Deferred revenue recognition records income when payment is received but services are yet to be performed, ensuring liabilities are accurately stated on balance sheets. The completed contract method recognizes revenue only after the entire project or contract is finished, aligning income with final project outcomes for long-term contracts. Explore more about these revenue recognition methods to optimize your accounting practices.

Why it is important

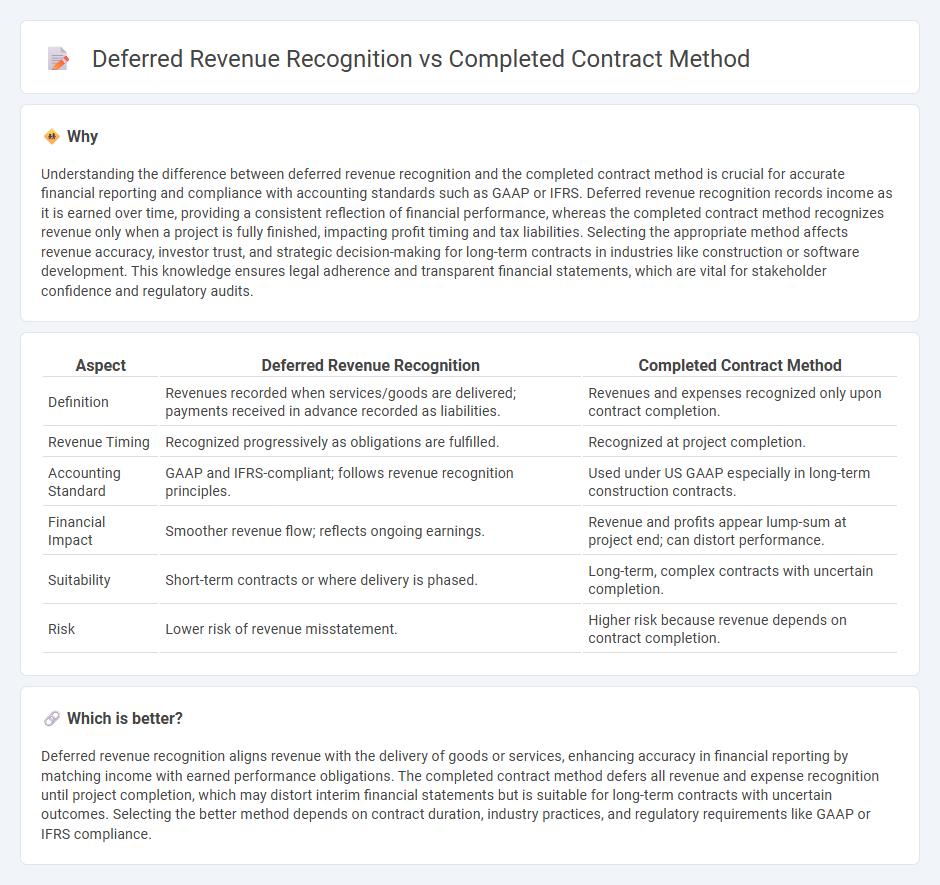

Understanding the difference between deferred revenue recognition and the completed contract method is crucial for accurate financial reporting and compliance with accounting standards such as GAAP or IFRS. Deferred revenue recognition records income as it is earned over time, providing a consistent reflection of financial performance, whereas the completed contract method recognizes revenue only when a project is fully finished, impacting profit timing and tax liabilities. Selecting the appropriate method affects revenue accuracy, investor trust, and strategic decision-making for long-term contracts in industries like construction or software development. This knowledge ensures legal adherence and transparent financial statements, which are vital for stakeholder confidence and regulatory audits.

Comparison Table

| Aspect | Deferred Revenue Recognition | Completed Contract Method |

|---|---|---|

| Definition | Revenues recorded when services/goods are delivered; payments received in advance recorded as liabilities. | Revenues and expenses recognized only upon contract completion. |

| Revenue Timing | Recognized progressively as obligations are fulfilled. | Recognized at project completion. |

| Accounting Standard | GAAP and IFRS-compliant; follows revenue recognition principles. | Used under US GAAP especially in long-term construction contracts. |

| Financial Impact | Smoother revenue flow; reflects ongoing earnings. | Revenue and profits appear lump-sum at project end; can distort performance. |

| Suitability | Short-term contracts or where delivery is phased. | Long-term, complex contracts with uncertain completion. |

| Risk | Lower risk of revenue misstatement. | Higher risk because revenue depends on contract completion. |

Which is better?

Deferred revenue recognition aligns revenue with the delivery of goods or services, enhancing accuracy in financial reporting by matching income with earned performance obligations. The completed contract method defers all revenue and expense recognition until project completion, which may distort interim financial statements but is suitable for long-term contracts with uncertain outcomes. Selecting the better method depends on contract duration, industry practices, and regulatory requirements like GAAP or IFRS compliance.

Connection

Deferred revenue recognition and the completed contract method are interconnected through the timing of revenue reporting in long-term projects. Deferred revenue represents payments received before service delivery, which under the completed contract method, is recognized only upon project completion. This approach aligns revenue recognition with actual contract fulfillment, ensuring accurate financial reporting and matching of income with expenses.

Key Terms

Revenue Recognition

The completed contract method recognizes revenue only after a project is fully finished, aligning revenue recognition with project completion and eliminating interim estimates. Deferred revenue recognition records cash received before services or goods are delivered as a liability, reflecting obligations to customers until revenue is earned. Explore detailed comparisons to understand how these methods impact financial reporting and compliance.

Percentage of Completion

The Percentage of Completion method recognizes revenue based on the progress of a project, aligning earnings with project milestones, whereas the Completed Contract method defers all revenue recognition until project completion. Deferred revenue recognition records payments received in advance as liabilities until the service is fully delivered or the contract is completed. Explore how applying the Percentage of Completion method enhances accurate revenue matching and financial reporting in long-term contracts.

Liability Accounts

The completed contract method records revenue and expenses only when a project is finished, causing liability accounts like contract liabilities to remain until completion, while deferred revenue recognition gradually recognizes revenue as work progresses, reducing deferred revenue liabilities over time. Liabilities under deferred revenue include unearned revenue accounts that reflect payments received but not yet earned, contrasting the completed contract method's accumulation of contract-related liabilities until project delivery. Explore detailed accounting treatments and liability impacts to optimize revenue recognition strategies for construction and long-term contracts.

Source and External Links

How to Use the Completed Contract Method in Construction - The completed contract method is an accounting technique used in construction to recognize revenue and profit once a contract is fully completed, providing a straightforward measure of profitability.

Completed Contract Method - Definition, Examples - The completed contract method defers revenue and expense recognition until the project is complete, often used in situations with uncertain cash collection.

Completed Contract Method Defined, With Examples - This method is accrual-based, recognizing revenues and expenses only when the project is fully completed, making it simpler than the percentage of completion method for certain projects.

dowidth.com

dowidth.com