Payroll automation streamlines employee salary processing using software that reduces errors and saves time by handling calculations, tax deductions, and direct deposits. Outsourced payroll services delegate these tasks to specialized firms, offering expert compliance management and freeing internal resources from administrative burdens. Discover how each approach can optimize your business's payroll efficiency and accuracy.

Why it is important

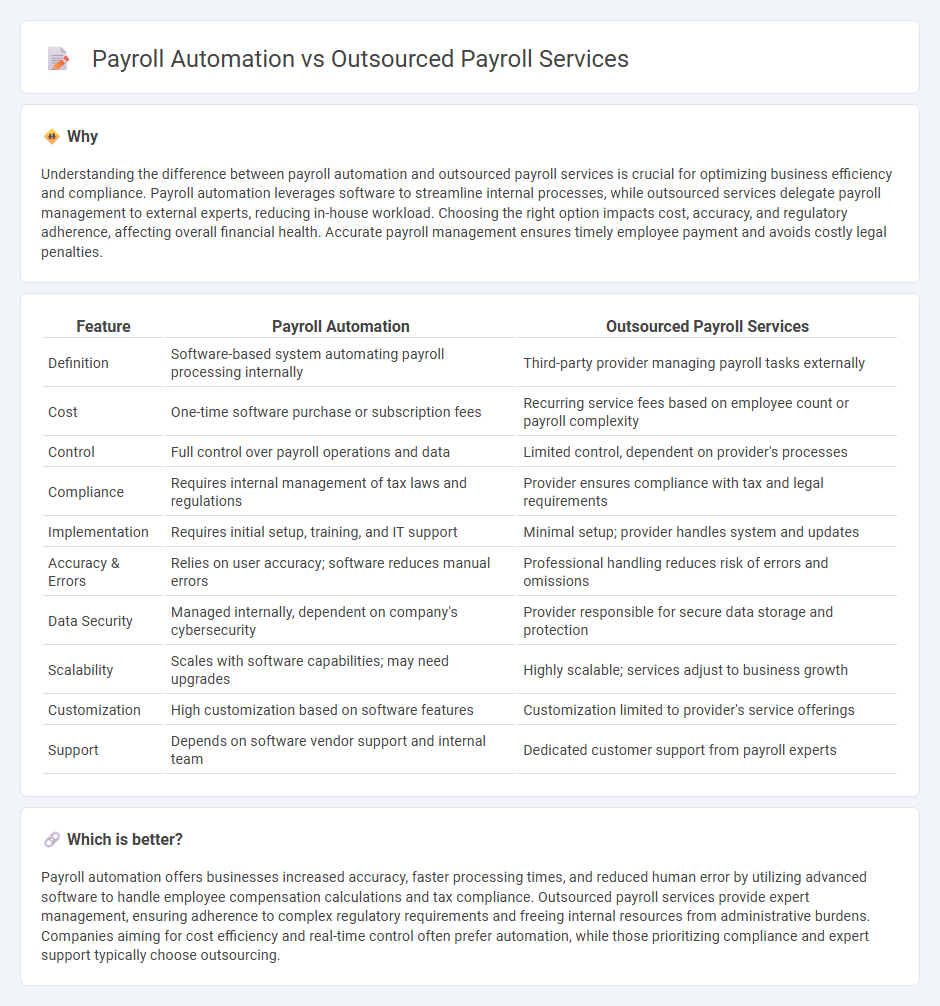

Understanding the difference between payroll automation and outsourced payroll services is crucial for optimizing business efficiency and compliance. Payroll automation leverages software to streamline internal processes, while outsourced services delegate payroll management to external experts, reducing in-house workload. Choosing the right option impacts cost, accuracy, and regulatory adherence, affecting overall financial health. Accurate payroll management ensures timely employee payment and avoids costly legal penalties.

Comparison Table

| Feature | Payroll Automation | Outsourced Payroll Services |

|---|---|---|

| Definition | Software-based system automating payroll processing internally | Third-party provider managing payroll tasks externally |

| Cost | One-time software purchase or subscription fees | Recurring service fees based on employee count or payroll complexity |

| Control | Full control over payroll operations and data | Limited control, dependent on provider's processes |

| Compliance | Requires internal management of tax laws and regulations | Provider ensures compliance with tax and legal requirements |

| Implementation | Requires initial setup, training, and IT support | Minimal setup; provider handles system and updates |

| Accuracy & Errors | Relies on user accuracy; software reduces manual errors | Professional handling reduces risk of errors and omissions |

| Data Security | Managed internally, dependent on company's cybersecurity | Provider responsible for secure data storage and protection |

| Scalability | Scales with software capabilities; may need upgrades | Highly scalable; services adjust to business growth |

| Customization | High customization based on software features | Customization limited to provider's service offerings |

| Support | Depends on software vendor support and internal team | Dedicated customer support from payroll experts |

Which is better?

Payroll automation offers businesses increased accuracy, faster processing times, and reduced human error by utilizing advanced software to handle employee compensation calculations and tax compliance. Outsourced payroll services provide expert management, ensuring adherence to complex regulatory requirements and freeing internal resources from administrative burdens. Companies aiming for cost efficiency and real-time control often prefer automation, while those prioritizing compliance and expert support typically choose outsourcing.

Connection

Payroll automation streamlines the processing of employee salaries by using software to calculate wages, tax deductions, and generate pay slips accurately and efficiently. Outsourced payroll services leverage this automation technology to handle complex payroll tasks for businesses, ensuring compliance with tax regulations and reducing the risk of errors. The integration of payroll automation in outsourced services enhances data security, improves processing speed, and allows companies to focus on core financial strategies.

Key Terms

Cost Efficiency

Outsourced payroll services reduce overhead by transferring payroll management to specialized providers, often lowering staffing and compliance costs. Payroll automation streamlines internal processes using software, minimizing manual errors and accelerating payment cycles, thus enhancing cost savings. Explore detailed comparisons to find the ideal solution for maximizing payroll cost efficiency.

Data Security

Outsourced payroll services offer enhanced data security through specialized encryption protocols and compliance with industry standards such as GDPR and SOC 1, relying on expert teams to safeguard sensitive employee information. Payroll automation solutions provide in-house control with secure cloud-based platforms designed to reduce human error and enable real-time monitoring, leveraging multi-factor authentication and role-based access controls for data protection. Explore how each approach ensures robust data security tailored to your organizational needs by learning more about their distinct advantages.

Human Intervention

Outsourced payroll services rely heavily on human intervention for data processing, error checking, and compliance management, which can lead to higher operational costs and risks of manual errors. Payroll automation minimizes human involvement by leveraging software algorithms to handle calculations, tax filings, and record-keeping with increased speed and accuracy. Explore the advantages and challenges of both approaches to determine the optimal payroll solution for your organization.

Source and External Links

Payroll Outsourcing: 5 benefits for Companies - Payroll outsourcing means partnering with a third-party to manage payroll tasks like wage calculation, tax withholding, and reports, saving companies time and reducing compliance risks.

Outsourcing Payroll: How It Works, Benefits, Costs & More - Outsourced payroll helps companies save time, minimize errors, improve security, maintain compliance, and often reduces costs compared to handling payroll internally.

11 Best Outsourced Payroll Services Companies in 2025 - Outsourced payroll services range from large providers with scalable, tech-enabled solutions to independent contractors offering personalized service, though full-service providers may cost more but cover tax filing, benefits, and HR administration.

dowidth.com

dowidth.com