Taxonomy alignment ensures that financial data is structured and standardized according to specific accounting taxonomies, facilitating seamless data exchange and consistency across reporting platforms. Regulatory reporting mandates the submission of financial statements in compliance with local and international accounting standards, often requiring alignment with taxonomy frameworks to meet legal obligations. Explore more to understand how taxonomy alignment enhances accuracy and efficiency in regulatory reporting processes.

Why it is important

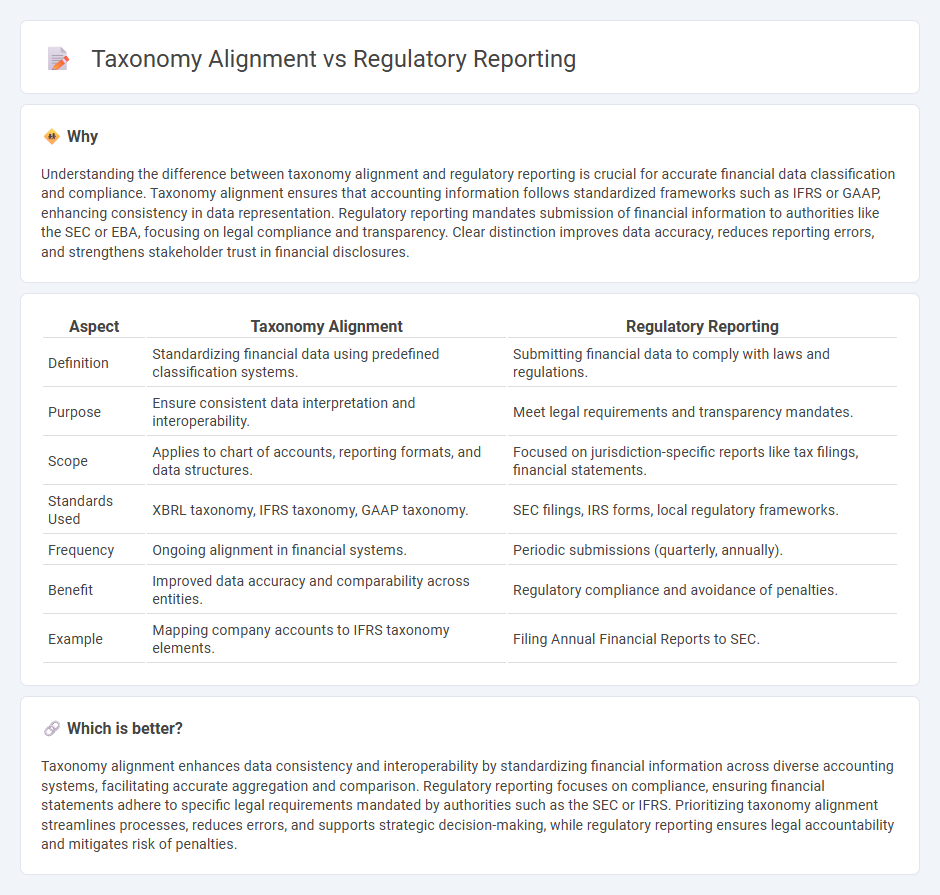

Understanding the difference between taxonomy alignment and regulatory reporting is crucial for accurate financial data classification and compliance. Taxonomy alignment ensures that accounting information follows standardized frameworks such as IFRS or GAAP, enhancing consistency in data representation. Regulatory reporting mandates submission of financial information to authorities like the SEC or EBA, focusing on legal compliance and transparency. Clear distinction improves data accuracy, reduces reporting errors, and strengthens stakeholder trust in financial disclosures.

Comparison Table

| Aspect | Taxonomy Alignment | Regulatory Reporting |

|---|---|---|

| Definition | Standardizing financial data using predefined classification systems. | Submitting financial data to comply with laws and regulations. |

| Purpose | Ensure consistent data interpretation and interoperability. | Meet legal requirements and transparency mandates. |

| Scope | Applies to chart of accounts, reporting formats, and data structures. | Focused on jurisdiction-specific reports like tax filings, financial statements. |

| Standards Used | XBRL taxonomy, IFRS taxonomy, GAAP taxonomy. | SEC filings, IRS forms, local regulatory frameworks. |

| Frequency | Ongoing alignment in financial systems. | Periodic submissions (quarterly, annually). |

| Benefit | Improved data accuracy and comparability across entities. | Regulatory compliance and avoidance of penalties. |

| Example | Mapping company accounts to IFRS taxonomy elements. | Filing Annual Financial Reports to SEC. |

Which is better?

Taxonomy alignment enhances data consistency and interoperability by standardizing financial information across diverse accounting systems, facilitating accurate aggregation and comparison. Regulatory reporting focuses on compliance, ensuring financial statements adhere to specific legal requirements mandated by authorities such as the SEC or IFRS. Prioritizing taxonomy alignment streamlines processes, reduces errors, and supports strategic decision-making, while regulatory reporting ensures legal accountability and mitigates risk of penalties.

Connection

Taxonomy alignment plays a crucial role in regulatory reporting by ensuring standardized classification and consistent presentation of financial data across organizations. This alignment facilitates accurate data aggregation, enhances transparency, and supports compliance with regulatory frameworks such as IFRS or GAAP. Effective taxonomy implementation streamlines reporting processes and improves the reliability of financial disclosures for stakeholders.

Key Terms

Compliance

Regulatory reporting ensures adherence to legal frameworks by submitting accurate financial and operational data, while taxonomy alignment standardizes this data according to predefined classifications, enhancing clarity and comparability across regulatory submissions. Effective compliance relies on harmonizing both processes to meet requirements set by bodies like the SEC, EBA, or IFRS Foundation. Explore how integrating regulatory reporting and taxonomy alignment can strengthen your compliance strategy.

Data Standardization

Regulatory reporting and taxonomy alignment both prioritize data standardization to ensure accuracy, consistency, and compliance across financial and non-financial disclosures. Standardized data formats enhance comparability and streamline reporting processes for institutions adhering to diverse regulations such as ESRS and SFDR. Explore how data standardization drives efficiency and transparency in regulatory frameworks to optimize your compliance strategy.

Financial Disclosure

Regulatory reporting in financial disclosure ensures compliance with mandated formats and standards set by authorities such as the SEC or ESMA, whereas taxonomy alignment organizes financial data according to structured classifications like the EBA or IFRS taxonomies, enhancing comparability and transparency. This alignment enables automated data processing and improves the accuracy of disclosures across multiple regulatory frameworks. Explore the differences in regulatory reporting and taxonomy alignment to optimize your financial disclosure processes.

Source and External Links

What is Regulatory Reporting? - SolveXia - This webpage explains regulatory reporting as the process by which financial institutions submit data to regulatory authorities to ensure compliance with laws and regulations.

What is Regulatory Reporting: A Beginner's Guide - Finreg-E - This guide provides an introduction to regulatory reporting, covering its importance, components, and the role it plays in maintaining financial stability.

What Is Regulatory Reporting? A Complete Guide - HighGear - This guide offers a comprehensive overview of regulatory reporting, discussing its difference from financial reporting and frequency of submission for financial institutions.

dowidth.com

dowidth.com