Cryptocurrency taxation involves reporting taxable events such as trades, sales, or income received through digital assets, while airdrops and forks present unique tax challenges due to their nature of distribution and creation. Airdrops are considered taxable income at the fair market value when received, and forks may generate taxable gains depending on the control and use of the new coins. Explore the complexities of cryptocurrency taxation, airdrops, and forks to ensure compliance and optimize your financial strategy.

Why it is important

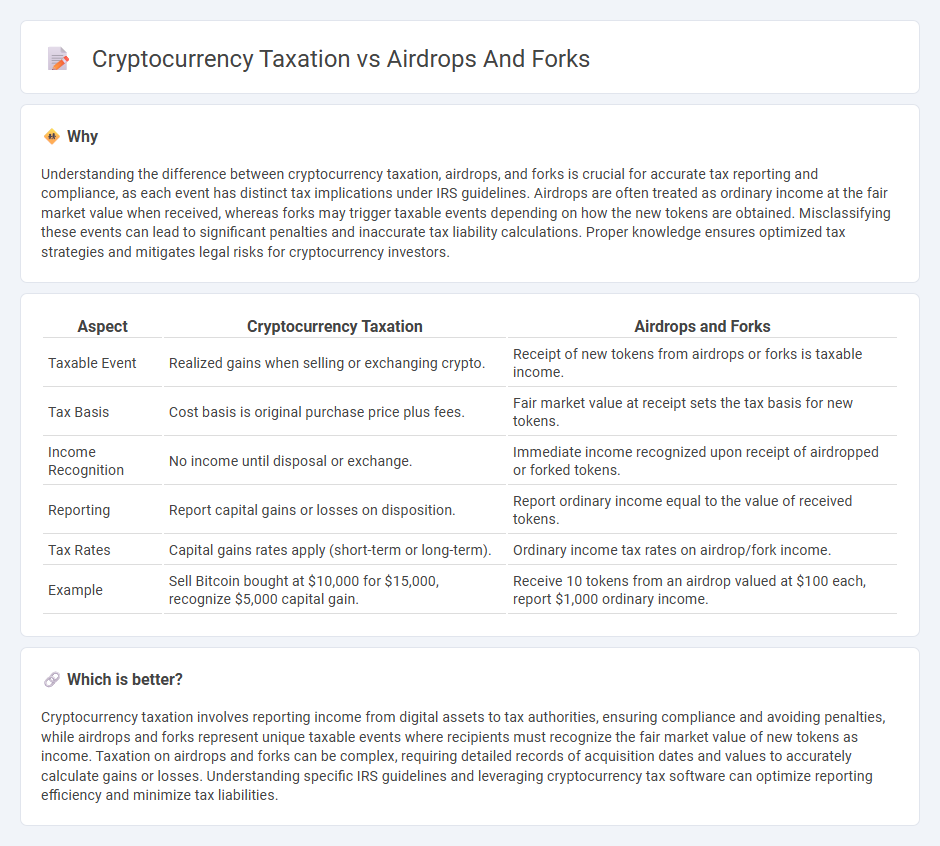

Understanding the difference between cryptocurrency taxation, airdrops, and forks is crucial for accurate tax reporting and compliance, as each event has distinct tax implications under IRS guidelines. Airdrops are often treated as ordinary income at the fair market value when received, whereas forks may trigger taxable events depending on how the new tokens are obtained. Misclassifying these events can lead to significant penalties and inaccurate tax liability calculations. Proper knowledge ensures optimized tax strategies and mitigates legal risks for cryptocurrency investors.

Comparison Table

| Aspect | Cryptocurrency Taxation | Airdrops and Forks |

|---|---|---|

| Taxable Event | Realized gains when selling or exchanging crypto. | Receipt of new tokens from airdrops or forks is taxable income. |

| Tax Basis | Cost basis is original purchase price plus fees. | Fair market value at receipt sets the tax basis for new tokens. |

| Income Recognition | No income until disposal or exchange. | Immediate income recognized upon receipt of airdropped or forked tokens. |

| Reporting | Report capital gains or losses on disposition. | Report ordinary income equal to the value of received tokens. |

| Tax Rates | Capital gains rates apply (short-term or long-term). | Ordinary income tax rates on airdrop/fork income. |

| Example | Sell Bitcoin bought at $10,000 for $15,000, recognize $5,000 capital gain. | Receive 10 tokens from an airdrop valued at $100 each, report $1,000 ordinary income. |

Which is better?

Cryptocurrency taxation involves reporting income from digital assets to tax authorities, ensuring compliance and avoiding penalties, while airdrops and forks represent unique taxable events where recipients must recognize the fair market value of new tokens as income. Taxation on airdrops and forks can be complex, requiring detailed records of acquisition dates and values to accurately calculate gains or losses. Understanding specific IRS guidelines and leveraging cryptocurrency tax software can optimize reporting efficiency and minimize tax liabilities.

Connection

Cryptocurrency taxation involves reporting taxable events such as airdrops and forks, which are treated as income based on the fair market value at the time received. Airdrops distribute tokens to holders without direct purchase, triggering taxable income recognition, while forks create new tokens or alter blockchain history, often resulting in taxable events upon asset acquisition. Accurate tracking and valuation of these events are essential for compliance with tax regulations and proper accounting reporting.

Key Terms

Fair Market Value

Airdrops and forks trigger taxable events based on the fair market value (FMV) of the received cryptocurrency at the time of acquisition, which the IRS treats as ordinary income. Accurate FMV assessment is critical for compliance as it determines both the income reported and the cost basis for future capital gains calculations. Learn more about how FMV impacts taxation of these crypto events and optimize your tax strategy accordingly.

Cost Basis

Airdrops and forks create unique tax challenges due to the determination of cost basis, which is essential for accurately calculating capital gains or losses. The IRS typically considers the fair market value of tokens received during an airdrop or fork as the cost basis at the time of acquisition. Understanding these tax implications can help optimize your cryptocurrency portfolio management; explore further to stay compliant and minimize tax liabilities.

Taxable Event

Airdrops and forks are considered taxable events under cryptocurrency taxation, triggering income recognition when new tokens are received. The fair market value of the airdropped or forked coins at the time of receipt must be reported as taxable income. Explore how these events impact your tax obligations and strategies for compliance.

Source and External Links

Forks & Airdrop Policy Bit2Me - An airdrop is when a blockchain issues new assets to holders of another blockchain's addresses, whereas a fork is the creation of a new blockchain via a new consensus layer on an existing chain; Bit2Me treats both similarly in terms of user access and value support.

What determines dominion and control for crypto assets - Dominion and control of airdrops vary by type, with users needing to actively claim tokens, such as importing private keys for forked chains like Bitcoin Cash, differing from token standard airdrops like ETH-based tokens.

Crypto Airdrop vs Fork: What Web3 Founders Need to Know - Crypto airdrops are planned token giveaways aimed at marketing and community growth, while forks result from blockchain splits creating new tokens earnable by users, reflecting different strategic and technical origins.

dowidth.com

dowidth.com