Embedded finance accounting integrates financial services directly within non-financial platforms, streamlining transactions and simplifying revenue recognition by embedding payment processing and lending functions into business operations. Digital wallet accounting focuses on managing electronic payment methods, tracking wallet balances, transaction histories, and reconciling digital fund flows with traditional accounting systems. Explore how these innovative accounting approaches transform financial transparency and operational efficiency in modern businesses.

Why it is important

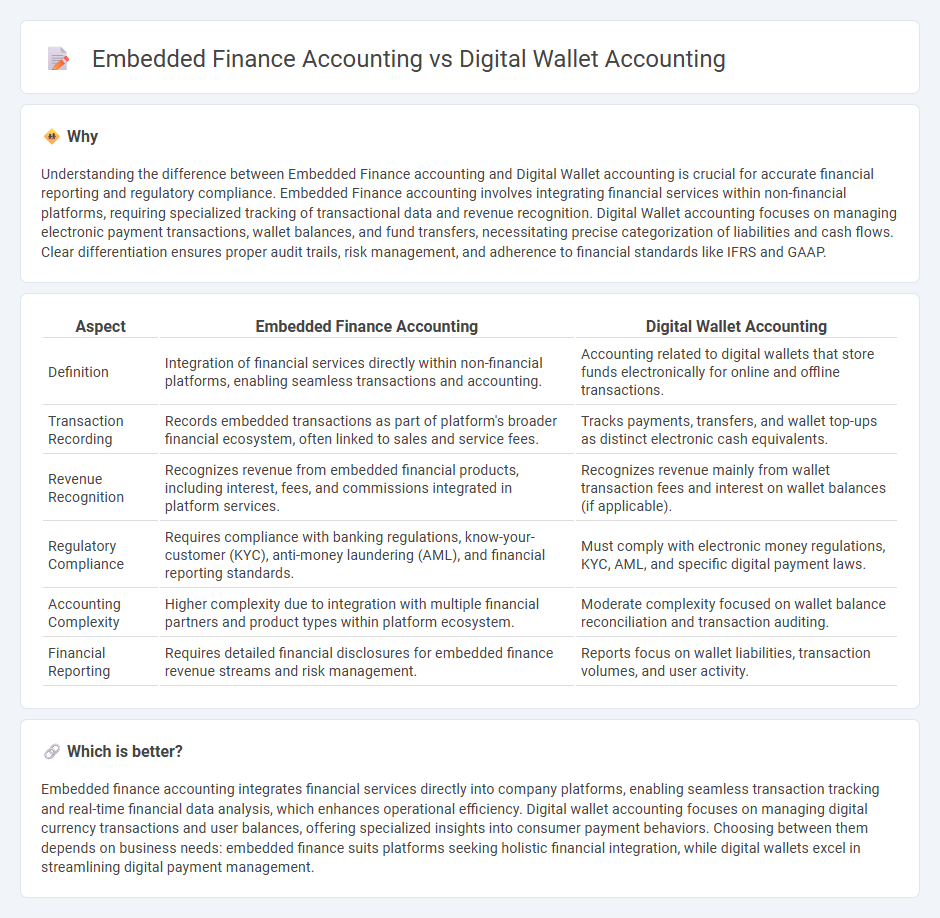

Understanding the difference between Embedded Finance accounting and Digital Wallet accounting is crucial for accurate financial reporting and regulatory compliance. Embedded Finance accounting involves integrating financial services within non-financial platforms, requiring specialized tracking of transactional data and revenue recognition. Digital Wallet accounting focuses on managing electronic payment transactions, wallet balances, and fund transfers, necessitating precise categorization of liabilities and cash flows. Clear differentiation ensures proper audit trails, risk management, and adherence to financial standards like IFRS and GAAP.

Comparison Table

| Aspect | Embedded Finance Accounting | Digital Wallet Accounting |

|---|---|---|

| Definition | Integration of financial services directly within non-financial platforms, enabling seamless transactions and accounting. | Accounting related to digital wallets that store funds electronically for online and offline transactions. |

| Transaction Recording | Records embedded transactions as part of platform's broader financial ecosystem, often linked to sales and service fees. | Tracks payments, transfers, and wallet top-ups as distinct electronic cash equivalents. |

| Revenue Recognition | Recognizes revenue from embedded financial products, including interest, fees, and commissions integrated in platform services. | Recognizes revenue mainly from wallet transaction fees and interest on wallet balances (if applicable). |

| Regulatory Compliance | Requires compliance with banking regulations, know-your-customer (KYC), anti-money laundering (AML), and financial reporting standards. | Must comply with electronic money regulations, KYC, AML, and specific digital payment laws. |

| Accounting Complexity | Higher complexity due to integration with multiple financial partners and product types within platform ecosystem. | Moderate complexity focused on wallet balance reconciliation and transaction auditing. |

| Financial Reporting | Requires detailed financial disclosures for embedded finance revenue streams and risk management. | Reports focus on wallet liabilities, transaction volumes, and user activity. |

Which is better?

Embedded finance accounting integrates financial services directly into company platforms, enabling seamless transaction tracking and real-time financial data analysis, which enhances operational efficiency. Digital wallet accounting focuses on managing digital currency transactions and user balances, offering specialized insights into consumer payment behaviors. Choosing between them depends on business needs: embedded finance suits platforms seeking holistic financial integration, while digital wallets excel in streamlining digital payment management.

Connection

Embedded finance accounting integrates financial services directly into non-financial platforms, streamlining transaction recording and reconciliation within core business systems. Digital wallet accounting tracks electronic payment activities, providing real-time data on user balances, transactions, and fees, which enhances financial transparency and control. Both systems converge by automating transaction flows and improving accuracy in financial reporting through seamless data synchronization.

Key Terms

Transaction Reconciliation

Transaction reconciliation in digital wallet accounting involves matching recorded transactions with bank statements to ensure accuracy and prevent fraud. Embedded finance accounting integrates financial services into non-financial platforms, necessitating more complex reconciliation processes due to multiple transaction sources and real-time data synchronization. Explore detailed methodologies and tools for efficient transaction reconciliation in both financial models.

API Integration

Digital wallet accounting prioritizes streamlined API integrations to facilitate real-time transaction tracking, fund transfers, and user authentication within the wallet ecosystem. Embedded finance accounting leverages APIs to seamlessly integrate banking, lending, or payment services directly into non-financial platforms, enhancing operational efficiency and data synchronization across different financial products. Explore the nuances of API-driven accounting solutions in digital wallets and embedded finance to optimize your platform's financial infrastructure.

Revenue Recognition

Digital wallet accounting emphasizes tracking transaction fees, user balances, and merchant settlements for accurate revenue recognition, ensuring compliance with standards like ASC 606. Embedded finance accounting integrates financial services into non-financial platforms, requiring nuanced recognition of revenue streams from lending, insurance, or payment facilitation within broader business models. Explore further to understand how these differences impact financial reporting and compliance.

Source and External Links

Technical Line: Accounting for digital assets - This document discusses the accounting principles and disclosures required for entities involved in digital assets, including how to classify and report transactions related to crypto assets.

Digital Wallets in Today's Payments Ecosystem - This article highlights the advantages of digital wallets in financial management and their impact on business operations, including enhanced security and streamlined transactions.

How to Use a Digital Wallet to Track Your Expenses - This blog post provides guidance on leveraging digital wallets for expense tracking, offering insights into how they can simplify financial management.

dowidth.com

dowidth.com