Digital asset reporting leverages blockchain technology and real-time data analytics to enhance transparency and accuracy, contrasting traditional asset reporting which relies on periodic manual entries and paper-based documentation. This shift improves auditability and reduces reconciliation errors, streamlining compliance with evolving regulatory standards. Explore how digital asset reporting transforms financial management by visiting our detailed guide.

Why it is important

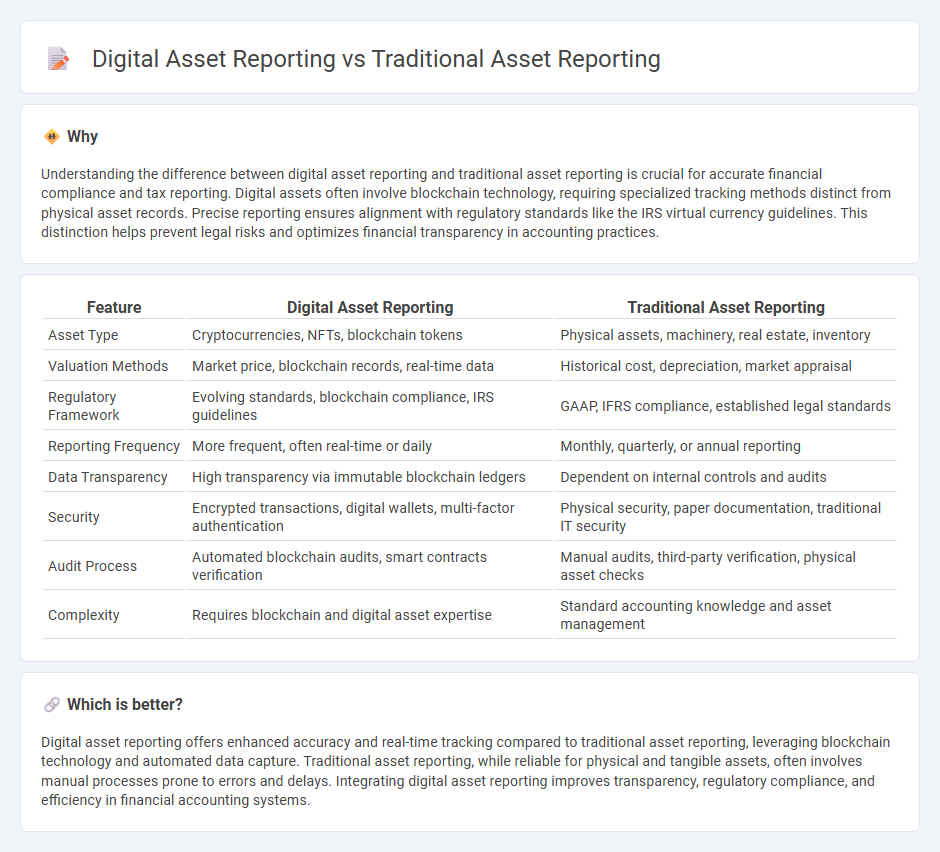

Understanding the difference between digital asset reporting and traditional asset reporting is crucial for accurate financial compliance and tax reporting. Digital assets often involve blockchain technology, requiring specialized tracking methods distinct from physical asset records. Precise reporting ensures alignment with regulatory standards like the IRS virtual currency guidelines. This distinction helps prevent legal risks and optimizes financial transparency in accounting practices.

Comparison Table

| Feature | Digital Asset Reporting | Traditional Asset Reporting |

|---|---|---|

| Asset Type | Cryptocurrencies, NFTs, blockchain tokens | Physical assets, machinery, real estate, inventory |

| Valuation Methods | Market price, blockchain records, real-time data | Historical cost, depreciation, market appraisal |

| Regulatory Framework | Evolving standards, blockchain compliance, IRS guidelines | GAAP, IFRS compliance, established legal standards |

| Reporting Frequency | More frequent, often real-time or daily | Monthly, quarterly, or annual reporting |

| Data Transparency | High transparency via immutable blockchain ledgers | Dependent on internal controls and audits |

| Security | Encrypted transactions, digital wallets, multi-factor authentication | Physical security, paper documentation, traditional IT security |

| Audit Process | Automated blockchain audits, smart contracts verification | Manual audits, third-party verification, physical asset checks |

| Complexity | Requires blockchain and digital asset expertise | Standard accounting knowledge and asset management |

Which is better?

Digital asset reporting offers enhanced accuracy and real-time tracking compared to traditional asset reporting, leveraging blockchain technology and automated data capture. Traditional asset reporting, while reliable for physical and tangible assets, often involves manual processes prone to errors and delays. Integrating digital asset reporting improves transparency, regulatory compliance, and efficiency in financial accounting systems.

Connection

Digital asset reporting and traditional asset reporting are interconnected through integrated accounting systems that consolidate financial data across diverse asset classes, ensuring comprehensive portfolio visibility. Both reporting methods rely on standardized frameworks like GAAP or IFRS to provide transparency, accuracy, and compliance in financial statements. The convergence of these reporting practices enhances real-time data analytics, risk management, and regulatory adherence for modern accounting professionals.

Key Terms

Valuation Methods

Traditional asset reporting primarily relies on manual valuation methods such as market comparison, income capitalization, and cost approaches, which often involve slower data collection and less frequent updates. Digital asset reporting leverages automated tools, real-time data integration, and AI-driven analytics to provide more accurate, dynamic asset valuations, enhancing transparency and decision-making. Explore the benefits of digital valuation methods to optimize your asset reporting strategies.

Custody and Control

Traditional asset reporting relies heavily on manual processes and physical documentation, resulting in delayed and less transparent updates regarding custody and control. Digital asset reporting leverages blockchain technology and automated platforms to provide real-time verification, enhanced security, and seamless tracking of asset ownership and transfer. Explore how these innovations are transforming the accuracy and efficiency of custody and control in asset management.

Regulatory Compliance

Traditional asset reporting relies heavily on manual processes and paper-based documentation, often causing delays and increasing the risk of errors in regulatory compliance. Digital asset reporting leverages automated data collection, real-time analytics, and blockchain technology to enhance accuracy, transparency, and adherence to regulatory standards. Explore how digital asset reporting transforms compliance management and mitigates regulatory risks.

Source and External Links

Part I: Assets and Income - This webpage provides guidance on reporting traditional assets such as stocks, sector mutual funds, bonds, and real estate, with specific requirements for assets held in retirement accounts like 401(k)s.

Strategic Asset Management - This guide discusses the importance of asset data collection and management for effective reporting and strategic decision-making, especially in local government settings.

Overview of Asset Allocation - This overview focuses on aligning asset allocation with investment objectives, highlighting traditional asset classes and their roles in portfolio management.

dowidth.com

dowidth.com