intercompany automation streamlines financial processes by eliminating manual reconciliation tasks, reducing errors, and accelerating closing cycles across subsidiaries. Transaction matching ensures accuracy by electronically verifying intercompany transactions to detect discrepancies and maintain balance integrity. Explore how integrating these solutions can enhance your corporate accounting efficiency.

Why it is important

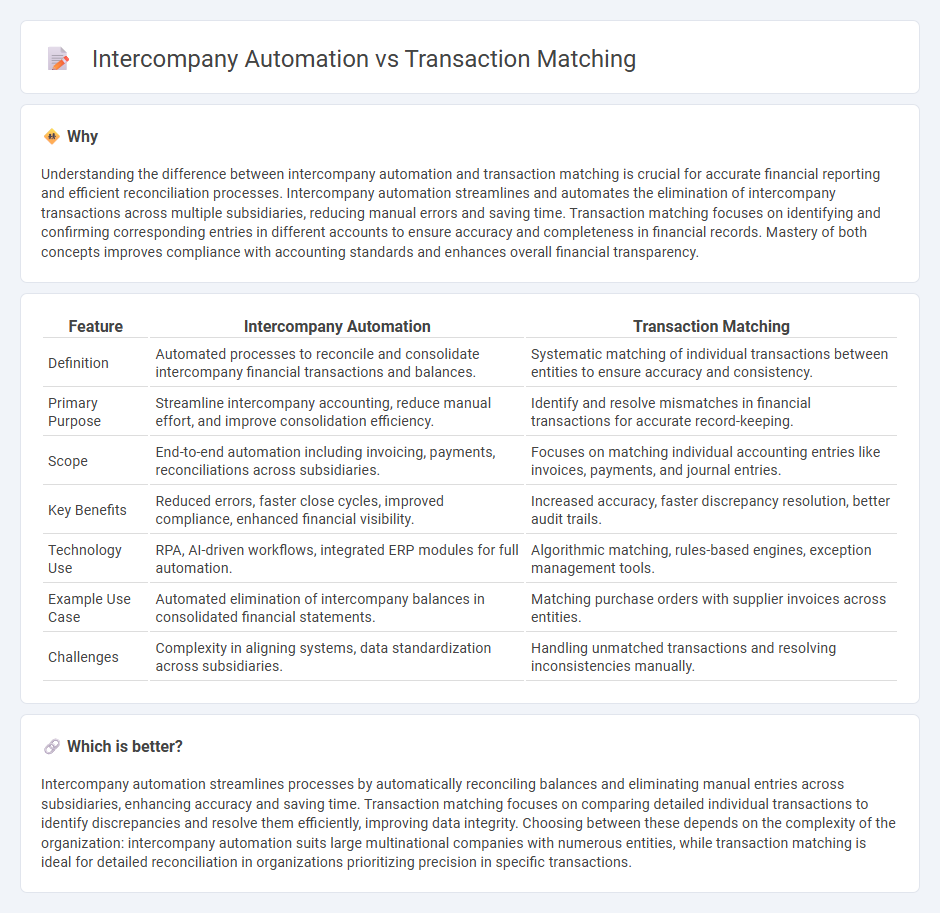

Understanding the difference between intercompany automation and transaction matching is crucial for accurate financial reporting and efficient reconciliation processes. Intercompany automation streamlines and automates the elimination of intercompany transactions across multiple subsidiaries, reducing manual errors and saving time. Transaction matching focuses on identifying and confirming corresponding entries in different accounts to ensure accuracy and completeness in financial records. Mastery of both concepts improves compliance with accounting standards and enhances overall financial transparency.

Comparison Table

| Feature | Intercompany Automation | Transaction Matching |

|---|---|---|

| Definition | Automated processes to reconcile and consolidate intercompany financial transactions and balances. | Systematic matching of individual transactions between entities to ensure accuracy and consistency. |

| Primary Purpose | Streamline intercompany accounting, reduce manual effort, and improve consolidation efficiency. | Identify and resolve mismatches in financial transactions for accurate record-keeping. |

| Scope | End-to-end automation including invoicing, payments, reconciliations across subsidiaries. | Focuses on matching individual accounting entries like invoices, payments, and journal entries. |

| Key Benefits | Reduced errors, faster close cycles, improved compliance, enhanced financial visibility. | Increased accuracy, faster discrepancy resolution, better audit trails. |

| Technology Use | RPA, AI-driven workflows, integrated ERP modules for full automation. | Algorithmic matching, rules-based engines, exception management tools. |

| Example Use Case | Automated elimination of intercompany balances in consolidated financial statements. | Matching purchase orders with supplier invoices across entities. |

| Challenges | Complexity in aligning systems, data standardization across subsidiaries. | Handling unmatched transactions and resolving inconsistencies manually. |

Which is better?

Intercompany automation streamlines processes by automatically reconciling balances and eliminating manual entries across subsidiaries, enhancing accuracy and saving time. Transaction matching focuses on comparing detailed individual transactions to identify discrepancies and resolve them efficiently, improving data integrity. Choosing between these depends on the complexity of the organization: intercompany automation suits large multinational companies with numerous entities, while transaction matching is ideal for detailed reconciliation in organizations prioritizing precision in specific transactions.

Connection

Intercompany automation streamlines the reconciliation of financial transactions between affiliated entities by enabling real-time data synchronization and eliminating manual errors. Transaction matching technologies leverage automated algorithms to compare and validate intercompany entries, ensuring accuracy and compliance with accounting standards. Together, these tools enhance efficiency in consolidating financial statements and reduce the risk of discrepancies in intercompany accounting.

Key Terms

**Transaction Matching:**

Transaction matching automates the comparison of financial records to identify discrepancies between transactions, improving accuracy and reducing manual reconciliation efforts. It leverages algorithms to align payments, invoices, and ledger entries, ensuring consistency across accounting systems. Explore how transaction matching streamlines financial operations and enhances audit readiness.

Reconciliation

Transaction matching streamlines reconciliation by automatically pairing related financial entries within the same entity, reducing manual errors and speeding up the closing process. Intercompany automation enhances reconciliation by integrating multiple subsidiaries' transactions, ensuring consistency and compliance across global operations. Explore how these technologies can optimize your reconciliation workflows for greater accuracy and efficiency.

Ledger Entries

Transaction matching streamlines ledger entries by identifying and reconciling corresponding transactions within or across accounts, reducing manual errors and improving accuracy. Intercompany automation extends this by automating the elimination and reconciliation of intercompany ledger entries, ensuring compliance and consistency in consolidated financial statements. Explore how leveraging both solutions can optimize your ledger management processes.

Source and External Links

What is Transaction Matching? | Trintech - Transaction matching involves comparing multiple data sources to confirm accurate transaction recording across different systems.

What is Transaction Matching? - SolveXia - Transaction matching is the process of comparing transactions from different data sources to identify and reconcile discrepancies.

Setting Up and Configuring Account Reconciliation - Transaction Matching helps automate complex reconciliations by loading transactions from multiple data sources, matching them using predefined rules, and identifying exceptions.

dowidth.com

dowidth.com