Cryptocurrency taxation involves unique regulations that differ significantly from traditional tax treaties governing cross-border income. While tax treaties aim to prevent double taxation between countries, crypto tax guidelines focus on classification, reporting, and compliance of digital asset transactions. Explore detailed insights to understand how these frameworks impact your financial obligations.

Why it is important

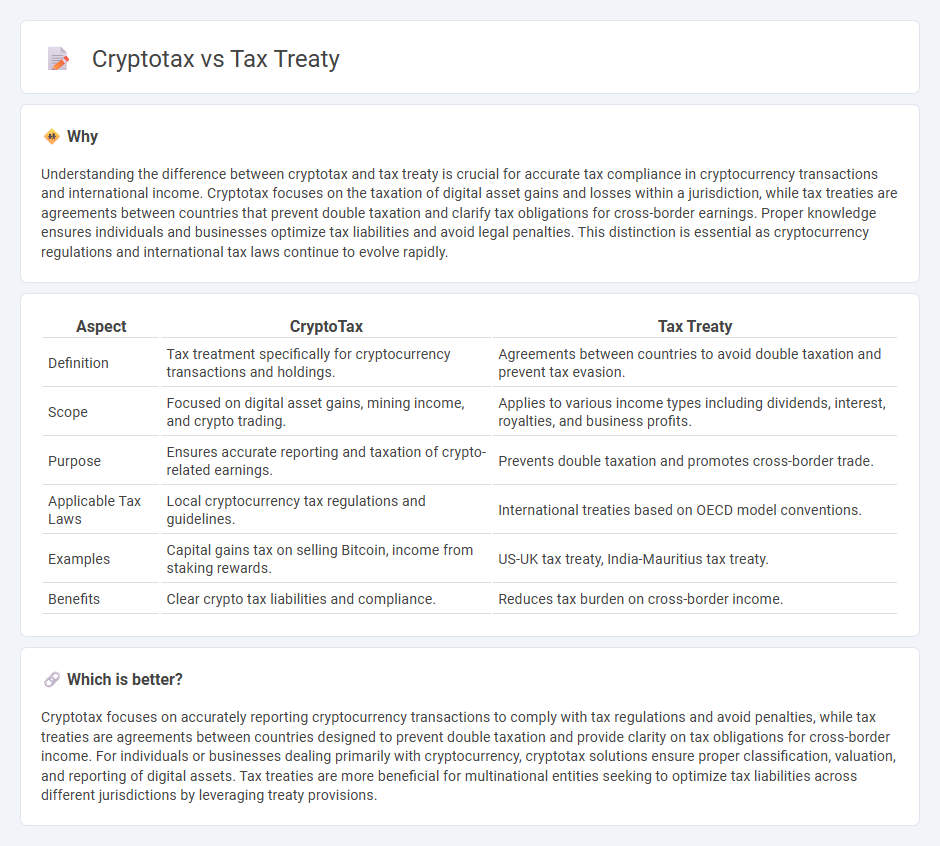

Understanding the difference between cryptotax and tax treaty is crucial for accurate tax compliance in cryptocurrency transactions and international income. Cryptotax focuses on the taxation of digital asset gains and losses within a jurisdiction, while tax treaties are agreements between countries that prevent double taxation and clarify tax obligations for cross-border earnings. Proper knowledge ensures individuals and businesses optimize tax liabilities and avoid legal penalties. This distinction is essential as cryptocurrency regulations and international tax laws continue to evolve rapidly.

Comparison Table

| Aspect | CryptoTax | Tax Treaty |

|---|---|---|

| Definition | Tax treatment specifically for cryptocurrency transactions and holdings. | Agreements between countries to avoid double taxation and prevent tax evasion. |

| Scope | Focused on digital asset gains, mining income, and crypto trading. | Applies to various income types including dividends, interest, royalties, and business profits. |

| Purpose | Ensures accurate reporting and taxation of crypto-related earnings. | Prevents double taxation and promotes cross-border trade. |

| Applicable Tax Laws | Local cryptocurrency tax regulations and guidelines. | International treaties based on OECD model conventions. |

| Examples | Capital gains tax on selling Bitcoin, income from staking rewards. | US-UK tax treaty, India-Mauritius tax treaty. |

| Benefits | Clear crypto tax liabilities and compliance. | Reduces tax burden on cross-border income. |

Which is better?

Cryptotax focuses on accurately reporting cryptocurrency transactions to comply with tax regulations and avoid penalties, while tax treaties are agreements between countries designed to prevent double taxation and provide clarity on tax obligations for cross-border income. For individuals or businesses dealing primarily with cryptocurrency, cryptotax solutions ensure proper classification, valuation, and reporting of digital assets. Tax treaties are more beneficial for multinational entities seeking to optimize tax liabilities across different jurisdictions by leveraging treaty provisions.

Connection

Cryptotax regulations impact how cryptocurrency transactions are reported and taxed, influencing cross-border tax obligations under existing tax treaties. Tax treaties help prevent double taxation by clarifying which jurisdiction has the right to tax specific crypto activities, such as capital gains or income from digital assets. Compliance with both cryptotax laws and bilateral tax treaties ensures accurate tax reporting and minimizes legal risks for multinational cryptocurrency investors.

Key Terms

Double Taxation

Tax treaties are bilateral agreements between countries designed to prevent double taxation by allocating taxing rights on various income types, including investments and business profits. Crypto tax regulations vary by jurisdiction, often lacking clear international agreements, which can lead to potential double taxation on cryptocurrency transactions when users operate across borders. Explore detailed comparisons of tax treaties and cryptocurrency tax frameworks to understand how double taxation risks are managed worldwide.

Tax Residency

Tax treaties determine the tax residency status by defining which country has taxing rights over an individual's income, preventing double taxation between nations. Cryptotax regulations, however, focus on the classification, reporting, and taxation of cryptocurrency transactions within a resident's jurisdiction. Explore more to understand how tax residency impacts your obligations in both traditional and crypto tax frameworks.

Capital Gains

Tax treaties often provide mechanisms to avoid double taxation on capital gains, typically allocating taxing rights between countries to reduce investor liability. Cryptocurrency taxation, particularly on capital gains, remains more complex due to varying international regulations and the lack of specific provisions in many tax treaties. Discover how tax treaties interact with crypto capital gains to optimize your tax strategy.

Source and External Links

Tax treaties | Internal Revenue Service - Tax treaties reduce U.S. taxes for foreign residents on certain income by providing reduced rates or exemptions, and also provide benefits for U.S. citizens taxed abroad, with specific treaty provisions determining eligibility.

Tax treaties can affect your income tax | Internal Revenue Service - U.S. tax treaties limit or eliminate U.S. taxes on various types of income for nonresident aliens and may reduce foreign taxes for U.S. residents, though most treaties include a saving clause retaining U.S. taxation rights for its citizens.

United States - Individual - Foreign tax relief and tax treaties - U.S. tax treaties apply reciprocal reduced tax rates or exemptions on certain income for residents of treaty countries, but contain saving clauses preventing U.S. citizens from avoiding U.S. tax on U.S.-source income.

dowidth.com

dowidth.com